There was a strong turnaround in fund performance last month as most Investment Association sectors rallied, in stark contrast to the brutal opening half of 2022, FE fundinfo data shows.

In the first six months of the year, 50 of the 57 fund peer groups posted a negative average return as investors were spooked by rising inflation and interest rate hikes, as well as China’s coronavirus lockdowns and the war in Ukraine.

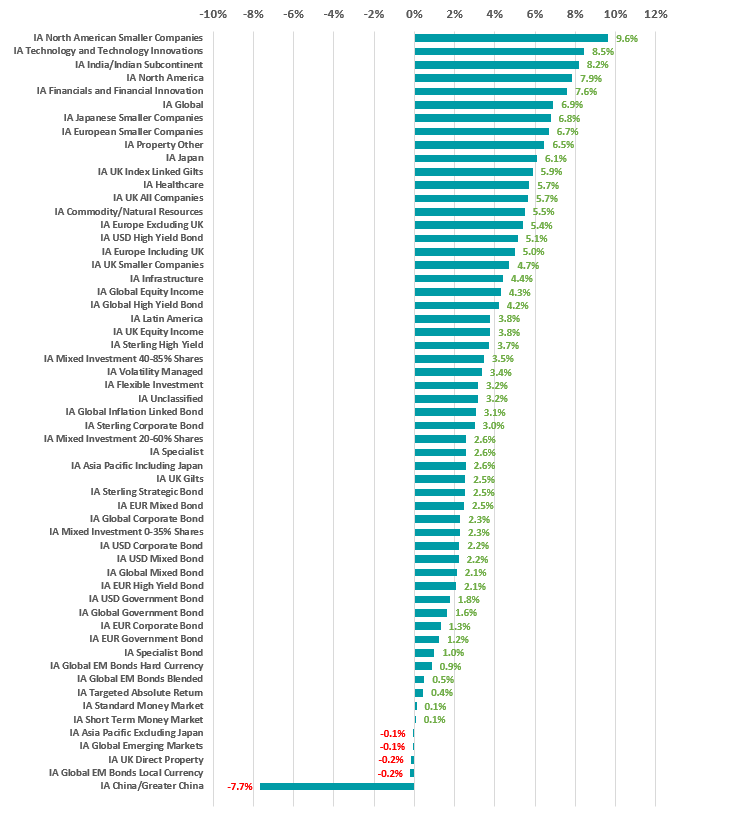

However, things looked much different in July: our data shows that only five sectors made a loss last month – and relatively modest ones at that (in the main) – with the average fund in the remaining 52 peer groups making positive returns.

Ben Yearsley, director at Fairview Investing, put this turnaround down to investors expecting central banks to take notice of slowing economic growth and reassessing the path of interest rate hikes. As evidence, he pointed to the market rally which followed the news that the US has entered a technical recession.

Source: FE Analytics. Total return in sterling between 1 and 31 Jul 2022.

“Bad news is good news. This appears to be the paradoxical stage of the investment cycle we are facing as we move deeper into the second half of 2022. As the economic gloom deepened during July, risk assets rallied strongly,” he explained.

“The rationale being that as economic growth weakens, investors are betting that central banks may be more reluctant to aggressively increase interest rates and slower economic activity will help dampen inflationary pressures.”

As the chart above shows, the strongest sector last month was IA North American Smaller Companies, with IA Technology and Technology Innovations, IA North America, IA Financials and Financial Innovation and IA European Smaller Companies close to the top.

All of these sectors were some of the worst performers in 2022’s first half, when sentiment was at rock bottom, as they are seen as some of the riskier parts of the market.

The big miss was the IA China/Greater China sector, with an average loss of 7.7% in July. Chinese stocks had been rallying hard in recent months after a difficult start to the year but were brought down in July by rising Covid-19 cases, mortgage boycotts across dozens of cities and fresh regulatory action on internet giants.

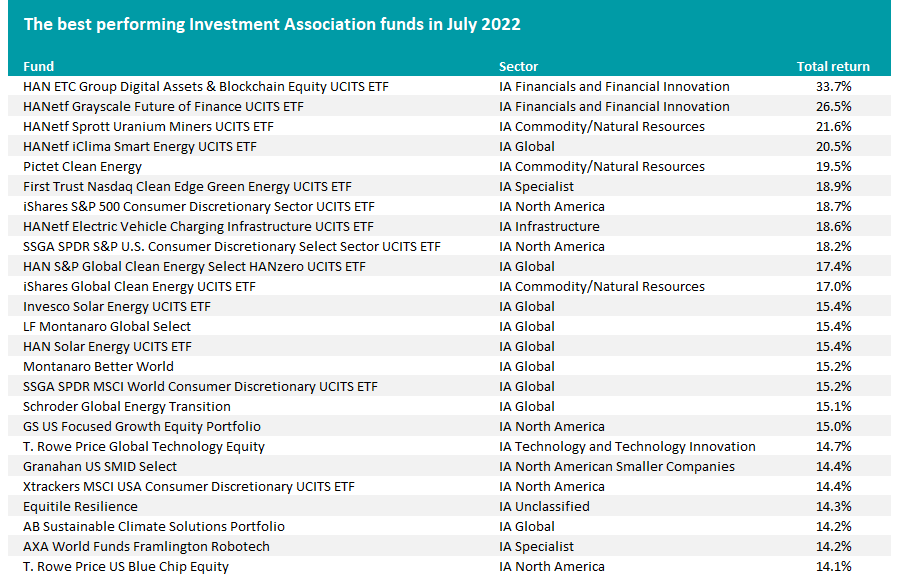

Turning to individual funds, the top of the table is dominated by growth and tech strategies.

Source: FE Analytics. Total return in sterling between 1 and 31 Jul 2022.

These have been the areas hardest hit over 2022 as higher interest rates today make their future earnings less attractive to investors, but they were the kinds of investments that surged in the previous decade of ultra-loose monetary policy.

HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF, the fund that made the strongest returns in July, was the worst performer in the first half of the year after it lost 67.7%.

Clean energy funds are another obvious trend in the above table, with the likes of Pictet Clean Energy, HAN S&P Global Clean Energy Select HANzero UCITS ETF, iShares Global Clean Energy UCITS ETF and Schroder Global Energy Transition among some of the month’s best performers.

“Looking at funds, it felt like a rewind to 2020 with the top of the tables dominated by high growth and clean energy,” Yearsley said. “I’m not sure whether the latter is a response to Europe’s growing realisation that it’s going to be a cold dark winter without Russian gas, or just that pessimism has been overdone with these long-term themes.”

Source: FE Analytics. Total return in sterling between 1 and 31 Jul 2022.

The list of last month’s worst funds is full of Chinese equity strategies, reflecting the fact that the IA China/Greater China sector was the outlier by a clear margin.

Some 21 of the 25 funds with the biggest losses in July were from the IA China/Greater China sector, including larger names such as Barings Hong Kong China, iShares China Large Cap UCITS ETF, Baillie Gifford China, Allianz China Equity and Janus Henderson China Opportunities.