Last year was one in which the mega-caps won, with UK larger companies significantly outperforming the rest of the market.

This can be seen in the graph below, where there is a considerable distance (17 percentage points) between the FTSE 100 and the FTSE 250.

Recently, as the FTSE 100 has risen to an all-time high, appreciating 15.2% between October 2022 and January 2023, some experts have been turning their attention to smaller companies instead, convinced that larger companies don’t have much further to go.

In fact, Darius McDermott, managing director of FundCalibre, would now invest in smaller rather than large companies.

“If I was investing in the UK today, I would look beyond just the FTSE 100,” he said. “This part of the market has already enjoyed a decent run, and although it may continue, I do see value in the smaller- and medium-sized companies that had such a bad time last year.”

Performance of indices over 1yr

Source: FE Analytics

For Daniel Green, co-manager of FTF Martin Currie UK Smaller Companies, the asset class has gone through an “indiscriminate” sell-off in 2022, which has created opportunities for bottom-up stock pickers.

“The last quarter of last year was definitely an example of an extreme swing to despair and pessimism, but it's important to remember the longer-term returns that have historically been generated by investing in smaller companies,” he said.

“One pound invested in large-caps in 1955 would have given £1,255 at the end of 2022. Mid-caps have outperformed this, generating an average return of 12.8% per annum at £3,671, and the bottom 10% of companies by market capitalization would have given you a 14.2% return, or £8,326. Finally, the bottom 2% of companies by market cap would have generated a 15.8%, or £21,168, at the end of 2022. With equities, it's very much a case that the smaller the better.”

For those who agree that now is the time to invest in smaller companies, below are five expert-selected fund picks for your consideration.

One of McDermott’s recommendations was JOHCM UK Dynamic, which has a multi-cap portfolio with a mid-cap bias.

Performance of fund over 10yrs against sector and index

Source: FE Analytics

“Manager Alex Savvides uses a distinctive ‘change’ investment strategy, looking for sustainable improvement from stocks that can create idiosyncratic sources of return. He is a pragmatic manager and not afraid to look at companies that have been beaten up by the market,” McDermott said.

The £1.4bn fund has had a strong first-quartile performance in the IA UK All Companies sector over 10 as well as over 2022, only falling to the second quartile for performance over three and five years.

Rob Burgeman, investment manager at wealth manager RBC Brewin Dolphin, chose the Odyssean Capital Investment trust, a £195m vehicle with five FE fundinfo crowns run by Stuart Widdowson and Ed Wielechowski, which he selected for its “excellent track record” and a “clearly differentiated investment proposition”.

Performance of fund since launch against sector

Source: FE Analytics

“The fund uses private equity techniques, alongside a panel of extremely experienced advisors to identify and target companies with niche positions and strong cash flows,” said Burgeman.

The portfolio is concentrated and focused on industrial companies such as Elementis and Xaar, software companies like NCC Group and Ascential and Healthcare companies like Spire. Given the investment criteria, the fund is unlikely to ever invest in resource stocks or banking/finance stocks.

Gavin Haynes, investment consultant at Fairview Investing, picked Aberforth Smaller Companies.

Performance of fund over 10yrs against sector and index

Source: FE Analytics

“Aberforth is a UK small-cap specialist that operates with a team-based approach and has applied the same value process for more than 30 years, producing strong long-term returns,” he said.

“Their focus is on smaller small-caps in the Numis Smaller Companies Index that are trading on cheap valuations and have potential for recovery. They are long-term investors, more aligned with private equity in terms of how they forensically look at businesses over the cycle.”

The trust has assets under management for £1.1bn and currently trades on a 12% discount.

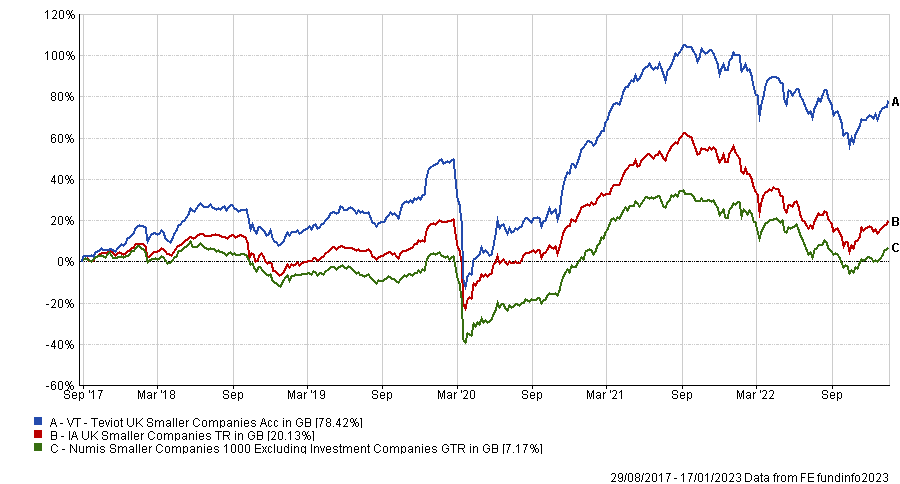

Dan Cartridge, assistant fund manager at Hawksmoor Fund Managers, went for Teviot UK Smaller Companies, a fund which is run by Dan Vaughan and Barney Randle and offers the “compelling combination of protecting capital during weaker markets and participating on the upside too”, with a “good chance to deliver strong absolute and relative returns over the next three-to-five years”.

Performance of fund since launch against sector and index

Source: FE Analytics

“Since launch in August 2017, the fund has outperformed its Numis Smaller Companies benchmark by around 68 percentage points, or 10 percentage points per annum. It has outperformed the index in every discrete calendar year since launch despite the types of companies leading the market varying substantially through that time,” Cartridge said.

“The team focuses on the importance of liquidity within the small-cap universe and can quickly build positions in new ideas, as well as quickly exit investments that reach price targets or where the thesis breaks. This gives the team an edge over larger peers who have to tiptoe in and out of positions.”

Finally, GDIM investment director Tom Sparke selected Chelverton UK Growth. The £1bn fund is focused on companies at the smaller end of the UK capitalisation spectrum and focuses on those with a higher-than-average rate of growth.

Performance of fund since launch against sector

Source: FE Analytics

“Run by James Baker, an industry veteran with more than 30 years of experience, Edward Booth and recent addition Henry Botting, the fund typically holds a diverse portfolio of 150 companies and has posted impressive performance over the longer term,” said Sparke.

“The fund has traversed many periods of serious volatility significantly better than most of its peers, mainly due to the high-quality bias that it imposes, despite the overall fund volatility being similar.”