Growth funds have had some of the best performance across all Investment Association portfolios over the past decade but have been the worst hit by 2022’s high inflation and interest rate hikes.

Some investors have cut their losses and fled the market, with £3.6bn being pulled from equity funds since the start of the year according to the Investment Association, but many others are waiting for returns to pick up again.

That recovery will arrive one day and, when it does, it will be rapid, according to Chris Metcalfe, chief investment officer at IBOSS.

“I think if Powell came out with one speech where he changed his language slightly and suggested we can potentially see the end of the interest rate cycle, you will see a massive rally in growth assets – absolutely huge,” he said.

Question is, which funds will rebound the highest when markets improve? Trustnet has asked industry experts which funds they’re holding onto for when things get sunnier.

Ben Yearsley, director of Fairview Investing, said value or cyclical funds often have a sharp recovery after a market downturn, but value stocks have performed well this year so have less chance of a strong rebound

Instead, he would allocate to FE fundinfo Alpha Manager Stephen Yiu’s Blue Whale Growth fund as its preferred quality-growth stocks have been those that have fallen the hardest in the current market.

Yiu’s concentrated portfolio of 25 stocks is up 61.3% since it launched in 2017. It’s since-incept returns had peaked at 127.8% in November last year before the market cycle dragged on performance.

Total return of fund vs sector since launch

Source: FE Analytics

With markets turning away from growth and into value, Blue Whale Growth has fallen 25.9% since the start of the year, lagging 15.3 percentage points behind its peers in the IA Global sector.

Yiu said in his July performance update that the fund has suffered from its lack of exposure to cyclical sectors such as mining and gas, which have been one of the few areas to thrive in this environment.

He also added that growth funds have “taken a hit indiscriminately” this year, regardless of the quality of their assets.

“Short-term underperformance, whilst displeasing, is to be expected in any portfolio,” Yiu said.

“We cannot promise consistent short-term returns, but we can promise to only invest in companies of the highest quality.”

Yearsley has faith in Yiu’s stock picking skills and predicts that holding the fund through this difficult period will pay off in the long run.

He said: “The beaten-up areas have been the quality-growth stocks - with rates rising they have become unloved. At some point these will stocks will rebound in my view.”

Alternatively, Darius McDermott, managing director of Chelsea Financial Services, said investors could consider the Baillie Gifford Global Discovery fund.

This £973m portfolio, run by FE fundinfo Alpha Manager Douglas Brodie, invests in mid and small-cap companies across the globe, although most assets are held in the US (67%).

Unfortunately for the fund, mid and small-cap stocks were hit worse than large-caps in the recent market drawdown and the portfolio dropped 43.9% over the past year as a result, making it the third worst performer of all 480 funds in the IA Global sector over the period.

However, McDermott said that because Baillie Gifford Global Discovery did so poorly this year, it has the potential to bounce back higher than its peers when the recovery comes about.

“The fund has suffered a lot - it's out-and-out growth, and it's mid- and small-cap, so it's been a perfect storm,” he said. “If mid- and small-caps sell off most of the way down, one might expect them to recover best when that turn is.”

McDermott also pointed out that the fund’s stunning long-term track record should not be overlooked: it’s up 273.4% over the past decade.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

He added: “If we believe that funds that invest in quality-growth businesses will have their day again, then something with small- to mid-cap exposure is exactly the extra bang for your buck we would be looking for.”

A more niche option that Andy Merricks, fund manager at 8AM Global, said is well positioned to climb high when markets improve is the Heptagon Future Trends fund.

The £133m portfolio generally has between 24-30 holdings and includes “well known, as well as not so well known, names,” according to Merrick.

It also differed from the MSCI World benchmark in terms of sector exposure, with an overweight to information technology at 35.7%, compared to the index’s 21.1%

Likewise, its largest underweight position is in financials – the sector accounts for 13.5% of the benchmark, but the fund has no exposure to it whatsoever.

This had helped it return 31.2% over the past five years but, unlike many other large-cap growth funds, it is up 10% over the past six months.

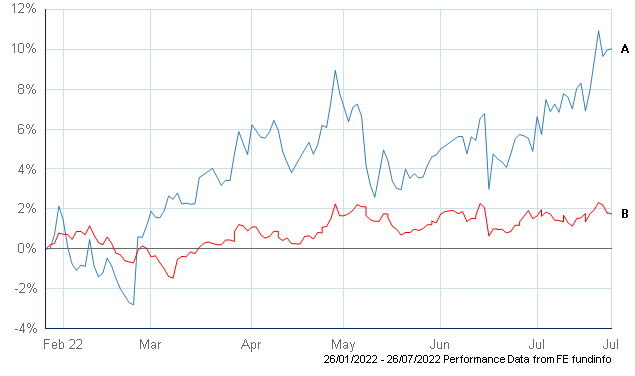

Total return of fund vs sector over the past six months

Source: FE Analytics

Merricks said that he 1% management fee could mean “that those who invest based solely upon cost will find reasons to avoid it” but he personally has a strong conviction in manager Alexander Gunz’s ability to scout out emerging trends.

“He knows and understands his companies very well and is prepared to give them time to grow with the trends to which they are linked,” Merricks said. “ It is important to differentiate between trends and fads, something about which Alex is all too aware.”