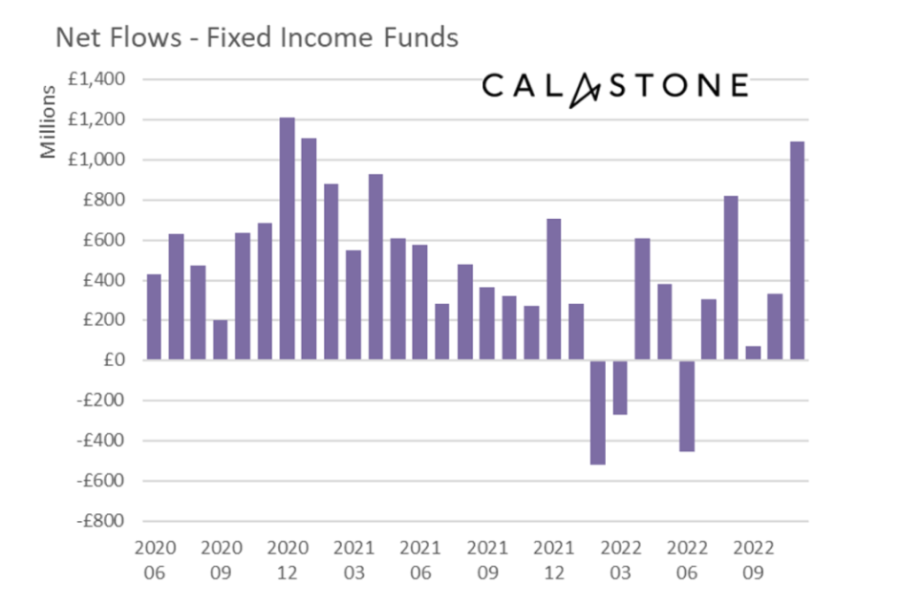

Investors were bullish on fixed income, but lost confidence in the UK in November, according to the latest Fund Flow Index data from Calastone.

It was the fourth largest inflow for fixed income on Calastone’s record: the asset class topped the charts, growing by £1.1bn, reaching a level not seen since the end of 2020.

Two thirds of the new cash flowed in in the first nine trading days of the month, reflecting the fall in global bond yields that followed US inflation data, which came in more positive than expected.

Edward Glyn, head of global markets at Calastone, said this was due to investors “scrambling to lock purchases in at higher yields in November”.

“Any inkling that inflation might be coming under control is good for bond prices because it means interest rates can peak at a lower level. Bond yields are simply market interest rates and when they fall, bond prices move mechanically higher,” he explained.

“Investors were securing that superior income on their capital and anticipating capital gains as yields fell and bond prices rose.”

Source: Calastone

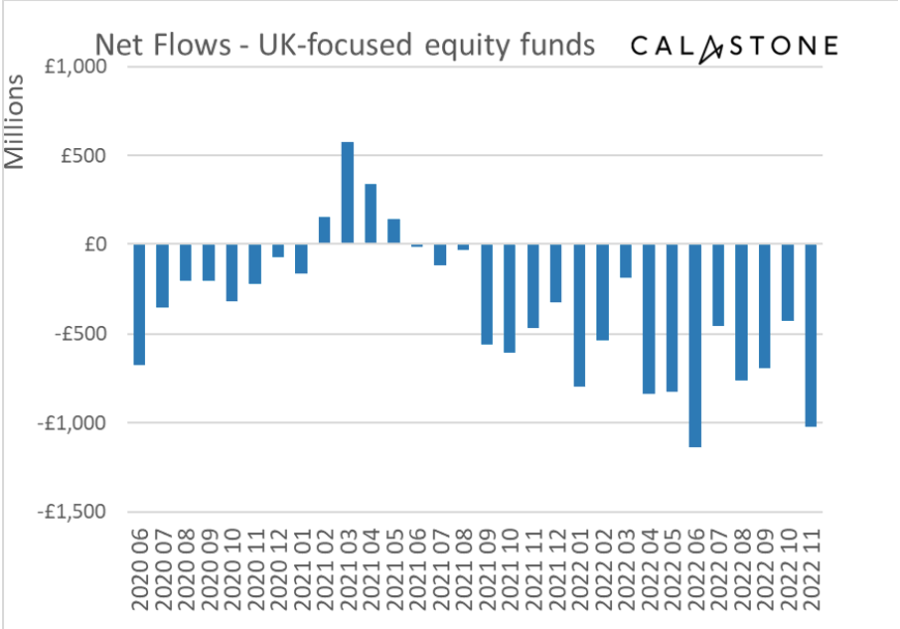

But, for as much money that flowed into fixed income, just as much left UK equities, where outflows reached £1bn in November, the second-largest withdrawal on record after that of June 2022.

