Picking a fund that will perform over a 12-month period is no easy feat, at least that is what the Trustnet editorial team is telling itself after a tough year for its 2022 predictions.

The past 12 months have been particularly volatile, with war in Europe, Covid lingering in certain parts of the world and political instability in a number of nations combining to make it a tricky year.

Yet it was persistently high inflation and subsequent interest rate rises that were the true downfall for markets – both bonds and equities.

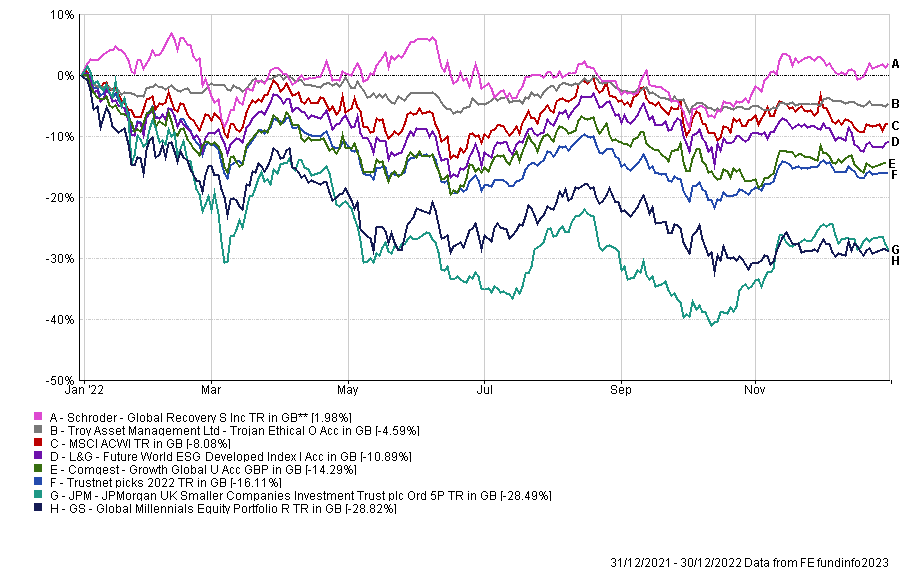

A year ago, the editorial team produced a list of funds that each member believed would do well in the coming 12 months. Unable to predict all of the events that were to take place, only one of us made a profit, while on average our picks lost 16.1%, almost double that of the MSCI All Countries World index.

Total return of funds and their average vs MSCI AC World in 2022

Source: FE Analytics

Top of the heap was editor Jonathan Jones’ selection of Schroder Global Recovery, which had a strong year as value stocks rebounded. A year ago, he said that coming off the back of a strong end to 2021, this fund could continue its momentum in 2022, citing the potential for interest rate rises as reasons for backing the portfolio.

“The fund’s largest weighting is to financials (18%), which should do well if interest rates rise, while it is very light on technology stocks (4%), which are likely to be hit harder should central banks keep to their word and hike rates,” he said at the time.

On reflection of his pick, Jones said he was pleased with assessment of interest rates and inflation, but noted that he had not considered the rise of energy stocks, to which the fund has some exposure but not as much as other value peers.

“The financials allocation proved successful, while the lack of technology has been a huge boost to performance,” he said. “Overall I think the fund performed as I would have expected, making a modest return in a year when most portfolios struggled.”

Schroder Global Recovery was a top-quartile performer in the IA Global sector, but was not the only fund on the list to beat 75% of its peers.

Indeed, FE fundinfo head of editorial Gary Jackson also managed to pick a relative winner with Trojan Ethical, which despite making a 4.6% loss was in the top quartile of the IA Flexible Investment sector.

“Trojan Ethical was my 2022 fund pick because I wanted a defensive holding, given the emergence of the omicron variant and continued inflationary pressures. Markets ultimately moved past omicron but they have fixated on inflation all year,” he said.

He noted that the fund’s structural allocations to cash and gold helped during 2022’s tough environment, although this was offset by its positions in quality stocks and index-linked bonds, which were one of weakest assets this year.

“I would have achieved a better result if I just tracked the FTSE All Share. However, Trojan Ethical has displayed less than half the volatility of the UK index and suffered a much lower maximum drawdown this year, which is exactly what I want in a defensive pick. After the year markets have just been through, it feels like a win not to be staring at a double-digit loss.”

In a very respectable third place was reporter Tom Aylott, who made his pick of L&G Future World ESG Developed Index having only just joined Trustnet.

“I had been working in financial journalism for less than a month when I chose my 2022 and did so thinking that a global tracker would be my safest option – alas, I’m still down 10.7% over the year,” he said.

“Given the year we’ve had (and the unforeseeable shakeup from Russia in February), I’m not particularly disappointed with the fund’s performance. I don’t expect to recover from 2022’s decline any time soon, but having a stake in the world’s leading companies should pay off if held over the long-term.”

Former senior reporter Abraham Darwyne was next, with his Comgest Growth Global fund making a 14.3% loss on the year.

At the time, he said that growth companies could struggle to justify their lofty earnings multiples after success in 2020 and 2021, but noted that this fund would be able to pinpoint stocks that were “able to consistently grow their earnings”.

Having languished at the bottom of the rankings in 2021 with a UK smaller companies trust, Trustnet Magazine editor Anthony Luzio doubled down in 2022 and picked another trust from the same asset class.

This time around, he is second-to-last (down 28.5%) and can thank former senior reporter Eve Maddock-Jones for pipping him late in the year for the wooden spoon.

“Conditions seemed ideal for UK small-caps at the end of 2021 – valuations were reasonable, the economy was re-opening post-Covid and people appeared desperate to get out and spend the money they had saved during lockdown. Interest rates were still low and, although inflation was rising, the consensus was it would prove to be ‘transitory’,” Luzio said.

Although last year was a struggle, it has not stopped him backing the same trust for 2023. Is it Einstein’s definition of insanity, or is this the year it comes good?

“Small-caps tend to lead the market in any recovery and the fall in valuations last year means the trust could surprise to the upside once the economy recovers and the interest rate-hiking cycle peaks,” he said.

In last place, Maddock-Jones’ GS Global Millennials Equity Portfolio plummeted in 2022 as the growth-heavy, technology-laden portfolio was adversely impacted by rising interest rates and a move away from risk assets.

At the time, the former senior reporter said top holdings such as, Meta Platforms, Alphabet and Nike “are all undeniably strong brands that have pricing power, which should allow them to navigate a changing market environment of rising inflation and interest rates”.

This assessment, however, could not have been more wrong last year, with the fund down 28.8% overall. The portfolio is the only one of our selections to sit in the bottom quartile of its sector (IA Global) for the year.