Balancing risk and reward is possibly one of the hardest elements to get right when it comes to investing. While those with an aggressive approach can take their lumps and cautious investors are willing to sacrifice returns for the safety that they won’t lose too much, perhaps the trickiest group to be in is those who want to maximise returns while also not losing too much – the holy grail of investing.

Being a balanced investor has been difficult this year as 2025 included a sharp April swing in equity markets, geopolitical uncertainty and shifting interest rate expectations, yet markets ended the year on a high.

As we move into 2026, the outlook remains mixed. While interest rates in several regions are expected to edge downward, structural risks – from energy markets to geopolitics – continue to loom large.

For those unsure of how to balance risk and return, Trustnet asked fund pickers to select a fund that could work next year, but won’t suffer huge losses if it doesn’t.

First up, Ben Yearsley, director at Fairview Investing, suggested Troy Trojan and Polar Capital Global Insurance, noting that “both are very different but can each add value and are definitely not an artificial intelligence or Magnificent Seven play”.

Launched in 2001, the £5.2bn Trojan Fund has been managed by FE fundinfo Alpha Manager Sebastian Lyon since inception, with Charlotte Yonge appointed deputy manager in 2013.

The fund’s objective is to deliver long-term capital growth ahead of inflation while prioritising capital preservation.

It avoids highly cyclical or capital-intensive sectors such as mining and airlines, instead investing in gold, quality equities and inflation-linked bonds. “The managers will vary the weights in these three areas according to their views on the world,” Yearsley explained.

He said it could serve as a one-stop shop fund and comes into its own when there is turbulence, although warned “it will be left behind in a bull market”.

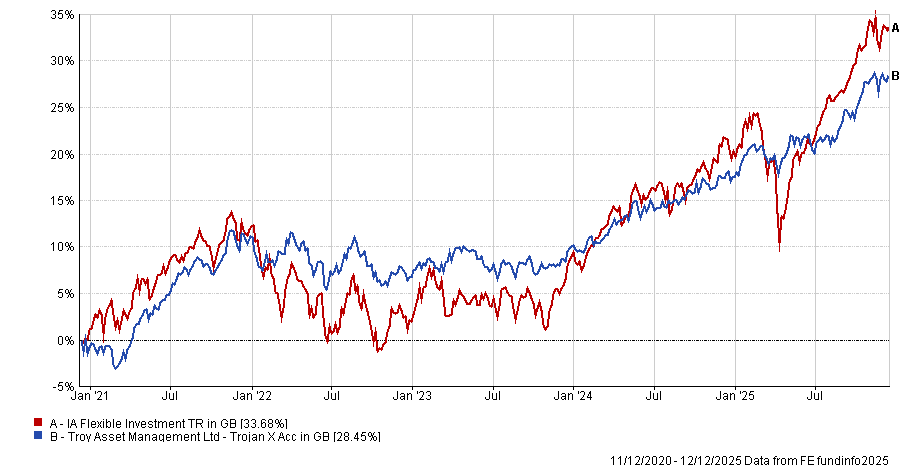

Trojan has vacillated between the third and fourth quartile of the IA Flexible Investment sector for returns over one, three, five and 10 years as markets have risen.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

Yearsley’s second pick “grinds out returns over the long-term”.

The £2.5bn Polar Capital Global Insurance fund is co-managed by Nick Martin and Dominic Evans and aims to act as a pool of underwriting capital by investing in high-quality insurance businesses with underwriting discipline.

“It gets a double whammy in effect – profits from the underwriting and profit from the growth of where those premiums are invested,” Yearsley said.

It operates a buy-and-hold strategy with minimal turnover, typically limited to one or two changes per year.

