Stockpickers can’t afford to ignore the macroeconomic environment anymore, according to Georgina Brittain of the JPMorgan UK Smaller Companies Investment Trust, even if they are keeping one eye on the eventual recovery.

In a recent presentation, Claire Shaw, an investment specialist on Scottish Mortgage, said that the trust’s managers didn’t even try to make near-term macro predictions, as it wasn’t worth the effort.

“I have no idea about when the tragic situation in Ukraine might be resolved and I have little visibility about whether high inflation is going to be prolonged,” she said.

“We don't know where GDP or yields are going to be this year or next. But here's the crucial point: even if we did know, we're not convinced it would help us make better long-term decisions.”

Like the managers at Baillie Gifford, Brittain said that in an ideal world, she would like to buy and hold companies for the long term. However, she claimed the extreme changes in macroeconomic conditions over the past few years and the impact they have had on markets mean this is no longer an option if you want to extract maximum value from your investments.

“At the end of last year, we were concentrating on the re-opening of the UK, and the consumer being able to get out and about, spend their money and actually start to live life again,” she said.

“Then, coming up to Christmas, we had a renewal of concerns about Covid, which affected a lot of companies. Coming into 2022, everything changed with the Russian invasion, and in the background to all of that you had rising inflation and interest rates.”

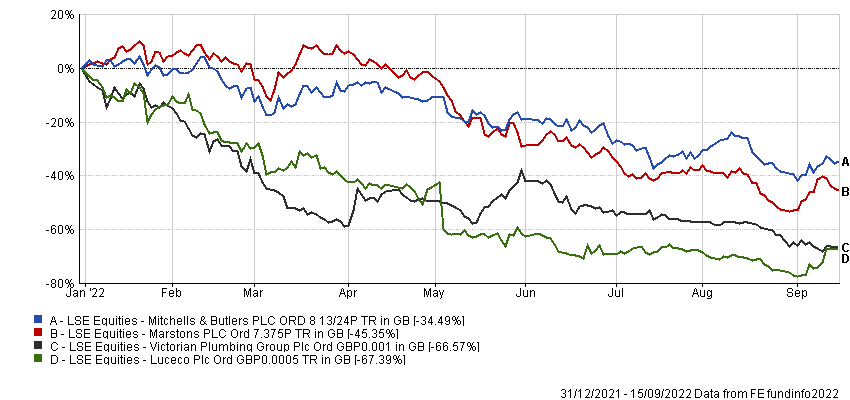

Brittain has made significant changes to her portfolio in response to these events, selling out of pub group Marston’s and restaurant group Mitchells & Butlers due to worries about the impact of rising energy costs.

Other disposals were more difficult – Victorian Plumbing and lighting products maker Luceco issued profit warnings due to supply chain issues and falling consumer spending on home improvements, respectively. However, poor liquidity in the market meant she struggled to find buyers for these companies.

Performance of equities in 2022

Source: FE Analytics

Yet while the manager is readying her portfolio for a recession, she has been surprised by how few portfolio holdings, outside of those directly affected by specific macro issues, have reported a slowdown in their business.

“They're all expecting it, and some of them are starting to make cost-cutting moves in various areas,” she continued. “They're quizzing their customers, quizzing their suppliers, but they’re not seeing it yet.

“It is quite extraordinary because the recession started in March for the stock market, and while we are expecting declines, we think a lot of share prices have overstated the magnitude of those declines.”

She admitted this issue has been blurred by the inflationary price rises that companies are putting through. In addition, she said that while the UK small- and mid-caps look cheap in terms of price-to-earnings, those figures are “absolutely, no question, wrong” as results have yet to take into account the hit to earnings experienced by specific industries.

However, despite Brittain’s caution, she is not filling her portfolio with safe businesses, and is maintaining some exposure to those companies “in the eye of the inflationary storm”.

“We can't possibly tell you when it will be,” the manager continued, “but we know that when those companies start to recover, the moves won't be 5 or 10%, they'll be 30, 50, 90 or 120%: that's the magnitude of the decline, and that's how much value we can see stored in a number of names.”

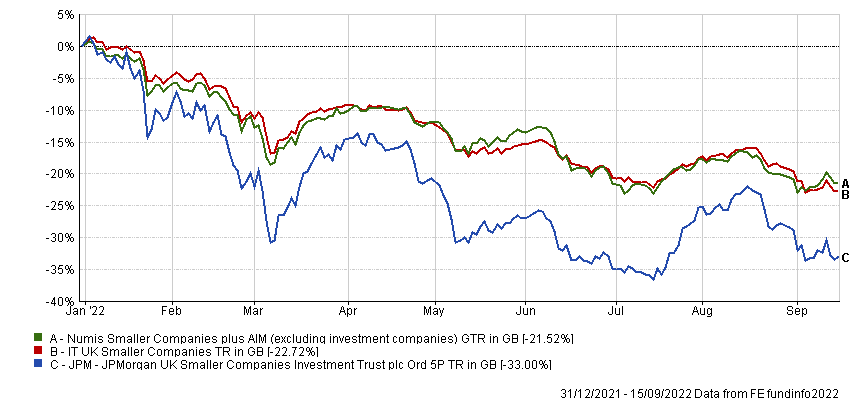

She pointed to the performance of the trust in July as an example of what the recovery is likely to look like when it eventually arrives. The trust jumped more than 20% in a month, as global markets rose on rumours the Federal Reserve would pause its rate-hiking programme. When these rumours were found to be wide of the mark, the trust relinquished all these gains.

Performance of trust vs sector and index in 2022

Source: FE Analytics

However, Brittain said the point is that it will be impossible to time the bottom of the market and the point to buy back in ahead of the rebound.

“I took care to talk to young members of the team that haven't seen it before, to emphasise this is how quickly things can move. It’s no good saying ‘I will buy back into X and Y’. You'll find there's too many other people trying to do the same thing and the shares are already 50% higher.

“I cannot possibly say when it will happen, but the speed with which small and mid caps will move means that if you're on the sidelines, you will be left standing,” she finished.