The UK is reeling from the effects of the Covid pandemic and the cost of living crisis, but the manager of the Supermarket Income REIT trust says the resiliency of the grocery industry is cause for optimism.

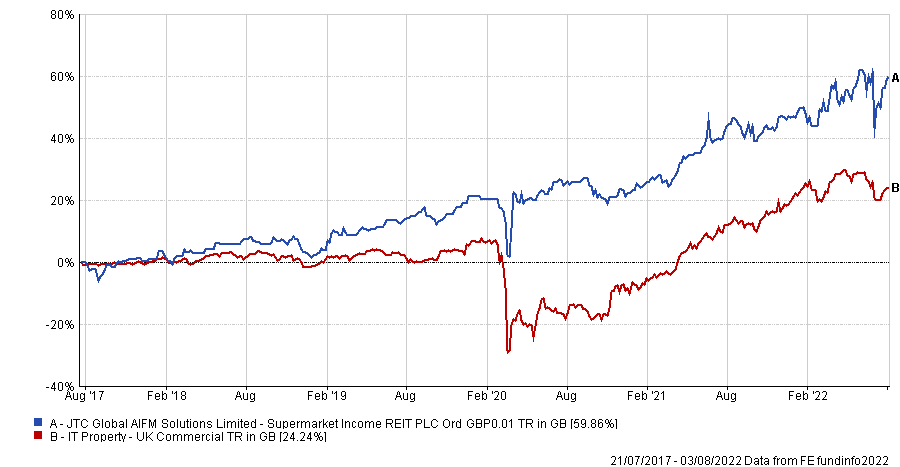

By leasing out its 69 properties across the UK to various supermarket chains, the trust has delivered a total return of 59.9% since inception in 2017 and is currently paying shareholders a yield of 3.8%.

Even over the past year, the trust is up 10.6% while many other areas of the market have been in decline.

Here, manager Robert Abraham tells Trustnet how the boost in home deliveries in the pandemic has shuffled supermarket dynamics and why investing in property can be a long-term inflation hedge.

Total return of trust vs sector since launch

Source: FE Analytics

What’s your investment process?

We’re the UK’s only listed fund dedicated to supermarkets, so we've just got really good insight into how these operators work.

The real driver behind the fund is to offer long-dated, secure inflation linked income.

Who are your largest tenants?

