There hasn’t been a better time to invest in small caps since 1989, according to data from Research Affiliates, with chief investment officer of equity strategies Que Nguyen pointing out that small-cap stocks are “now trading at a 25% discount from their historical median valuation since 1989”.

According to the firm’s models, these stocks are poised to outpace large-cap stocks by 3.7 percentage points a year over the next five years.

“This return forecast meaningfully surpasses small-caps’ long-term historical average return premium of 0.5 percentage points,” Nguyen said.

Scott Spencer, investment manager in the multi-manager team at Columbia Threadneedle Investment, said smaller companies offer a range of attractions as an investment which increase the drivers for performance portfolios and so should be considered as a separate asset class.

“Repeated studies of long-term returns have shown that small cap outperform large-cap indices across the world,” he said.

However, "before we fill up our portfolios with small-cap equities and sit back to wait for superior returns”, he noted that the reason for those additional gains is that investors are taking on more risk.

“Shares in smaller companies have higher risk and higher potential returns. Small-caps are not just miniature versions of large companies. They can operate with different business models and in entirely separate, niche markets,” he warned.

If you have always been a fan of small-caps and can take on the additional risks that they pose, this might be the right time to turn your attention to them. Below, Trustnet gathered four small-cap funds from around the world that might be able to capture this growth.

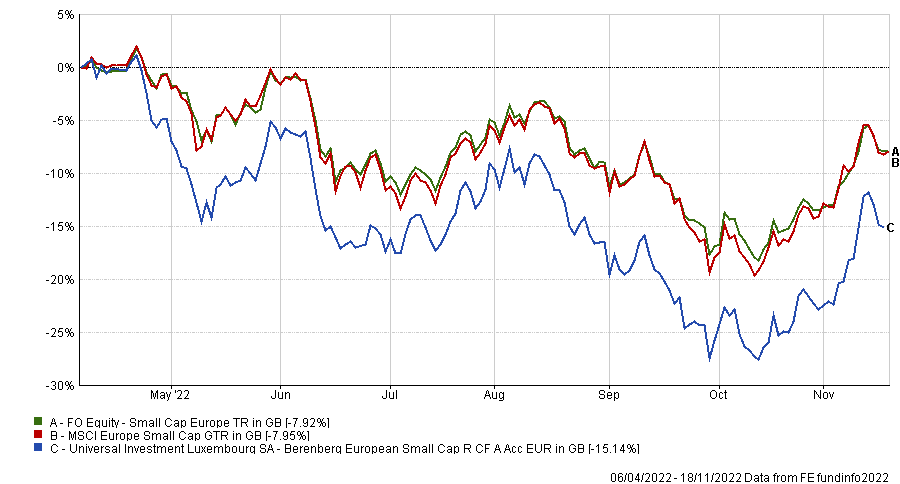

Spencer highlighted Berenberg European Small Cap, a “nimble fund that invests across the different economies of Europe but with a clear focus on a certain type of company”.

“The manager, Peter Kraus, has invested in European small- and micro-cap business for 20 years and has developed a distinct investment style of focusing on compounding growth companies reinvesting their cash flows at high returns,” he said.

“In order to generate better returns, these companies must have a high barrier to entry and a clear runway of growth ahead of them. The manager takes a five-year view and believes the companies in the portfolio have the potential do double their profits over this period.”

Performance of fund since inception against sector and index

Source: FE Analytics

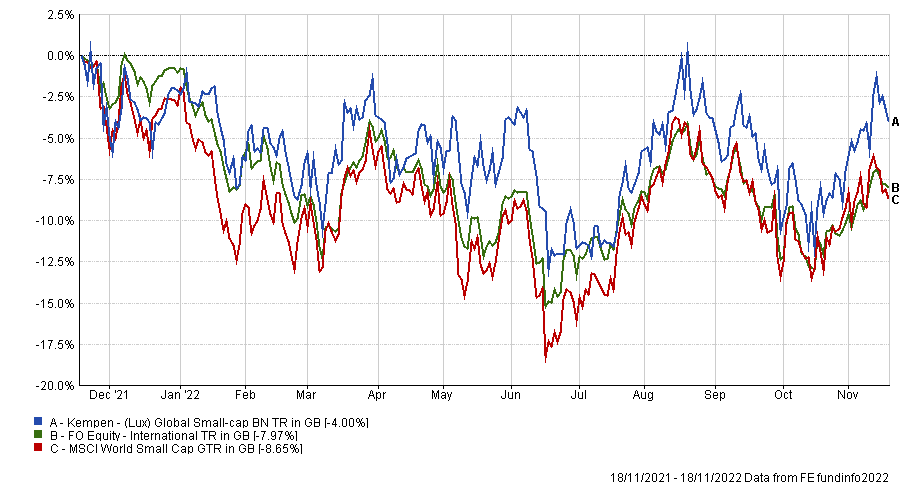

Rob Morgan, chief analyst at Charles Stanley Direct, selected the “lesser-known” €1.4bn fund Kempen Global Small-Cap.

“The managing team seek stocks with quality characteristics trading at a valuation discount and have an impressive ‘hit rate’, illustrating its research-intensive process and high levels of constructive engagement with company management,” he said.

The team, based in Amsterdam, has built “an impressive long-term record, overcoming a longer-term headwind for their value style”.

The managers try to avoid taking major bets in terms of geography and sector to maximise the influence of their stock picking which makes it a “welcome diversifier”, Morgan concluded.

Performance of fund over 1yr against sector and index

Source: FE Analytics

He also picked Brown Advisory US Smaller Companies, which invests in a portfolio of smaller US companies that generate above-average growth and possess sound management teams and favourable competitive positioning. The aim of the fund is to beat the Russell 2000 Growth Index over a typical market cycle on a risk-adjusted basis.

“Brown Advisory are experienced and well-resourced US small cap investors. Through their disciplined, bottom-up investment process, the team have been successful in picking winners,” he said.

Ben Yearsley, director at Fairview Investing Limited chose Montanaro Global Select, despite it having suffered over the past year – it has lost 27.7%, well behind the -10.3% of its IA Global sector.

Performance of fund versus sector and index over 2yrs

Source: FE Analytics

“It’s a long-term, quality-growth fund focused on US and pan-European small- and mid-caps. It’s had a tough time due to its style over the past year or so, but I’d back it for the medium-to-long term.”