The world’s leading growth companies often pay little to no dividends to shareholders, but “those days are over,” according to Fran Radano, manager of the North American Income Trust.

Mega-cap companies such as Meta, Apple, Amazon, Netflix and Alphabet (FANNGs) have generated high volumes of cash revenues over the 2010s, which they have used to expand the business and explore new ventures.

This high level of reinvestment has left little room for dividend pay-outs so the FAANGs have rarely been an appealing purchase for income-seeking investors.

However, Radano anticipates that they could grow their dividend payments in the near future, presenting a potential entry point for his income value trust.

He said: “We’d definitely look at buying them [the FAANGs], but it’s not about the dividends getting higher, it’s whether they managed the business in a sensible manner.

“We’re completely open minded. We’re not anti-tech, but we need a dividend stream. I like the discipline a dividend brings.”

With lower revenue, FAANG companies could be forced to reduce their spending and use the stockpile of cash they have built up over a decade of outperformance to reward shareholders and incentive investors to continue to hold them.

This could make them a more enticing investment case for income managers like Radano who have previously seen little appeal in high-growth US companies.

One exception is Microsoft, which Radano held in the portfolio from 2012, but sold out of the position in 2018/19 due to its excessive spending and lowering yield.

Revenues soared in the growth supportive markets of the past decade, but the company was spending a lot on improving the business and little was being directed to shareholders.

Radano said that “you could argue that we probably sold it early,” but the dividend shrunk from 3% to 1.5% over the holding period despite a substantial rise in revenues.

Microsoft is one of several high-growth companies that he is looking at now that the prospect of lower spending and higher pay-outs is on the table.

Apple was another stock that Radano came close to buying over the past year, although it would have been the lowest yielding asset in the portfolio.

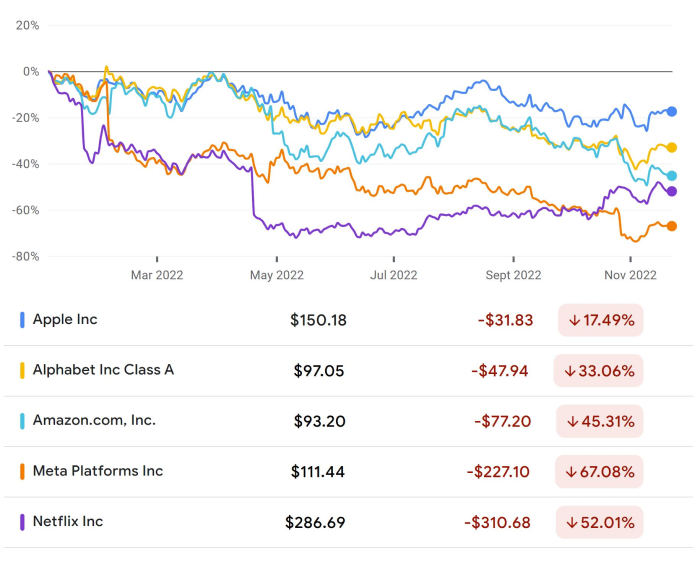

Now that FAANG revenues have hit the breaks for three consecutive quarters this year, Radano said that he could find an opportunity to buy them at derated prices if they slow their spending.

Share price of the FAANGs in 2022

Source: Google Finance

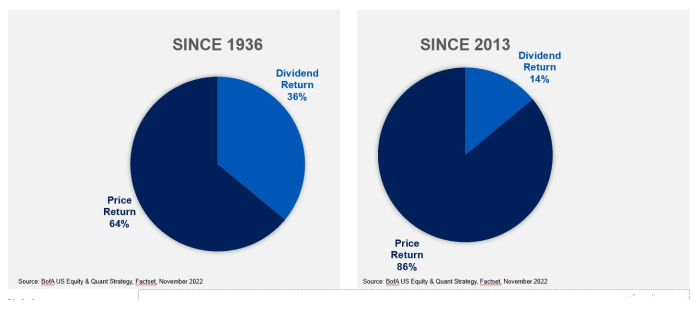

The US market has a reputation for being saturated with high-growth companies, but this has not always been the case. Historically, dividends from the US accounted for 36% of total returns since 1936.

In the high-growth era of low rates and an abundance of free cash, the dividend contribution to total returns shrunk to 14% since 2013.

Dividend contribution to US total returns over the long and short-term

Source: abrdn

The narrow contribution made by dividends over the past decade is an unusual anomaly brought about by the growth-dominant markets of the 2010s – investors could see a return to higher dividend levels over the coming years, according to Radano.

He said: “It was a growth market with a growth backdrop, and it crowded out the dividend payers. It might not get back to the same level any time soon, but it will rise a decent amount given the new backdrop of inflation and interest rates.”

Some growth companies, such as chemical manufacturer, FMC, which is worth an estimated $16.1bn (£13.6bn), has already began to increase its dividend pay-outs to shareholders.

Radano said: “Twenty years ago, FMC wouldn't pay dividend. It would just buy back stock but now it understands the benefit of sort of returning capital to shareholders.”