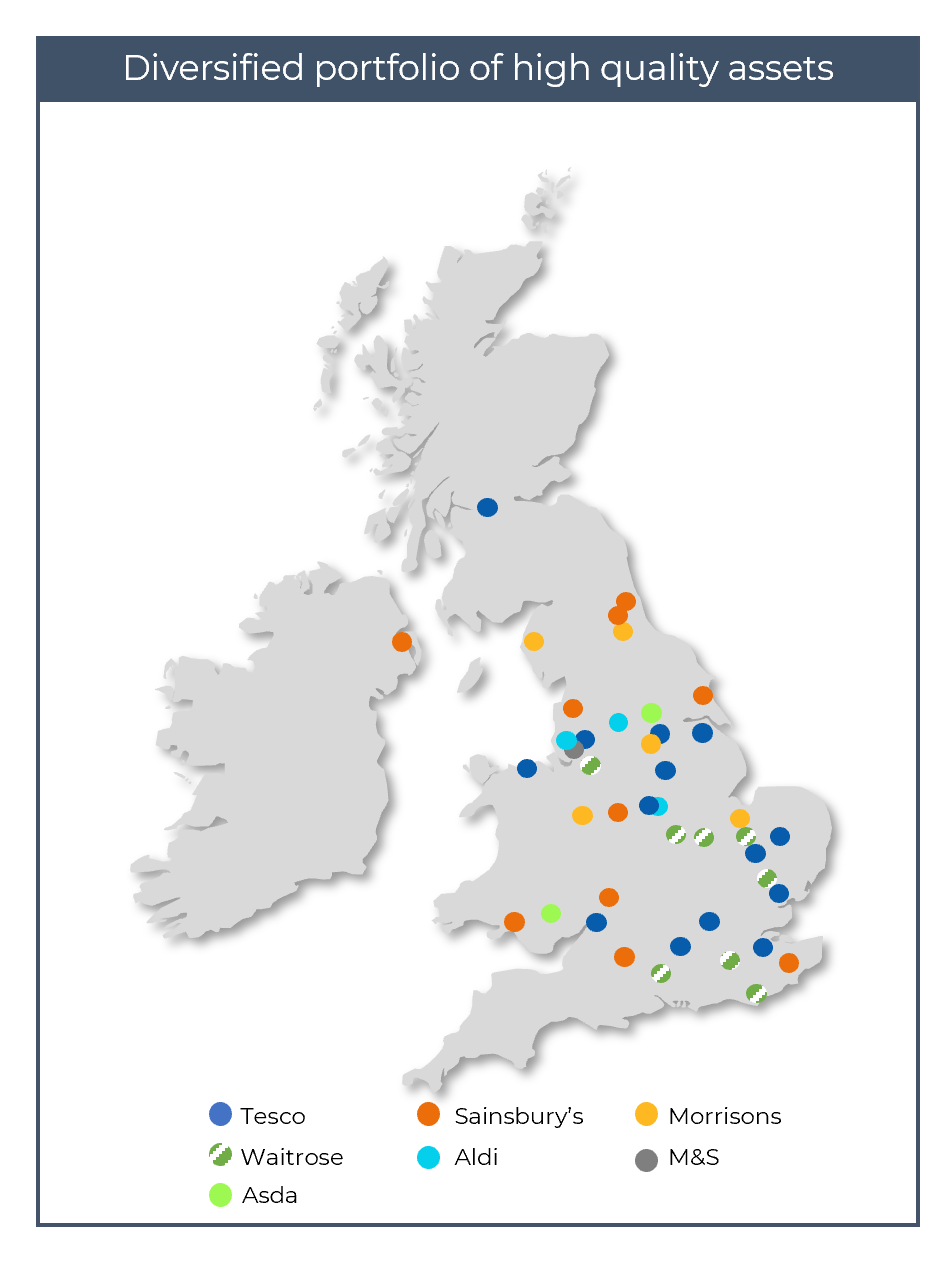

The portfolio has a natural weighting towards Tesco and Sainsbury’s – Tesco is about 44% and Sainsbury's at 31%.

A larger proportion of their estate is held leasehold, around 40-50%. You look at Asda and Morrisons, and they're more like 15%.

We've got a weighting towards those names and I think that will always be the case, because if you've got a much smaller pool of Asda and Morrisons available, then naturally you're going to end up with more Tesco and Sainsburys.

Supermarket locations and their tenants

Source: Supermarket Income REIT

How long are your properties typically leased for?

We actually regeared two leases in the last nine months or so for two of our Tesco stores. We put new 15-year leases on those with inflation uplifts on an annual basis.

That secure, long-dated income is the really attractive aspect for us.

That's been one of the main reasons for setting up the fund and we're producing a pretty attractive dividend yield relative to our peers at the moment as well.

Our shortest supermarket lease is eight years. We do have a handful of shorter leases but they don't make up a material amount of the portfolio – they’re around 3-4%.

How has the rise of e-commerce affected sales?

In the past, online delivery sales were always quite a loss making part of the business but it became profitable during Covid for the first time.

There was a perception in years gone by I think that the large format supermarket had had its day and the online grocery was going to look like the Ocado model.

What we've actually seen is the big four have gone for this omni channel model. You may not have noticed it but some of them have got 15 to 20 delivery vans parked at the back because they're operating as both a logistics hub to fulfil online grocery but also a physical supermarket.

Before Covid, it was about 8% market share and moved to around 15% at the peak so it near enough doubled. It's back down to about 12% now.

That means if online sales start to fade off again post-pandemic (which they have done a little bit) it's still much larger than it was before and our stores are perfectly placed to benefit from it.

How is the supermarket model different from Ocado's?

We've got stores that deliver around six orders an hour, whereas it's virtually impossible for Occado to do that – their vans have to travel so much further because they've got the centralised fulfilment hubs.

Ocado have less than 20 sites whereas Tesco fulfil online grocery orders from 350 stores, so their coverage of the country is so much better.

They've got so much more of the country within 15 minutes of one of their locations, whereas Ocado has been in a planning battle for five years trying to get a site approved in Islington.

Tesco in that same situation can just add home delivery vans to an existing store. In terms of delivery slot capacity, they added about 600,000 slots during the pandemic in a very short space of time, which is more than tripled the size of a Ocado’s entire business.

Share price of Ocado over the past year

Source: FE Analytics

Is the cost of living crisis a concern for you? Could it tighten consumer spending in stores?

Yeah, I think it's one of those things where you have to accept that inflationary pressures are impacting the entire economy and grocery isn't going to be immune to that.

But actually, consumers are more likely to cut back on luxury type goods, whether that's clothing, or eating out in restaurants and bars.

It's a really defensive, non-discretionary sector – ultimately, people will always need to eat and there isn't an alternative other than grocery.

You don't want to look like you're profiteering from it, but actually it's just more a fact of life that these operators are on fine margins and they have to pass that on to consumers.

Have you added new names to the portfolio recently?

We're ultimately looking to reflect the UK grocery market and we’ve seen a cycle of new names in recent times, so we’ve now added a couple of Aldis. They haven't got the store networks to be able to do omni channels as well as the larger operators.

These discounters ultimately have good business models but they follow a different model to the larger operators; they have smaller format stores which means they don't really do anything online other than partnerships with the likes of Deliveroo.

They also typically have smaller lot sizes, so they’re not as wedded to these locations. They could just move two minutes up the road and build another one in many instances. What that means is you’re at risk at the expiry of that lease.

What do you like to do outside of fund management?

I signed up for the London marathon again last week so I need to get myself fit. It’ll be my fourth one in October and apparently you get better as you get older!