December is a time for giving and nowhere have people found that to be true more so than in the stock market, where investors have often made phenomenal returns in the last month of the year.

While most well-worn adages such as ‘sell in May and go away’ have proven baseless, the ‘Santa rally’ is one that seems to hold true.

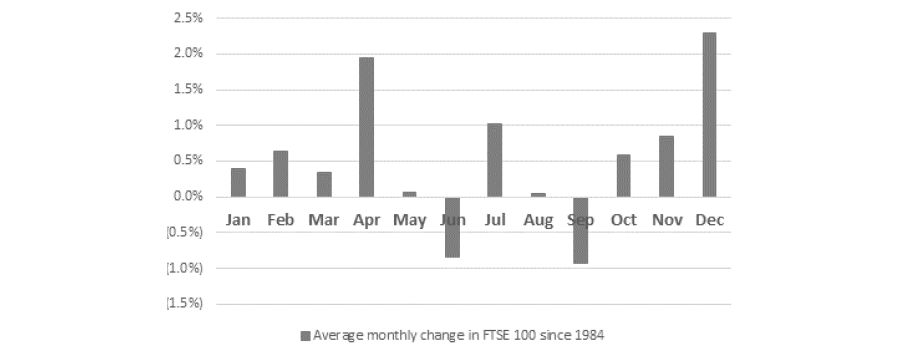

Indeed, since its launch in 1984, the FTSE 100 index has gained 2.3% on average in December, with April and July the only other months to offer an average uplift of 1% or more, according to data from AJ Bell.

Average monthly returns of FTSE 100 since 1984

Source: AJ Bell

Russ Mould, AJ Bell investment director, said the reasons for this anomaly are less clear. One theory used to be that investors would put money to work in January, known as ‘the January effect’, but this has not held up as a strategy. Indeed, since 2000 the FTSE 100 has only risen seven times in 20 attempts in January.

“It is possible that the Santa Rally has developed because investors have looked to anticipate the January effect and price it in, or discount it,” he said.

“Another possible explanation is year-end ‘window-dressing’ by professional money managers, as they put money into the market, bid up stocks and generate a bit of extra positive performance to help appease clients and justify fees.”

Garry White, chief investment commentator at Charles Stanley, said psychological reasons such as the mood of investors increasing when the holiday approaches as well as people buying equities with their Christmas holiday bonuses have also been mooted as possible explanations.

He said that, regardless of the reason, investors should get excited for the festive season as it is likely that 2022 will follow the same pattern as previous years.

“The global economy faces a difficult 2023, but markets are still likely to rally towards the end of this year,” said White who noted that the US has passed its peak of inflation, which will allow central banks to be more measured and able to pause their interest-rate increases early next year.

Indeed the US Federal Reserve is expected to raise interest rates by 50 basis points (bp) at its December meeting, compared with the 75bp that it has hiked by in the previous four.

“This means the Santa rally has great potential to take off after its decision is revealed on 14 December, a move that should reassure markets,” he said.

Ben Laidler, global markets strategist at eToro, agreed that the outlook for next year appears much brighter than previously expected as the more benign outlook for inflation and rates gives investors confidence to explore opportunities, particularly in the UK market.

“This is why we have seen domestic shares perform better than they usually would at this time of year,” he said.

However, he added that “of course, the outlook remains uncertain and confidence remains fragile, meaning there is no guarantee share prices will continue to rise as they have done”.

Whether there is a Santa rally or not, Mould said investors should not take the optimism at the end of the year as a sign of things improving over the following 12 months.

“For all of its apparent reliability – the FTSE index has fallen just seven times in December since 1984 and only four times since 2000 – the Santa rally is not certain to offer anything more than festive cheer because it does not seem to be a reliable indicator for the following year,” he said.

The FTSE 100 fallen in 11 calendar years since 1984 with 10 coming after a gain in the December of the previous year – 2015 was the only exception to this.

“If anything some of the best Decembers have led to the most treacherous subsequent years,” he said, while “some grim Christmases have been followed by cheerful years”.

“If nothing else, that may back up Warren Buffett’s old aphorism that: ‘The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs’.”