Consistency is a hard thing to achieve in the world of financial markets, but Man GLG’s Michael Scott has proven adept at making money no matter the market condition.

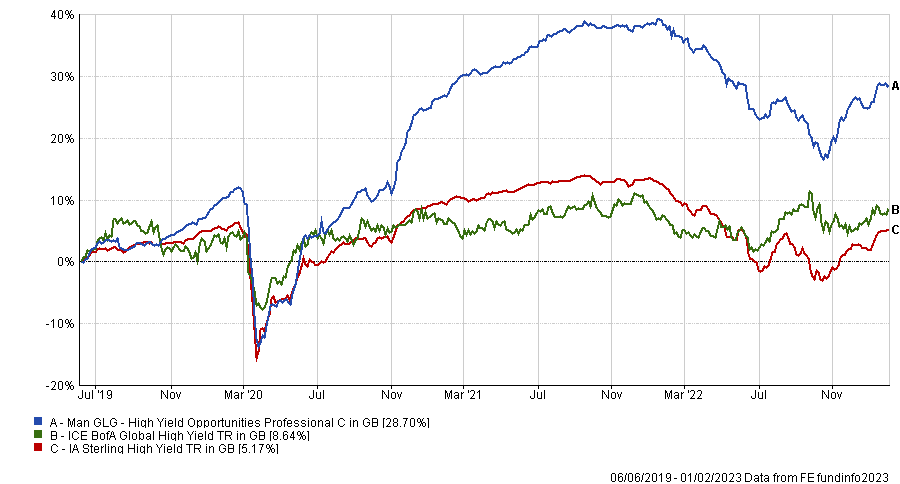

Since he launched the £252.2m Man GLG High Yield Opportunities fund a little over three years ago it has been the best performer in the IA Sterling High Yield sector, making a total return of 28.7%, as the below chart shows.

This comes after a successful six-year stint from 2012 to 2018 in charge of the Schroder High Yield Opportunities, during which time the fund made a 62.3% return – also the highest in the sector.

Below, the manager tells Trustnet how the fund is able to gain an edge on its peers, why the business cycle suggests caution from here and how duration hampered returns somewhat last year.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

What is your process for investing?

Returns are driven by bottom-up idiosyncratic risk and decisions are made from fundamental research. We combine this with analysis of secular themes and these can be anything from the backdrop of the macroeconomic environment to regulation or demographics. In credit you get one or the other, it is quite unusual that a process looks at both.

More specifically, we conduct forward-looking cashflow and balance sheet analysis, looking at things such as leverage and fixed charge cover.

We also actually value the enterprise itself because a lot of these different businesses are private so we need to understand the risk we are taking.

In terms of traditional credit, a lot of people look at cashflows and balance sheets, but less common is the focus on the value of the business, which is important when bonds are trading at substantial discounts.

What is the main driver for high yield bonds?

High yield bonds are cyclical. They are affected by the business cycle more than the interest rate cycle. If you think about the yield on a bond, roughly two-thirds of that is the credit spread and 25% is the government bond.

Where are we now in the cycle?

We think we are quite late in the business cycle and that certainly portends a more cautious stance around cyclical risk. That said, it is all about relative value.

In the past, high yield has delivered stronger risk-adjusted returns than equities through a cycle but also in and out of recession. That is because you are paid a fixed coupon. It is about compounding that.

Rule of thumb is that when spreads get to 600 basis points over government bonds, forward returns have been double-digit and much more equity-like. We touched that back in October and I think it is likely we see those levels again.

What have been your best and worst calls over the past year or so?

The best has been the fund’s move towards less cyclical sectors, which has been ongoing since September of 2021 and continued through 2022 with a much keener focus on the likes of healthcare, telcos, consumer non-cyclicals and senior secured property.

That had been an ongoing theme since the summer of 2021 and coming into 2022 the fund was positioned with a non-cyclical bias in sectors that are usually rather dull. We saw substantial value in owning businesses that could generate strong cashflow in a weak demand backdrop.

As an example, we recently bought a high quality healthcare firm focussed on medical devices with a coupon above 8%, at a discount to par of 93 which implies a yield of more than 10% in a floating rate structure with many defensive characteristics if we are to go through a recession.

During this period the fund dramatically reduced its exposure to energy, which had been as high as 20% or more of the fund post-Covid. When oil was at $30 there was a lot of value in the sector, but when it was at $140 there was very little value.

Coming into 2022 it was less than 5% of the fund and these shifts benefited the fund. Our risk-adjusted yield was very attractive.

On the other hand, fixed-yield bonds have duration to some degree. We can’t get away from that fact. We don’t trade duration in an active way so are not a macro fund.

Therefore the funds that are low duration outperformed on the basis that they didn’t have as much interest rates exposure. The duration of the fund is currently in line with the benchmark at around 3.7 years

Is there anywhere you don’t invest in?

We try to have as much flexibility as we can as our sector is very broad. There are 1,500 names in the universe all with different drivers and risks and return potential at different points in the cycle. Being flexible is the best way to give yourself ample ability to outperform.

We do have an exclusions list, but it’s very typical, with things such as no cluster munitions, no coal creditors and no nuclear weapon manufacturers or creditors related to the supply chain, although this is a very small number.

Do you incorporate environmental, social and governance (ESG)?

We do have a specific ESG fund but it is an offshore UCITS fund. We have a dedicated strategy with the same process in terms of stock selection but has integrated ESG process which is particular for that fund.

I don’t think you should muddy the waters. If you are going to offer an ESG product it should be a true ESG fund and not just changing an existing fund to fit the narrative.

Both have their position and should be distinct from one another so investors are served in the best interest of what they want to buy.

What do you do outside fund management?

I am big into hiking and spending time with family. I also like to travel, although this is a lot harder with children.