The past 12 months have been torrid for virtually all asset allocators and investors as it’s been a rare ‘everything down’ year. Quantitative easing (QE) was always going to be an experiment where the ending was not known.

The answer to the question many posed throughout the past decade and a bit, ‘so how do we actually get out of QE?’ is beginning to appear. We don’t, is the answer, at least not without some pain.

There has been no hiding place. The return of inflation has ravaged lower-risk assets such as bonds, both government and corporate, while the real shock has been that inflation-linked bonds (which one would assume from their title would be ready-made for just such an environment) have fared in many cases even worse.

Equities have suffered, but then so has gold, another oft-touted haven against inflation. Even cash, despite holding on to its capital value, has lost value in real terms.

Everything comes to an end, as will this cycle, but it is important to have survived said cycle in the first place to be able to position correctly for its next phase. The charts that I keep returning to for clues as to how this cycle is most likely to move on are below.

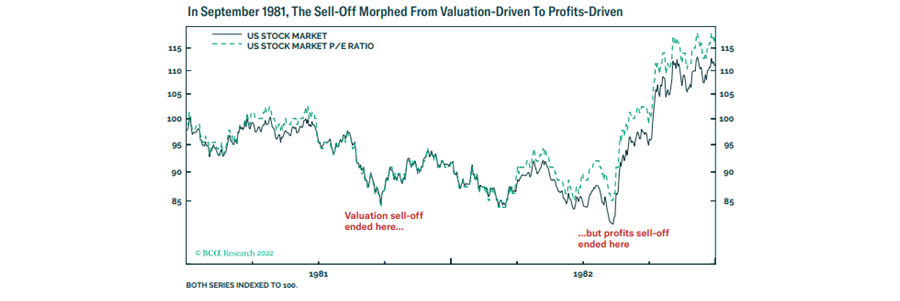

They are from BCA Research, which identified the most likely blueprint for what is to come as being learned from the 1981-82 period. Back then, as now, central banks were committed to doing whatever it takes to break the back of the inflationary monster that had exploded into the world’s atmosphere like some grumbling volcano, dormant no more.

Back then, as now, a conflict between two energy-producing nations, Iran and Iraq, had caused disruption in supply and prices. And back then, as now, the equity sell-off was led by declining bond prices and excessive valuations coming back to earth, to be followed by a profit-driven sell-off as recession bit.

Source: IDAD

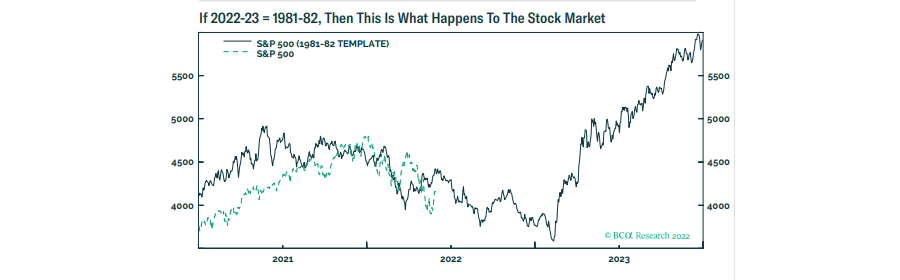

It’s what happened next that is so interesting. We’ve seen a number of bear market rallies so far and you never know when you’ve reached the final one until you can look back and realise with hindsight.

With what appears to be brewing this winter though, it is hard to believe that we’ve yet to see the profits sell-off. If it comes, look at what happens afterwards if the 1981-82 blueprint plays out.

Source: IDAD

Time to reassess asset allocation models?

Anyone who claims that they can accurately time a market is either a fool, a liar, or unaware just how lucky they’ve been. We know, of course, that history never repeats exactly but…if the chart above is anything like indicative, look at the steepness of the bounce when it comes.

Being out of the market risks missing an initial surge and, referring to my comment about not knowing whether it is actually a change of direction without the benefit of hindsight, further opportunity could be missed by waiting for the next correction, which may not come.

This has got me thinking about traditional asset allocation models which, quite frankly, have not been particularly helpful this year. Is it time to think a bit differently? I’m thinking mainly here about geographic equity allocations.

Does it make sense to concentrate on geographic areas as much as we have traditionally done? I’m not suggesting we completely ditch geographic allocation. Of course there’s validity in diversifying between the US, UK, Europe (ex UK), Japan, Asia Pacific (ex Japan), emerging markets and China for example, but shouldn’t we be thinking of allocating, say, 5-10% to thematic equities as a nod towards adapting with the times?

After all, the themes that are with us such as digital industry (cyber, cloud, artificial intelligence etc), healthcare innovation (medical devices, robotic surgery, biotechnology, genomics etc), new energy and transportation (electric vehicles, battery solutions, decarbonisation, solar/wind/hydrogen etc) and online life (e-commerce, gaming and sports etc) are truly global in need and development but can include geographic hotspots such as South Korea, Israel, Scandinavia, Latin America, which are at the forefront of some of the innovative ideas being adopted but may slip through the cracks of a typical geographically based model.

John F Kennedy said: “Change is the law of life and those who look only to the past or present are certain to miss the future.”

Few would argue that these themes will help to form our future. Doesn’t it make sense to concentrate a little more on them?

Andy Merricks is co-manager of the IDAD Future Wealth fund. The views expressed above should not be taken as investment advice.