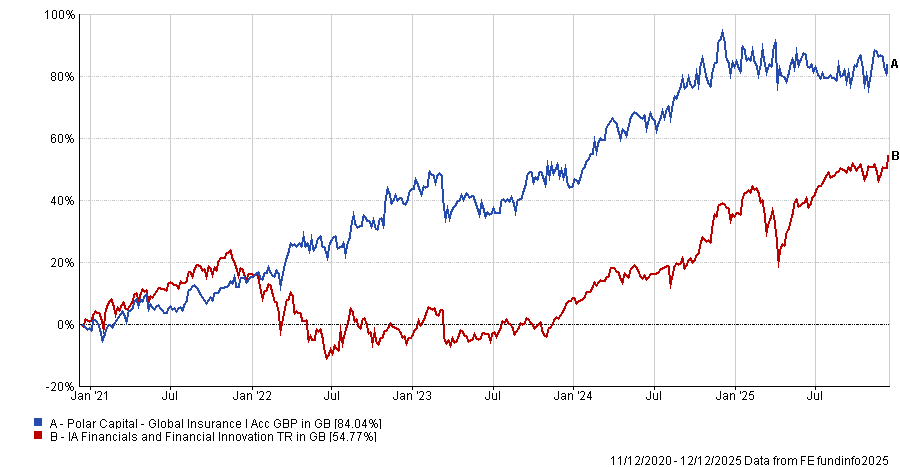

Performance has been mixed in recent years. The fund sits in the fourth quartile of the IA Financials and Financial Innovation sector over one and three years, losing 0.7% over the past 12 months. However, its long-term record is stronger, gaining 227.8% over 10 years, placing it in the second quartile.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

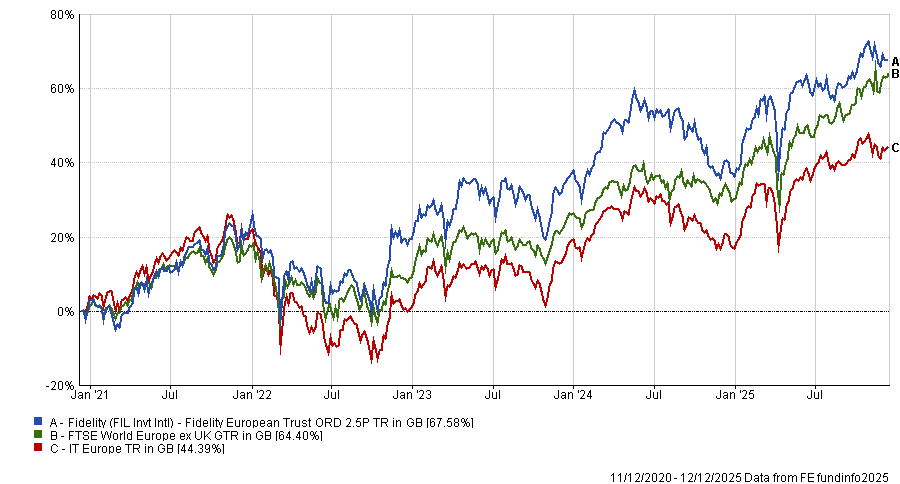

On the investment trust side, Emma Bird, head of research at Winterflood Securities, picked the £2.1bn Fidelity European Trust.

“The managers have been consistent in their emphasis on investing in high quality companies with good dividend growth prospects on attractive valuations,” she said.

The managers in question – Samuel Morse and Marcel Stotzel – aim to deliver long-term capital growth by investing primarily in continental European companies, using bottom-up fundamental research to build a concentrated portfolio of around 50 to 60 stocks.

While it is not an income fund, the strategy targets companies capable of growing and sustaining dividends over a three- to five-year horizon, based on the belief that consistent dividend growth is a marker of quality and a driver of superior returns.

The fund also has a quality growth bias, providing it with defensive characteristics, which could be attractive for investors looking for an element of downside protection.

Following a period of re-rating against a backdrop of improving sentiment towards European equities, Fidelity European Trust’s discount now stands at 2.4%, which is tighter than its one-year average of 4%, Bird said.

“However, we believe that downside discount risk is mitigated to an extent by the board’s commitment to maintaining the discount in single digits in normal market conditions, and it has demonstrated its willingness to buy back shares in the past,” she said.

