This year has been an aberration for growth funds as rampant inflation has led to rising interest rates, which have disproportionately affected companies with the potential to increase revenues and profits way into the future.

These earnings are measured against the long-term returns from risk-free investments such as cash or bonds. If the returns from stocks are significantly higher, then investors will take the risk.

This has been the case for much of the past decade, as interest rates have been rooted to the floor, but in 2022 central banks have picked them up rapidly, causing investors to sell out.

Hal Cook, senior investment analyst at Hargreaves Lansdown, said a number of high-profile and much-loved funds had been hit by the sudden shift in monetary policy, but this is not necessarily an indication that they are bad funds or are run by bad managers.

“This was a market adjustment that was out of their hands. Therefore, there is potential for these funds to rebound once things calm down and future expectations on interest rates become clearer,” he said.

One such fund that may be worth a look is Rathbone Global Opportunities, run by FE fundinfo Alpha Manager James Thomson and co-manager Sammy Dow.

So far this year the fund has made an 18.1% loss, around twice the average IA Global fund (9.2%). However, this is only the second year in the past decade that it has fallen to the bottom quartile of the peer group, and over three, five and 10 years it remains a top-quartile performer, as the below chart suggests.

Total return of fund vs sector over 10yrs

Source: FE Analytics

“They are pure growth-style investors who have shifted their portfolio in 2022 for a higher inflation, higher interest rates world, owning some of the world’s best-known companies and focusing on investing in developed markets such as the US, UK and Europe,” said Cook.

Smaller companies suffered an even worse fate this year, as the higher costs of borrowing and potential for weakened consumer demand due to inflation made for a potentially toxic mixture.

Investors sold out of these companies in their droves, but the Hargreaves analyst noted that this is not unusual during difficult economic times because investors tend to flock toward bigger companies that have larger balance sheets and a perceived better chance of surviving any potential recession.

“But there are still loads of very good smaller companies that will make it through the current challenges and come out stronger on the other side,” he said.

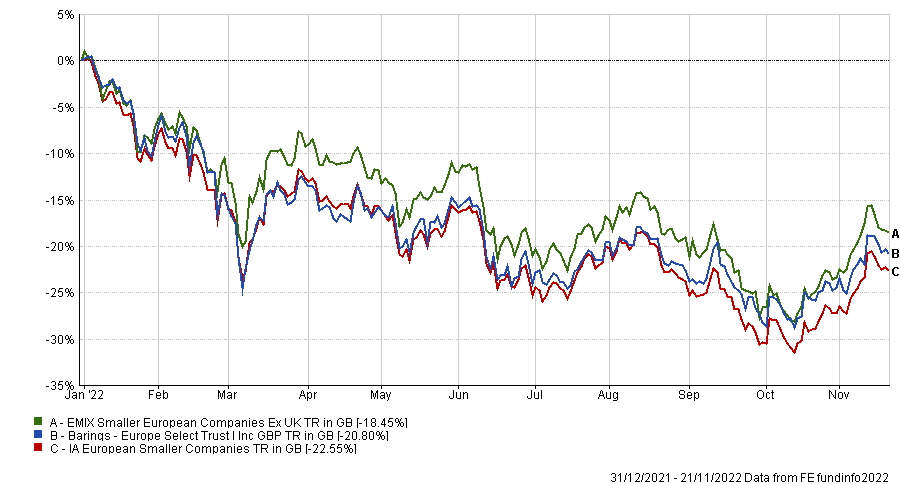

For investors willing to take on the additional risk and potential short-term pain for long-term gains, Barings Europe Select Trust is an interesting proposition.

“The team managing this fund have a very strong long-term track record investing in smaller companies listed within Europe. Historically, investing in smaller companies within Europe has led to greater long-term returns than their larger counterparts too,” he said.

The fund has fallen a lot this year in absolute terms (down 20.8%) but is ahead of the IA European Smaller Companies sector average (down 22.5%).

Total return of fund vs sector and benchmark over YTD

Source: FE Analytics

Turning to bonds, this year has been “terrible” for investors who have suffered “significant” losses in all parts of the market.

However, investing now presents an attractive opportunity to pick up bonds on higher yields, which gives some income protection should there be further capital losses from here.

