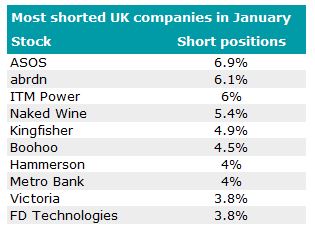

Short positions in asset management firm abrdn shot up in January, making it the second most shorted company in the UK behind ASOS, which stayed in the top spot for the third month running. Bets against the company continued to lower however, from their 8.8% peak in November.

Positions in abrdn, on the other hand, leapt 1.5 percentage points in January, bringing the total amount of shorted stocks up to 6.1%.

Source: Financial Conduct Authority

This came after Millennium International and Point72 joined the five other firms betting on its failure, which includes the likes of BlackRock and Citadel Advisors.

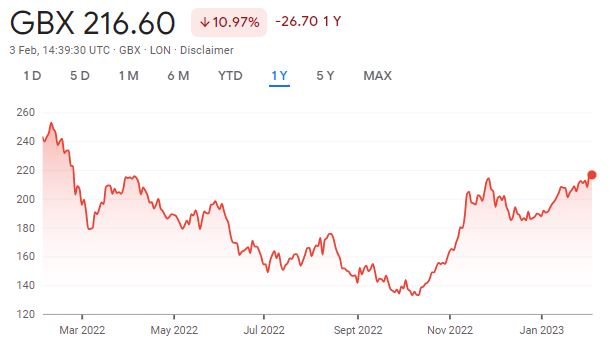

Shares in abrdn are down 11% over the past year, but sentiment picked up in the latter part of 2022, climbing 31.8% in the past six months.

Share price of abrdn over the past six months and past year

Source: Google Finance

Recently investment bank Jefferies downgraded its view on the company from a buy to a hold in January, forecasting difficulties ahead in 2023.

Jefferies’ report said: “Undertaking a turnaround of its core investments unit in current market conditions will be challenging and recent commentary adds uncertainty to the mix.”

Since joining the firm in 2020, chief executive Stephen Bird has attempted to streamline the business, which included merging or closing around 120 of the group’s funds.

Just last week, shareholders approved the merger of four additional funds – abrdn Multi-Manager Ethical Portfolio, abrdn Global Strategic Bond, abrdn UK Opportunities and abrdn Corporate Bond – which will involve significant realignment in the portfolios they will be joining.

This restructuring has led to some volatility over the past year, with the firm briefly dropping out of the FTSE 100 index in September after its market cap fell below £3.2bn. It re-joined in December last year after a three-month hiatus.

In its half-year results last August, abrdn announced that profits had sunk more than threefold compared to the same period the year before, making a £320m loss in the first six months of 2022.

The £4.4bn asset manager publishes its results bi-annually and its full-year report at the end of this month could have a significant impact on short positions.

There was better news for the likes of Travis Perkins, Sainsbury and Currys, which all exited the top 10 list throughout the course of the month.

They were replaced by three new additions – Metro Bank, Victoria and FD Technologies. Although they entered the top 10, short positions in Victoria were unchanged from December and the number of shorted stocks in Metro Bank dropped 0.1 percentage points month-on-month.

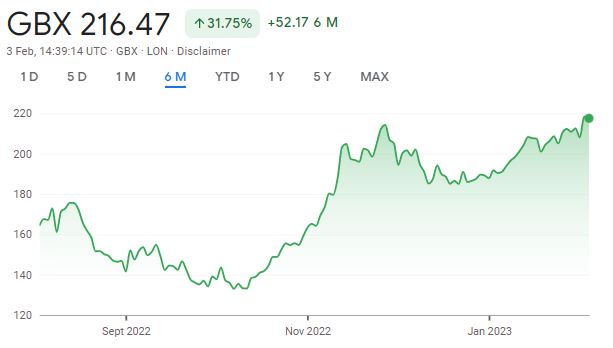

Share price of FD Technologies over the past six months

Source: Google Finance

Consulting and business services company, FD Technologies was the only one of the three names in the top 10 list to have an increased number of bets in January.

Shorts in the company went up 1.3 percentage points throughout the month, bringing the number of positions up to 3.8%.

In its half year report, the company announced a 15% increase in revenues, which reached £147m in the first six months of the year. Even so, shares in the company sank 22.2% over the past six months.