Performance of the trust vs sector and benchmark over 5yrs

Source: FE Analytics

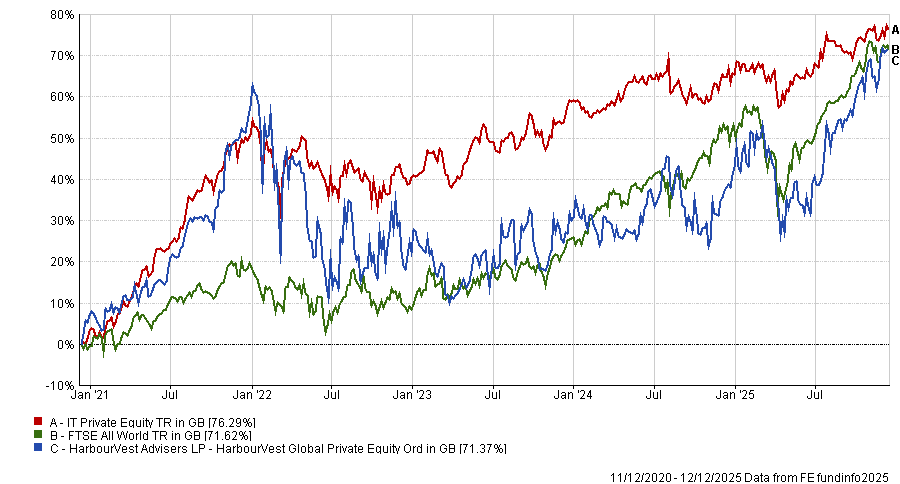

In addition, Shavar Halberstadt, senior analyst at Winterflood, said allocating to private equity is a “sensible component” of a balanced portfolio.

As such, the £2.9bn HarbourVest Global Private Equity was his 2026 pick. Halberstadt said “it is a highly diversified fund of funds strategy, primed to benefit from any broad-based recovery in global M&A as well as a further recovery in venture and growth valuations”.

The portfolio offers “look-through exposure” to over 1,000 funds and 14,000 companies, he noted, with underlying funds run by high-quality external managers, such as EQT, CVC and Kleiner Perkins.

“With a 53% year-on-year increase in global private equity exit value over the first half of 2025, we expect the trust to benefit through increased portfolio distributions as the year progresses,” Halberstadt said.

“Any increase in portfolio cashflows will benefit shareholders directly, as the fund earmarks 30% of incoming cash for share buybacks.”

The trust’s degree of portfolio diversification also inherently provides some downside protection, Halberstadt added, noting that a “substantial financial shock” would be required to drive widespread write-downs. Even then, its permanent capital structure would allow value to be recovered over time.

It is currently trading on a 30.4% discount to NAV.

Performance of the trust vs sector and benchmark over 5yrs

Source: FE Analytics

Meanwhile, David Batchelor, senior funds analyst at QuotedData, suggested Alliance Witan. The £5bn trust is the result of a merger between Alliance Trust and Witan last year.

“Alliance Witan provides balanced exposure to investors through its manager of managers approach,” he said.

The investment manager Willis Tower Watson appoints stock-pickers with different styles who each buy their 20 best ideas, cumulatively producing a portfolio of over 220 global equities across a wide range of sectors.

“The result is a core global equity fund that aims to provide investors with a positive real long-term return through a combination of capital growth and a rising dividend,” he said.

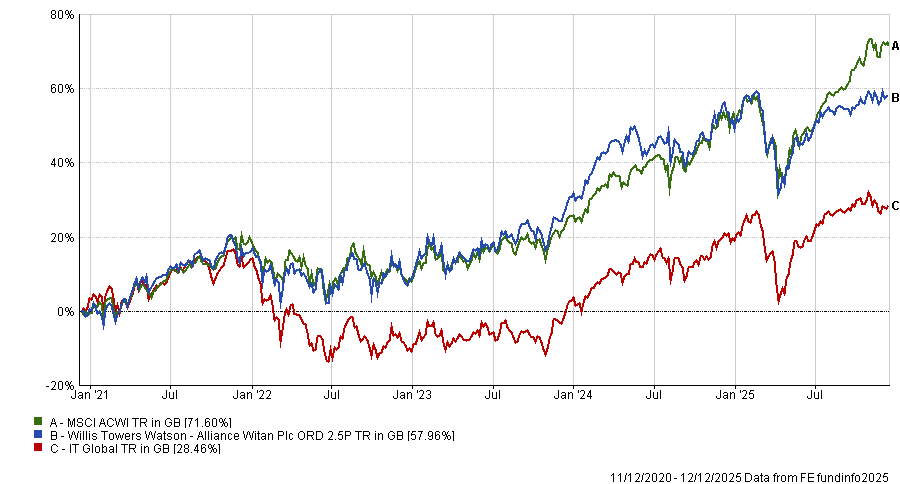

The long-term performance of the trust shows that Alliance Witan can experience periods of both underperformance and outperformance, Batchelor noted.

“With an active share of 73%, the multi-manager approach can result in underweighting certain market leaders – most recently the Magnificent Seven US technology stocks that have propelled the recent market rally,” he added.

“Whenever the technology sector has sold off, Alliance Witan has held up well, and indeed the fund performs much better relative to equal weight indices, thus providing a clearly balanced exposure for investors.”

Over the past decade, Alliance Witan has gained 221.9%, comfortably ahead of the IA Global sector average of 154.8%.

Performance of the trust vs sector over 5yrs

Source: FE Analytics