When buying into an investment company, the share price discounts and premiums are one of the crucial parameters investors have to consider.

While underlying net asset value (NAV) performance usually gets the most attention as the biggest driver of returns, narrowing discounts can also be a tailwind, and this is particularly relevant now, according to Numis analysts Ewan Lovett-Turner, Colette Ord, Priyesh Parmar and Andrew Rees.

In 2022, in fact, trust discounts widened considerably after the war in Ukraine and deteriorating macroeconomic conditions hit investor sentiment.

Equity investment companies were trading at a 2.7% discount after the Covid vaccine rally at the end of 2020. Growth-focused trusts were trading on premiums.

By early 2022 both were on discounts, with the average equity fund on a 4.4% discount, but this only got wider, ending the year at 8.5%.

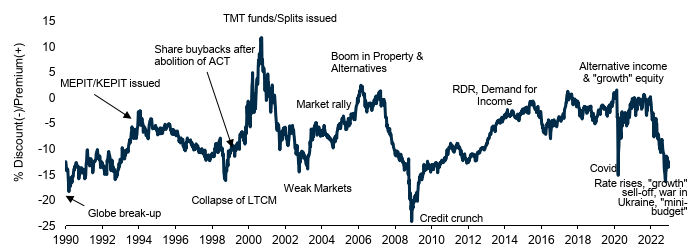

“On average, discounts are now close to levels seen at time of Covid-induced volatility and levels not seen on a consistent basis since the global financial crisis,” said the analysts team. This is highlighted in the graph below.

Long-term discount history in the Investment Companies universe

Source: Numis

This might therefore be the right time to take advantage of the wide discounts, before they close. Below, Lovett-Turner, Ord, Parmar and Rees select a few investment companies with the greatest potential to narrow their discounts.

UK Equity

Despite a year of resilient performance, the UK has lagged global markets significantly in recent years and trades on a relatively cheap valuation, according to the analysts.

“Most investors have been allocating more globally in recent years, but we believe there may be value in UK exposure, particularly given the risk that a period of sterling strength could negatively impact overseas exposure,” they said.

“The pick-up in M&A is a potential route to crystallising some of this value.”

Here, the main highlights were Temple Bar (6% discount), which follows a value approach, Edinburgh IT (7%), which seeks to build an “all-weather” portfolio of growth, value and recovery stocks, and Fidelity Special Values (6%), whose returns are driven by a contrarian approach in which the manager looks for unloved stocks where the downside is limited and there is a catalyst for change.

Among smaller companies trusts, Henderson Smaller Companies (11%), Aberforth Smaller Companies (12%) and BlackRock Smaller Companies (13%) made the Numis list.

Performance of funds over 1yr against index

Source: FE Analytics

Global Equity

When looking more broadly, now is an “extremely attractive entry point” into RIT Capital, the team said, which has a record of limiting downside in market declines whilst participating in the market upside.

The shares were weak in early December, as concerns were raised about lags in the portfolio’s private equity valuations and the potential impact on NAV, but Numis analysts considered this an overreaction, and the current 17% discount is attractive to “both investors with a defensive mindset and those looking for an attractive total return opportunity”.

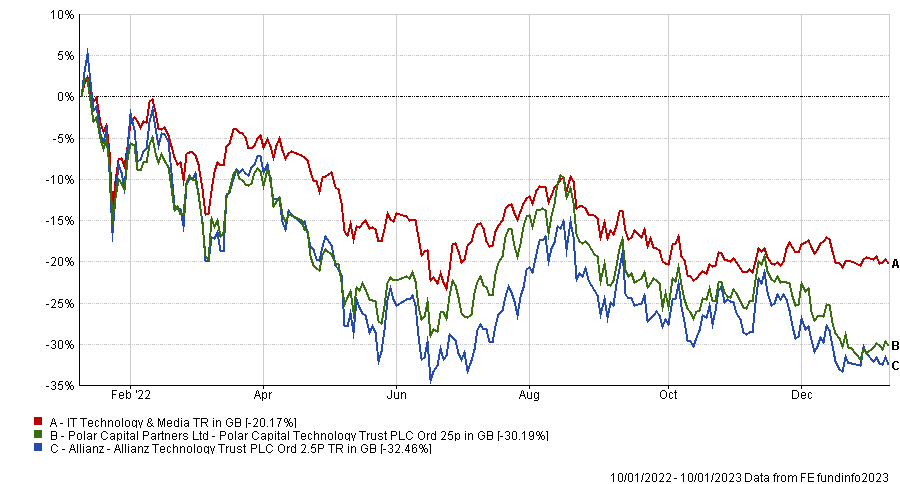

Elsewhere, in the technology space, after the great sell-off of these assets in 2022, a lot of the risks facing the sector have now been priced in, according to Lovett-Turner, who highlighted Allianz Technology and Polar Capital Technology as “highly appealing options” on 10% discounts.

