Funds that offer investors some protection against inflation have increased their lead in 2022 as investors continue to worry about rising prices and interest rate hikes, although a strong July saw most sectors improve their year-to-date numbers.

While the opening half of 2022 featured heavy losses for most parts of the market bar a few, July represented something of a turnaround and risk assets rallied as investors started to think that economic weakness would cause central banks to slow aggressive monetary tightening plans.

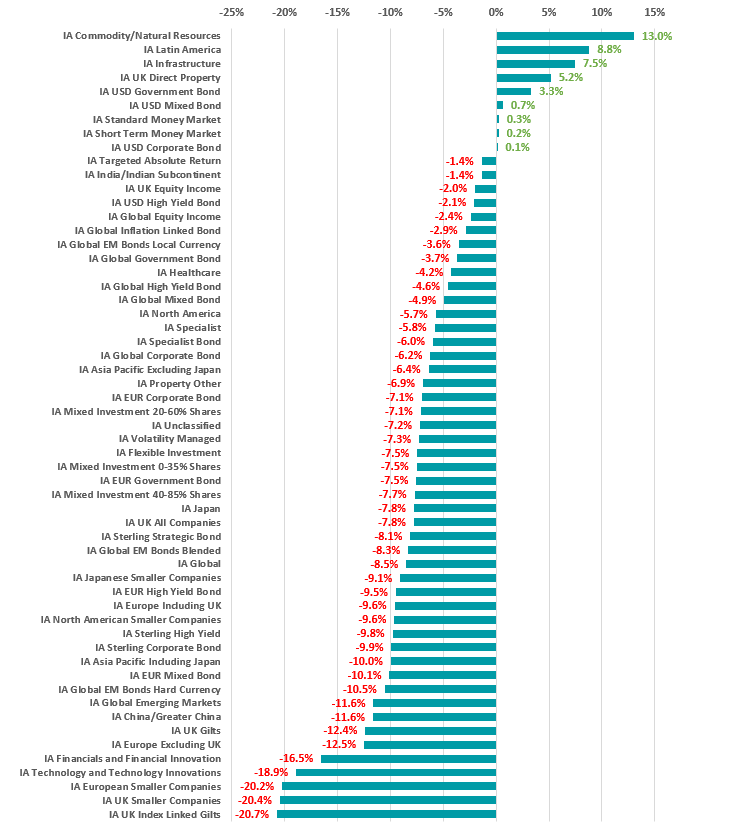

As the chart below shows, a strong July wasn’t enough to completely reverse the losses posted by funds over the course of 2022, when issues such as rising inflation and rates, concerns over the health of the economy and the war in Ukraine have hammered sentiment.

Performance of Investment Association sectors in 2022 so far

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Jul 2022

There are just nine Investment Association sectors where the average fund made a positive return over 2022 to the end of July, but this is an improvement from one month earlier when only seven peer groups had avoided a loss.

As has been the case for most of the year, the best sectors have been the likes of IA Commodity/Natural Resources (where the average member is up 13%), IA Latin America (up 8.8%) and IA Infrastructure (up 7.5%).

All of these sectors can be seen as inflation plays: commodities funds give exposure to raw materials, which have shot up in price recently; Latin America funds benefit from this as they are commodity exporters; and infrastructure assets tend to have a link to inflation through regulation, concession agreements or contracts.

At the bottom of the rankings are the IA UK Index Linked Gilts, IA UK Smaller Companies, IA European Smaller Companies and IA Technology and Technology Innovations, with average losses of around 20%.

However, this represents something of an improvement – one month ago, all of their year-to-date returns were about 25%.

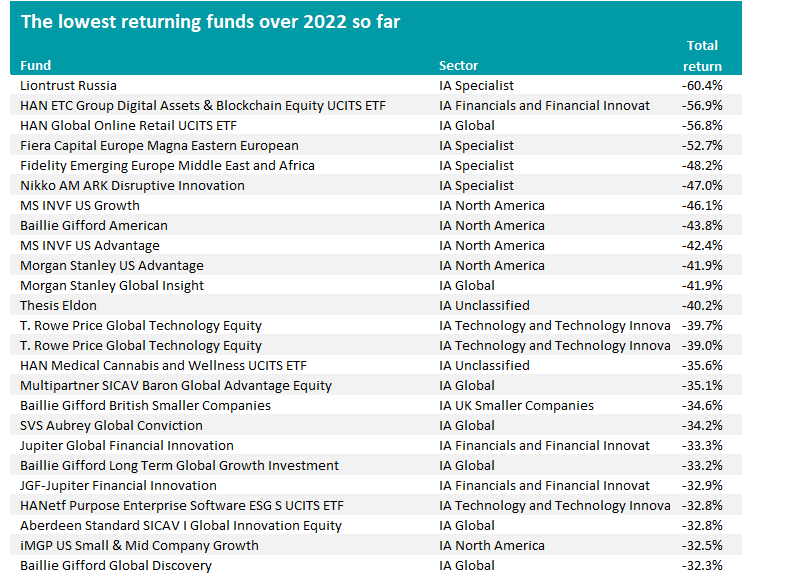

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Jul 2022

There has been relatively little change in the individual funds topping 2022’s performance rankings.

iShares S&P 500 Energy Sector UCITS ETF, SSGA SPDR S&P U.S. Energy Select Sector UCITS ETF and Xtrackers MSCI USA Energy UCITS ETF were the top three funds in the year to the end of June but have added 14 percentage points to their year-to-date return during the month since then.

Even a cursory glance at the table above shows how much of a powerful theme investing in energy has been in 2022. Although most commodities have been going up this year, oil and gas have rocketed as bottlenecks and the sanctions on Russia squeezed supply.

Only a few funds on the table – AQR Systematic Total Return UCITS, Winton Trend (UCITS), AQR Managed Futures UCITS, Winton Diversified (UCITS) and Invesco Emerging Markets ex China (UK) – are not commodity strategies.

Source: FE Analytics. Total return in sterling between 1 Jan and 31 Jul 2022

Again, there’s little change in the funds at the very bottom of the Investment Association performance rankings over 2022 so far, with Liontrust Russia’s 60.2% fall being the worst. The fund – along with other emerging and eastern Europe funds – suffered after Russia was frozen out of financial markets following its invasion of Ukraine.

The other dominant theme among 2022’s worst funds is a focus on the growth style of investing, especially tech stocks. As is well known now, these stocks surged in the decade of ultra-loose monetary policy after the financial crisis but are less attractive to investors when interest rates start to rise.