Jupiter Strategic Bond and Artemis Corporate Bond were the picks here in the fixed income space. Both are globally invested with the former run by FE fundinfo Alpha Manager Ariel Bezalel and co-manager Harry Richards.

“They often have a large part of the fund invested in higher yielding bonds, which have lower credit ratings,” said Cook, who noted Jupiter Strategic Bond's “very long track record of success”.

Although the fund has lost 15.3% this year – which has dragged it to below-average over 10 years in the IA Sterling Strategic Bond sector – it is only the second year since 2012 that it has slipped to the fourth quartile and the fourth year it has been below average.

Total return of fund vs sector over 10yrs

Source: FE Analytics

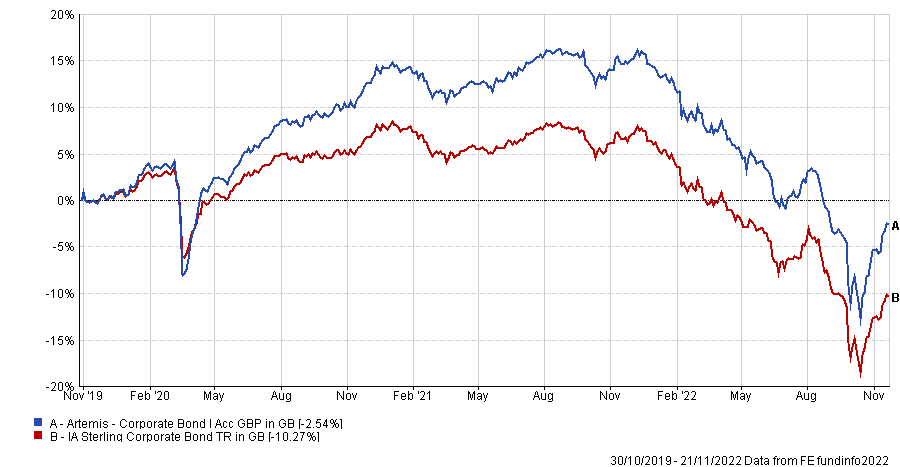

The Artemis Corporate Bond fund meanwhile is down 14.8% so far this year, although this is ahead of its IA Sterling Corporate Bond peer group (15.5% loss).

Overall, the fund is on course for its third year in a row ahead of the sector average and has outpaced its rivals by almost 8 percentage points since its launch in 2019.

Total return of fund vs sector since launch

Source: FE Analytics

“While the fund was only launched in October 2019, lead manager Stephen Snowden has a long and successful track record going back much longer than that at Aegon and Old Mutual,” said Cook.

An option that combines all three areas of the market – a growth bias, smaller companies and bonds – is Baillie Gifford Managed.

The Edinburgh-based investment firm has had a particularly tough year and this fund is no exception, down 23.8% in 2022 – more than double the loss of the average fund in the IA Mixed Investment 40-85% Shares sector.

Total return of fund vs sector and benchmark over YTD

Source: FE Analytics

However, despite this it remains a top-quartile performer over five and 10 years as the fund benefited from favourable conditions for most of the past decade.

“This is a growth-style offering, which invests in mainly in company shares but also some of the fund is invested in bonds has delivered over the long-term however,” Cook said.

“Within the equities allocation, there is often a good amount invested in mid-sized companies which gives the fund even bigger growth potential and the team at Baillie Gifford have a long and successful track record of picking companies that do achieve outsized growth.”

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

|

Artemis Corporate Bond |

IA Sterling Corporate Bond | £853m | Stephen Snowden, Grace Le | 3.7% | 0.37% | 30/10/2019 |

| Baillie Gifford Managed | IA Mixed Investment 40-85% Shares | £5,940m | Steven Hay, Iain McCombie | 1.3% | 0.42% | 01/04/1987 |

| Barings Europe Select Trust | IA European Smaller Companies | £651m | Nicholas Williams, Colin Riddles, Rosemary Simmonds, William Cuss | 1.3% | 0.80% | 29/08/2012 |

| Jupiter Strategic Bond | IA Sterling Strategic Bond | £3,450m | Ariel Bezalel, Harry Richards | 4.7% | 0.73% | 19/09/2011 |

| Rathbone Global Opportunities Fund | IA Global | £3,474m | James Thomson, Sammy Dow | 0.0% | 0.78% | 01/03/2012 |