Lastly, potential for returns “regardless of the macro backdrop” are expected for the life sciences sector, where small-cap biotech offers a recovery opportunity. Here, the pick was Biotech Growth, which has recently struggled due to its bias towards underperforming small-caps and exposure to China.

“We believe the sector benefits from positive tailwinds including favourable regulation, positive demographic changes, strong innovation and M&A,” said analysts at Numis.

“As a result, of these trends we believe the sector has the potential to deliver returns regardless of the general economic conditions.”

Biotech Growth currently trades on a 9% discount and benefits from an “experienced, well-resourced management team”.

Performance of funds over 1yr against sector

Source: FE Analytics

Asian Equity

In Asia Pacific, the Numis analysts suggested considering investing primarily in China and Vietnam. China is viewed particularly favourably as it has hastily reversed its zero-Covid policy, but other strategic moves were welcome too.

In early 2023, for example, regulators approved a $1.5bn fundraising for Ant Group’s consumer unit, an affiliate of Alibaba which owns the world's largest mobile payment platform Alipay, and authorities also approved “the most significant batch of new blockbuster game releases in months”, helping the MSCI China Index to rise 33% in sterling terms since the end of October.

Despite the recent recovery, “there may be some short-term volatility given the impact of a significant wave of Covid infections”, said Lovett-Turner, and Chinese equities still trade at a 45% discount to developed markets versus an average of 30% since 2010, which Numis believes to be “interesting”.

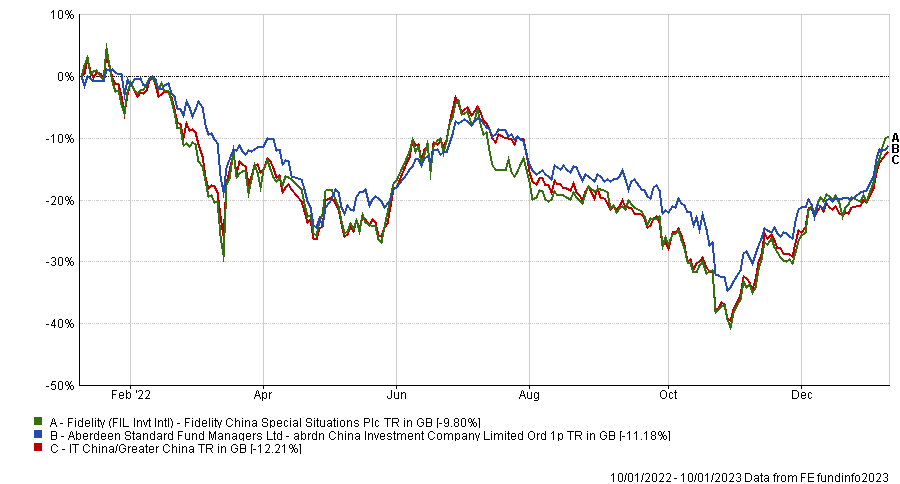

Here, abrdn China stood out as a value play on a 14% discount, whilst Fidelity China Special Situations (10% discount) is “an attractive option for investors comfortable with the risk profile” (the fund is 25% geared and has a small/mid-cap bias).

Performance of funds over 1yr against sector

Source: FE Analytics

The second most-attractive region in Asia was Vietnam, according to Numis analysts, who have “long been convinced” that investors should have exposure to the country.

“Vietnam’s economy is uniquely positioned, generating healthy economic growth (6.5% expected in 2022) supported by positive demographics and an emerging middle class, as well as strong foreign direct investment,” they said.

The country, which is also a manufacturing export hub that is benefitting from the diversification of supply chains away from China, sold off in 2022 because of significant volatility in real estate stocks due to difficulties in developers accessing credit.

However, Numis analysts continue to believe Vietnam offers “an attractive long-term fundamental growth story”, also driven by the potential inclusion in the MSCI Emerging Markets index which will help drive a rerating from the current decade-low valuations.

VinaCapital Vietnam Opportunity (14% discount) and Vietnam Enterprise (11% discount) are therefore on the recommended list.