Valuations in UK small caps are so low they are “embarrassing”, according to JOHCM’s Clive Beagles, who says they are now at levels indicative of a “broken market”.

Beagles runs JOHCM UK Equity Income, which aims to deliver a higher yield than the FTSE All Share index on a prospective basis. While income funds aren’t typically associated with small caps – these companies are at an earlier stage of their development than their larger peers and tend to reinvest excess cashflows into the business rather than return them to shareholders via dividends – Beagles’ portfolio currently has about 20% of his portfolio in this area of the market.

To explain why, he used construction firm Kier as an example.

“While it wasn’t a well-run business before, a really strong management team has been brought in,” he said.

“It has a net cash position, and it operates in infrastructure, which we need a lot more of in the UK. Yet it trades on just 3x earnings. The market is broken and serving no purpose as this type of company is just going to get taken private. And it gets embarrassing.”

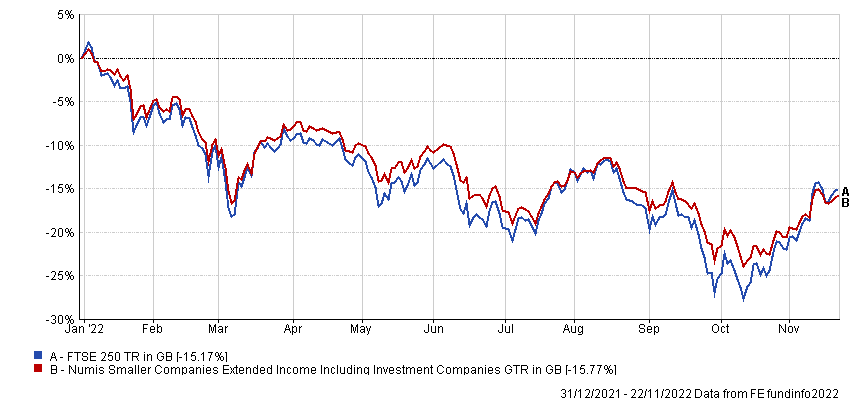

Beagles is not the only all-cap UK manager to highlight the value in smaller companies. Alex Wright, manager of the Fidelity Special Situations fund and Fidelity Special Values trust, said this year’s bear market in the UK has been unusual in that large caps have escaped largely unscathed, while mid and small caps are down by double digits. However, he said it is these battered areas that interest him the most.

Performance of indices in 2022

Source: FE Analytics

“It's that part of the market where I'm seeing more opportunities, particularly where there's been some forced sellers,” he said. “What's generated some of that forced selling is that we've seen outflows from the UK continue for a number of years, and we have seen a meaningful pickup this year, particularly in the small-cap space.”

While Beagles said the post-Woodford liquidity panic has contributed to the poor performance in small caps, he agreed with Wright about the impact of outflows from the UK.

He said the “self-harm of 2016 didn’t help” the UK’s standing among international investors, but pinned the blame for the FTSE’s unpopularity on its value bias, which has put it at a disadvantage in the era of growth investing. However, he said this should begin to work in its favour as we enter a “regime shift” of higher inflation and interest rates.

“My fund has the highest dividend yields and the highest dividend cover I’ve ever seen, and the best balance sheets: 60% of companies in my fund are buying back shares because they've got excess capital, and yet they are probably on the lowest multiples I've ever seen,” Beagles continued.

“It's an absolute candy shop in terms of opportunity. Our biggest problem is we've got too many ideas and not enough capital to put into them. I've been doing this job for more than 30 years and the first quarter of 2009 was the only comparable time for valuations.

“As long as Jeremy Hunt or Keir Starmer don't blow everything up, then there will be a reason for the UK to outperform, regardless of what sort of noise the media makes.”

He admitted the UK is unlikely to attract international investors without some sort of external catalyst, which could come in the form of a wave of major companies being taken private.

“But in the meantime, they will just distribute a large portion of that cash back to us, so I think we can afford to be patient,” he added.

Not everyone is so convinced that the UK will ever regain its former glory, however. Earlier this year, Laura Foll of the Henderson Opportunities Trust warned that unless it outperformed for a sustained period, it would remain easy for global asset allocators to ignore.

“There's an element that is self-fulfilling in that the UK equity market is actually a very small portion of the MSCI World now,” she said. “And then it effectively becomes a vicious circle: performance needs to correct, but you need people to pay attention to get performance.”