This marked the 18th consecutive month in which investors withdrew money from UK equities. Throughout the period, losses summed up to £9.8bn.

“In the UK, bond yields rose much higher during the ill-fated Truss interval than among similar nations, but have since come back into line. Fears over the potential duration of the UK’s recession rather than hopes for inflation abating are dominating investor concerns for UK assets,” said Glyn.

“Inflation is becoming entrenched in expectations, which will make it harder to eliminate quickly. And when inflation combines with recession, it is especially pernicious.”

A recent report by the Organisation for Economic Cooperation and Development (OECD) deemed the UK as set for the worst economic performance in the G7, which helps to explain why UK equities are so unloved, according to Glyn.

“Despite low valuations, you can barely give UK equities away at the moment. The new Chancellor may have steadied the ship, but there is still not much market confidence yet in the UK economy. The result is an intensification of investor selling of UK-focused equity funds with no end in sight,” he said.

Source: Calastone

Elsewhere, European equities also continued to suffer significant selling (£238m in November or £2.3bn year-to-date), reflecting the ongoing energy crunch and looming recession across the region, while outflows from Asia-Pacific equities slowed.

None were benefited from the bond market rally spilling over onto the stock market, which enjoyed net inflows (amounting to £383m) for the first time since April, Calastone reported.

Elsewhere, US equities benefitted from the spill-over effect caused by an increased interest in environmental, sustainability and governance (ESG) funds.

ESG funds had their best month on record. Investors added a net £1.6bn to their holdings, after “a distinct lull” between March and September, the report read.

This resulted in global funds also doing very well, with a £1bn inflow, just over half of which was ESG cash. North American equities were also boosted by ESG and experienced their first inflows since June.

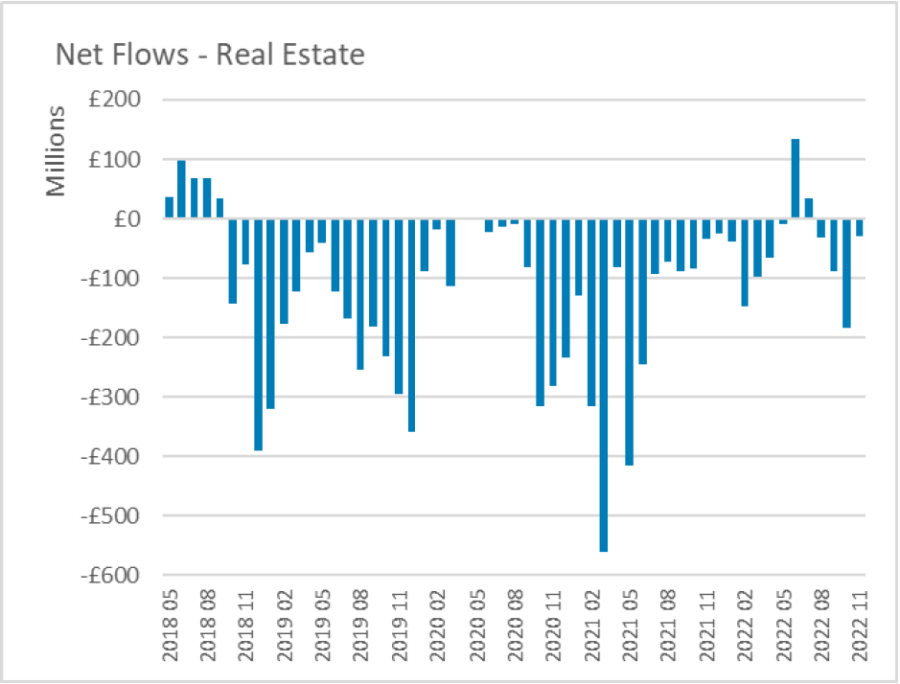

Property fund sales slowed, however, with outflows to £30.2m in November, the best reading in four months and one sixth of the October post-mini-budget rush for the exits.

According to Calastone’s analysis, the reduction in net outflows from property funds was caused by reduced selling activity, which may also reflect limits recently placed on investor selling by some funds.

But the strength in listed property company (REITS) share prices in the month suggests that wider market trends were important too.

“Moreover, the value of buy orders for property funds rose by a quarter in the month, which is consistent with improved investor sentiment,” the statement read.