There’s a reason why investors are nervous about the US: the future of its economy has great bearing on the rest of the world with a recession is likely to have repercussions on other markets as well.

Below, managers of US funds discuss the possibility of a recession, how deep or shallow it may be, and their strategies to play the market.

Jonathan Simon, investment manager of the JPMorgan American investment trust, had to carve out reasons to be optimistic.

“Amidst the ever-shifting macro-economic backdrop, US investment markets remain confused,” he said.

“Equity market volatility will no doubt persist until we get more clarity on the inflation picture, and price-to-earnings (P/E) ratios will also likely remain under pressure. This means that company earnings seem bound to be the main driver of returns for investors.”

Investors must tread carefully and diversify, he warned, but ultimately be thankful for the opportunities in select areas of the market, which the recent sell-off has brought down to more attractive prices.

“It is essential to opt for a mixed plate of opportunities, maintaining a balance between value and growth. Over the past few years US equity markets have continually rotated favour between the two approaches,” he said.

“Except for the first quarter of 2021, when value outperformed, growth emerged as the clear winner for 2021, but today value stocks are once again outperforming as investors try to shield themselves from rising inflation and geopolitical instability.

He continued: “We expect this relay to continue, and so for investors, this means that having a balanced portfolio which integrates both approaches may be more attractive than ever – particularly for those focused on the long term.”

Performance of trust over 10yrs against sector and index

Source: FE Analytics

By looking at the bond market, Richard de Lisle, manager of the VT De Lisle America fund, is positive a recession is coming to the US.

With 10-year treasuries currently yielding 3.6% and the 2-year yields are at 4.4%, interest rates on long-term bonds have fallen lower than those of short-term bonds, or the so-called inverted-yield-curve scenario has occurred. This is considered a reliable indicator for a recession.

“Slippery things recessions, surprisingly difficult to predict. Still, we have a survey that more than 60% of Americans think one is coming, the highest ever. And the yield curve has become inverted by 80 basis points from two to 10 years, the biggest inversion since 1982” he said.

“I suspect it will be milder than expected and that consumer durables, which hate a recession, will outperform next year. They are already on their cheapest trailing earnings ever, how bad can it be?”

Performance of fund over 10yrs against sector and index

Source: FE Analytics

The manager, whose portfolio is 20.7% exposed to consumer products, also expected the cost of labour as a percentage of profits to increase, so suggested avoiding labour-intensive firms .

However, he encouraged them not to give up on the dollar, which will resume relative strength as Europe does worse.

“Unusually, this is the cycle to stay at the short end of the curve and in inflation-protected securities, as inflation is not dead but resting. And overweight small stock and value stocks on the same principle as those durables: they’ll be best as we come round the U-bend,” the manager concluded.

Phil Milburn, member of Liontrust’s global fixed-income team and manager, among others, of the Liontrust Strategic Bond fund, finds good news in the fact that inflation will be heading in the right direction, but bad news in that this comes at a cost of a recession in 2023.

“There is more uncertainty over the depth of recession than inflation’s downward trajectory in 2023. The improvement that has been witnessed in supply chains, combined with falling commodity prices, is feeding through to lower goods price inflation,” he said.

“The Federal Reserve will continue to tighten monetary policy in order to bring balance back to the labour market and control wage inflation. Expect interest rates to stay in restrictive territory until unemployment has risen and demand for labour has dramatically fallen.”

Performance of fund since launch against sector

Source: FE Analytics

According to Milburn, rates are peaking and the conditions will be in place by the end of 2023 for them to be able to be cut again, albeit not to the ultra-low levels we have recently seen prior to 2022.

“We believe this is a good environment to be owning bonds; our funds have a long-duration position. Credit offers compelling long-term value, but one definitely has to be selective given the inevitable recession.”

If you prefer to look at the glass half-full, you should focus on the second part of the new year, said Felix Wintle, manager of the VT Tyndall North American fund, whose outlook for 2023 is “really bullish”, but only after investors have traversed a tricky couple of quarters first.

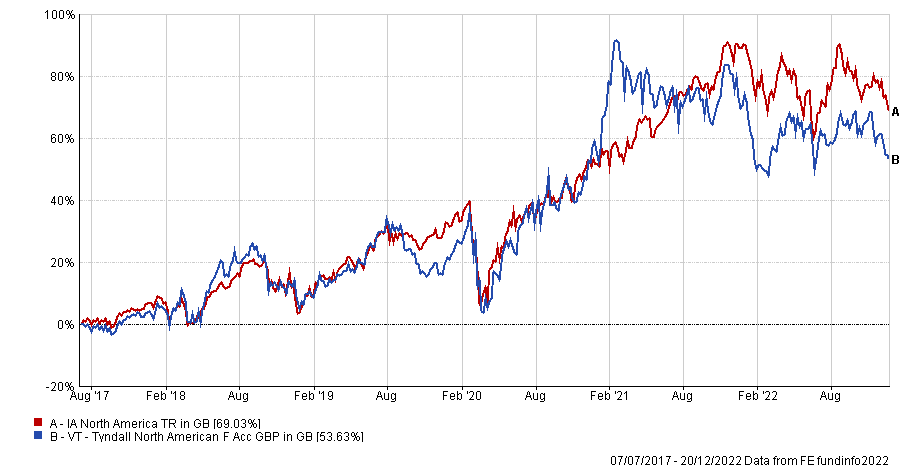

Performance of fund since launch against sector

Source: FE Analytics

“The first half of 2023 will be problematic for many companies as markets struggle with the ongoing recession. Sectors such as technology and consumer discretionary are likely to be particularly hard hit as they rely on strong economic growth to thrive. Consumers are already feeling the pinch, with inflation and interest rates remaining high and we see this as likely to continue into 2023,” he said.

“The second half, however, is setting up much more positively, and we believe that growth will inflect higher around the mid-year point. This could mean that the end of the bear market could be coincident with that time horizon.”

But as the market bottoms and starts a new bull cycle, Wintle thought it “very unlikely” for it to be led by mega-cap tech stocks, which generate a “significant” opportunity for active funds to outperform the market.