Fund managers’ views on China tend to be highly polarised. Those who shun the sector often stress its slowing economy and political risk; on the other side, it has an enormous demographic tailwind working in its favour, and poor sentiment could mean this is the perfect time to buy in.

A recent report by CrossBorder Capital highlighted a collapse in investor positioning, saying: “China has economic problems, but it’s not the basket case that some suggest.”

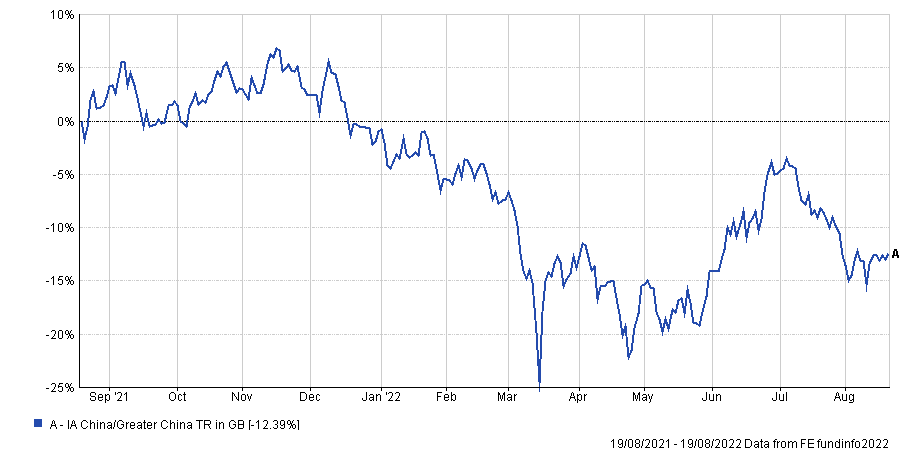

Meanwhile, the IA China/Greater China sector is down 12.4% so far in 2022, although this was as low as -25% earlier this year.

Performance of the sector over 1yr

Source: FE Analytics

Jason Pidcock, manager of the Jupiter Asian Income fund, sides with the more pessimistic view of China, slashing his country allocation to zero, as he told Trustnet in a recent interview.

“I got to a point where I was too uncomfortable investing in China, because politically I think that it has become a country that is more of an enemy than an ally,” he said.

“There are so many other countries in Asia that are exciting and have democracies, so my view is, why should I bother taking all these risks in China when I can invest in those other countries?”

But it is difficult to remain completely detached from the world’s second-largest economy.

Silvia Dall’Angelo, senior economist at Hermes, takes a more moderate stance, acknowledging several uncertainties in the short term without rejecting the prospect of better returns over the long run.

“All China economic activity data unexpectedly softened in July, challenging expectations of a swift recovery in the second half of this year,” she said.

The growth slowdown was particularly pronounced in retail sales and fixed asset investment, underscoring weakness in domestic demand and a struggling property sector.

“As a consequence, we expect policymakers to adopt a measured and targeted approach to stimulus in the coming months, resulting in a slow recovery in the second half of this year.

“Monetary policy easing is likely to be limited, which implies that the drag on domestic demand from the zero-Covid policy will continue to have an impact, making credit easing largely ineffective.”

Dall’Angelo also questioned whether infrastructure stimulus will be enough to offset the impact from the ongoing correction in the property sector. She noted that many forecasters – including the IMF – have cut their 2022 growth expectations for China to between 3 and 3.5%, well below the government’s official target of 5.5%.

But for the long-term investor, she said China might still be worth a punt.

“Growth is expected to bounce back to 5% in 2023, reflecting the likely easing of the zero-Covid policy at the end of this year, after the crucial National Party Congress in October-November,” the economist added.

GDIM investment manager Tom Sparke takes an optimistic approach. Despite concerns around the Taiwan issue, which “could prove catastrophic for risk assets”, and US dollar strength, which has historically been damaging for emerging markets as it increases the cost of servicing debt, he said the positives outweigh the negatives.

“Fiscal and monetary policy are fuelling the economy and should make it easier for China to reach somewhere near its growth targets, which remain relatively high,” he said.

“Longer term, the share of global GDP claimed by China will continue to increase and Chinese investments will undoubtedly do well over a number of years.”