More than £10bn is currently held in funds that have consistently underperformed over the past three years, Bestinvest has revealed in its latest Spot the Dog research.

However, the £10.7bn in ‘dog’ funds represents something of an improvement from the last time the firm ran the research six months ago. Then, £45.4bn was invested in ‘dogs’.

The Spot the Dog report looks for equity funds that have underperformed an appropriate benchmark in each of the past three discrete 12-month periods. To be labelled a ‘dog’, funds also will have underperformed the benchmark by 5 percentage points or more over the entire three years under consideration.

In the latest report, just 31 funds met this criteria – down from 86 when the research was carried out earlier in the year and well below the 150 ‘dog’ funds that were identified in January 2021.

“All sectors saw a drop in the number of dog funds. While Spot the Dog aims to identify serial underperformers rather than those that are temporarily out of fashion, it has undoubtably been tougher for value-orientated funds to stay out of the kennel in recent years,” the report said.

“This flipped in the first part of this year as growth sectors such as technology, communication services and consumer discretionary were hardest hit and investors started to turn to previously unloved parts of the market and value strategies in particular.”

Of the £10.7bn currently in ‘dog’ funds, £5.5bn came from products in the IA UK All Companies sector while £2.1bn is in the IA UK Equity Income sector.

“This could seem unexpected as the London stock market has held up reasonably well compared to some of the other major developed markets this year, particularly the US,” Bestinvest said. “But just as the relative stability of the UK market is down to just a few sectors, so there are funds whose approach has not worked well under any of the conditions experienced over the last three years.”

There has been a big turnaround in global strategies, however. In the previous edition of the report, £8.5bn of underperforming assets were in the IA Global sector and £10bn was in IA Global Equity Income funds.

This time, both peer groups have only contributed a collective £873m to the ‘dog’ fund total.

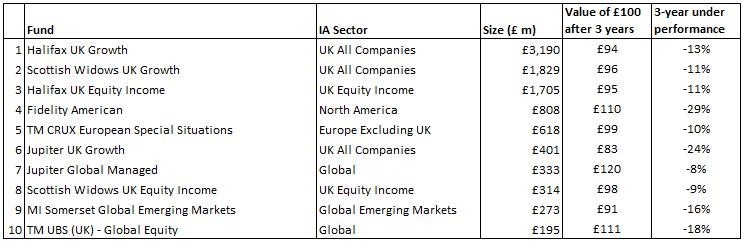

Bestinvest also pointed that £6.7bn of the total came from just three funds: Halifax UK Growth, Halifax UK Equity Income and Scottish Widows UK Growth.

“These have been on the list so long, it seems nothing can bring these dodgy dogs to heel,” the firm added. “It may be the mandate, it may be the manager or the market, but the underperformance is now so entrenched, it is clear that these pooches need some radical behavioural therapy.”

Schroders was singled out as the asset management house with most funds on the report’s list: two-thirds of the ‘dog’ funds are managed by the group. This includes Halifax UK Growth, Halifax UK Equity Income and Scottish Widows UK Growth mentioned above, which are all advised by Schroders.

Bestinvest also drew attention to Jupiter, which has three dog funds on the list including Jupiter UK Growth. This is down from six funds last time around, but the group still contributed £774.7m to the total.

Fidelity only has one fund highlighted for consistent underperformance but Bestinvest noted that the £776.5m Fidelity American fund runs a lot of money. “Managers Jonathan Guinness and Samuel Thomas have only been in place a relatively short time, so may need to be given some time to re-engineer the portfolio,” the report added.

The 10 biggest funds highlighted in the Spot the Dog report

Source: Evelyn Partners Investment Management

Jason Hollands, managing director of Bestinvest, said: “While short-term periods of weakness can be forgiven, as a manager may have a run of bad luck or their style may be temporarily out of fashion, there can be more concerning factors at work: important changes in the management team; a fund becoming too big, which might constrain its flexibility or a manager straying from a previously successful approach.

“We have been producing Spot the Dog for nearly three decades in order to raise awareness of the poor performance of many investment funds and to encourage investors to regularly check on how their investments are doing and take action if necessary. While there can be reasons to persevere a little longer with a poor performer – such as a change of manager or outlook – in other cases it may make sense to switch to a different fund with a stronger team and track record.”