It has been a strong year for the UK market, with the FTSE All Share up 22.8% year-to-date, outpacing the previously dominant US S&P 500.

But can the good times keep on rolling? The strong returns this year have pushed valuations higher, with the FTSE 100 approaching its historic average price-to-earnings (P/E) ratio based on future earnings.

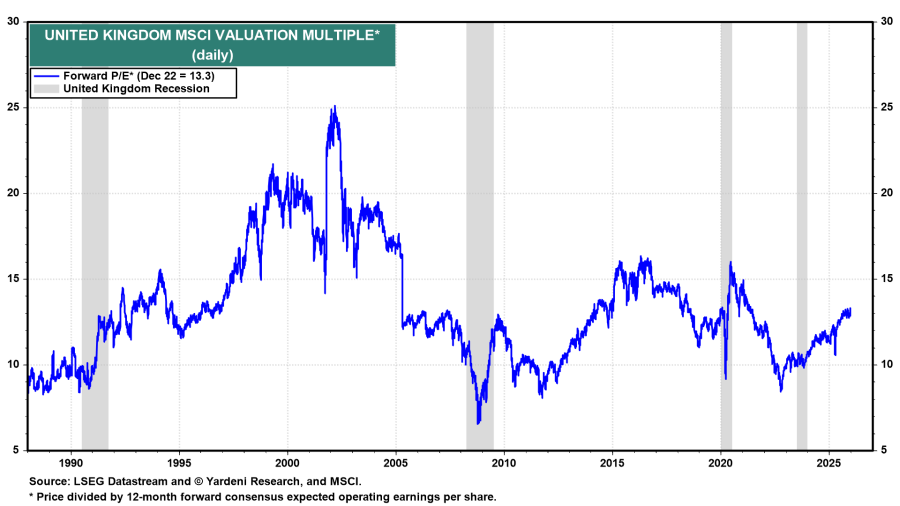

Yardeni Research data shows that the MSCI United Kingdom index sits on a forward P/E of 13.3x. While this is not as high as it has been in the past, it has come up significantly from its nadir, as the below chart shows.

Meanwhile, heightened geopolitical risks across the globe could impact the international mega-caps, while sluggish economic growth could hamper the fortunes of domestic mid- and small-caps

Yet experts remained cautiously optimistic heading into 2026, pointing to tailwinds such as falling interest rates and attractive opportunities outside the biggest risers.

Alan Dobbie and Carl Stick, managers of the Rathbone Income Fund, said: “A heady combination of falling interest rates, marginally supportive economic data and improving flows into a cheap market could make 2026 another strong year for UK equities, perhaps even a repeat of 2025’s success.”

Economic tailwinds in 2026

While inflation has remained stubbornly high, experts are positive on the consumer heading into 2026.

Ruffer fund manager Fiona Ker said that, compared to public sector data, household balance sheets are in “much better shape” with household debt-to-GDP down by 50 percentage points since the global financial crisis.

They are also benefitting from rising wages and falling interest rates, but lack confidence, she said. “If confidence turns, that could boost demand and support a more meaningful economic rebound.”

For James Henderson, manager of the Lowland Investment Company, further rate cuts next year will be crucial in restoring this confidence.

There have been “excessive levels of saving” among Britons in recent years, partially due to rising interest rates, which have allowed people to make meaningful money from their savings after a decade of record low rates.

“If people start to spend a bit more because interest rates come down, that’s a really good backdrop for further improvement in operating margins and upside surprises in earnings,” he said.

Additionally, muted economic data has led to some “relatively poor expectations” heading into 2026, which are much easier to beat than previous forecasts, according to Henderson. As a result, very little extra good news is required for another strong year from UK assets, he said.

“It’s tempting to think after a good year that we’re due for a weaker patch, but I don’t think it will take a lot to keep the market going up.”

Additionally, fiscal and economic policy should be supportive next year, according to Kristina Hooper, chief market strategist at Man Group.

The recent Budget successfully “cobbled together a wider variety of tax increases” to deliver adequate revenues without creating a headwind for growth. This should give more scope for further rate cuts from the Bank of England next year, she said.

“Thus far, the UK economy has been surprisingly resilient, able to withstand multiple headwinds. That should continue into the coming year.”

Mid-caps to stage a comeback?

Potential rate cuts and a relatively healthy consumer are causing managers to look further down the market capitalisation spectrum for opportunities.

Alexander Jackson, manager of the Rathbone UK Opportunities fund, said: “After several unusual years in the shadows, UK mid-caps could be the comeback story of 2026.”

Mid-caps underperformed large-caps in 2025, in part due to their more domestic focus and uncertainty around the delayed Budget, Jackson said.

However, in 2026, the outlook seems much better. Budget uncertainty is now behind us; potential rate cuts should support more domestically exposed businesses; and there are pockets of “solid earnings growth” and “compelling value” for investors in the mid-cap and small-cap space.

“Add to that the fact that many investors have been underweight this space and we see plenty of room for a catch-up trade,” she said.

Fidelity Special Values and Fidelity Special Situations FE fundinfo Alpha Manager Alex Wright is also increasing his allocation to mid- and small-caps next year, which are “materially undervalued” at around an 11x P/E ratio.

These mid-cap and small-cap companies contain many “pockets of value” but remain “less well known to investors”, according to the Fidelity manager.

“These unloved areas present compelling investment prospects and would benefit from a more stable environment in 2026 – although conditions do not need to improve materially for valuations to begin to recover.”

Banks and property to rally

While experts were excited about a range of sectors for 2026, banks are set to remain a big theme. The FTSE All Share Banks is up 64.9% year-to-date but Lowland’s Henderson said they could have further to run.

Even if interest rates start to decline, UK banks should remain “inherently very profitable”, according to the veteran manager.

“What really hurts a bank share price is an uptick in bad debts, which is usually tied to a slowdown in the economy,” he said. But there is little evidence that these sorts of ‘bad debts' are on the rise next year, particularly as bank lending has “been fairly low”.

Property is another area of focus for experts, with Wright interested in areas such as housing, furnishing and home improvement.

Volumes remain depressed compared to pre-Covid levels but elevated savings rates, healthy household balance sheets and potentially easing inflation could all contribute to a rally, he said.

“This collection of businesses combines attractive stock-specific opportunities with depressed industry volumes, offering multiple catalysts to support a turnaround.”

Ruffer’s Ker agreed, noting that housebuilders have struggled since the pandemic and now trade “at depressed valuations”.

However, they have solid balance sheets and substantial dividends, offering “an attractive risk-reward if the Bank of England cuts rates any further”.