Sometimes funds go through tough patches and knowing whether to stick or twist is a difficult call to get right. It is a question that investors in both the Fidelity Asia and Ninety One Asia Pacific Franchise funds may be asking themselves, after some recent underperformance.

Over the past three years, the funds have made losses of 2.6% and 3.3% respectively, while over 12 months they have dropped 20% and 21%. All of these returns are bottom-quartile versus the IA Asia Pacific Excluding Japan sector.

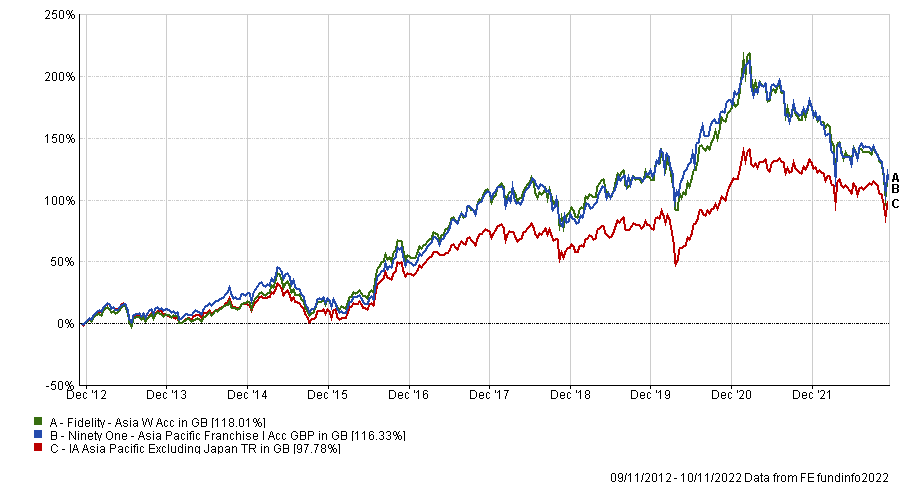

Yet, over the long term, both remain among the best of their peer group. Indeed, as the below chart shows, both have more than doubled investors’ money over the decade and rank 17th and 18th respectively out of 75 funds with a requisite track record.

Total return of funds vs sector over 10yrs

Source: FE Analytics

Marcus Stuart-Smith, associate analyst at wealth manager RBC Brewin Dolphin, said both have a growth bias and capitalised on the low interest rate environment of the past 10 years.

“As interest rates have risen and China has experienced its own turmoil, it is to be expected that these growth funds which have ridden the ‘North Asian Tech’ bull run will now sell off,” he said.

“The performance of Taiwan Semiconductor Manufacturing Company and Tencent, both of which are significant holdings in the funds, are prime examples of the tumultuous environment that companies have gone through.”

However, it is crucial that the funds do not deviate from their strategy despite this short-term wobble, as active fund managers should have conviction in their process.

As a result, he suggested the Fidelity Asia fund. The £3.3bn portfolio is run by Teera Chanpongsang, who has a “well outlined process which has been honed over time”.

In comparison, Stuart-Smith said: “A certain amount of style shift has occurred within the Ninety One fund over the past five years. Given the long-term nature, we would need to be satisfied that the process implemented matches with the holdings in the portfolio.”

Not everyone agreed, however. Darius McDermott, managing director at Chelsea Financial, said he preferred the £200m Ninety One Asia Pacific Franchise fund, managed by Charlie Dutton since 2017.

He said that the quality-growth style employed by the manager has been out of favour in recent months, but noted that any reversal in fortunes for the style should lead to strong performance once again.

“He also likes to find these businesses at attractive valuations, so opportunities will be presenting themselves today,” McDermott noted

McDermott noted Dutton, like Chanpongsang, is an experienced manager who runs a high-conviction portfolio that is predominantly invested in large-caps.

His fund currently has a more than 50% weighting to China, Taiwan and Hong Kong, while more than a quarter of the fund is invested in tech.

“The fund has been hit hard by zero-Covid lockdowns and the change in Chinese Communist Party (CCP) policy towards tech. If these things reverse, the fund would likely outperform, but you have to believe in China and Chinese equities to invest in this fund at the moment though,” said McDermott.

Over the summer, analysts were split on the future success of the world’s second-largest economy.

Silvia Dall’Angelo, senior economist at Hermes, said in the short term there may be more pain yet to come, but the country made for an interest long-term prospect, while GDIM investment manager Tom Sparke said the combination of fiscal and monetary policy currently being taken should allow China to reach its relatively high growth targets.