UK CPI inflation could reach 18.6% by next January, according to investment bank Citi, stretching price increases well beyond the 40-year high of 10.1% recorded in July.

Much of the predicted increase has been attributed to a rise in the energy price cap to £3,717 in October and £4,567 by January, more than double the current level of £1,971. By April next year, Citi said the cap could climb as high as £5,816.

Citi economist Benjamin Nabarro said the question now is what policymakers can do to offset the impact on both inflation and the real economy.

“This means getting rates well into restrictive territory, and quickly,” he said.

“Should signs of more embedded inflation emerge, we think a Bank Rate of 6 to 7% will be required to bring inflation dynamics under control.

“For now though, we continue to think evidence for such effects is limited, with increases in unemployment still more likely to allow the Monetary Policy Committee to pause around the turn of the year.”

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said: “A winter of woe is looming amid these frightening forecasts and there is little help in sight to stop a spiral of debt as Shocktober approaches.”

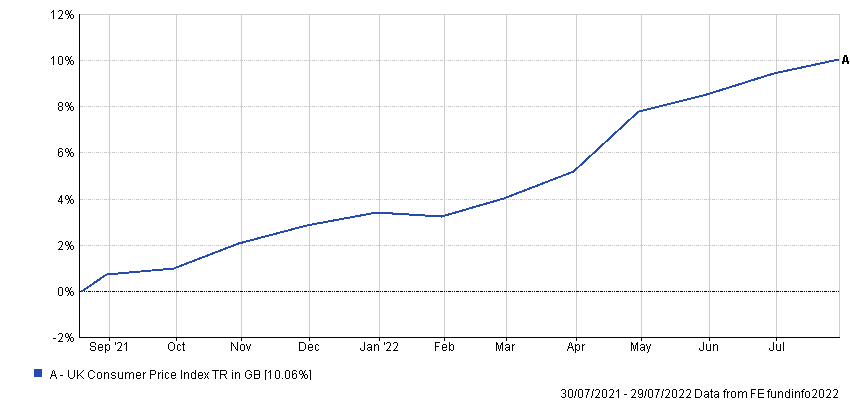

Performance of index over 1yr

Source: FE Analytics

She said that to make matters worse, the government is doing little to subdue inflation – the frontrunner in the Conservative leadership race, Liz Truss, has planned to cut green levies and VAT. But Coles said these measures will be “a drop in the ocean” compared with the wider cost-of-living crisis.

The government is holding off from introducing new measures until the next prime minister is chosen, but Coles said the situation is quickly getting out of hand and action needs to be taken sooner rather than later.

She added: “If we have to wait for an emergency Budget well into September to find out, it means weeks of desperate worry and uncertainty on top of everything else.”

Myron Jobson, senior personal finance analyst at interactive investor added: “The harsh reality is many more UK households could face financial breaking point without meaningful intervention.”

Low-income earners are likely to be the worst hit over the coming months, with Coles calculating that the lowest 10% of UK earners could be spending 41% of their income on energy alone come April 2023.

Likewise, people living off a full flat-rate state pension could be spending as much as 60% of their total income on energy by that stage.

Even those on a higher wage will feel a significant rise in their expenses, with many being forced to drain the savings they accumulated through lockdowns, according to Coles.

She said: “Rising prices and tightening belts are also making a recession more likely – which would force people out of work, and make a desperate situation completely impossible.”

Jobson agreed, stating that “recession is almost an inevitability at this stage”.