January provided respite to investors after a difficult 2022, with most major markets up over the course of the month. Yet it was one of the laggards that was forefront of veteran investor Nick Train’s mind.

Drinks-maker Diageo, which owns brands including Guinness and Smirnoff, was one of the rare stocks to struggle in the month despite seemingly positive interim results.

The share price was down around 4%, having fallen 8% last year. It means the stock is now trading roughly 12% lower than its all-time high set in early 2022.

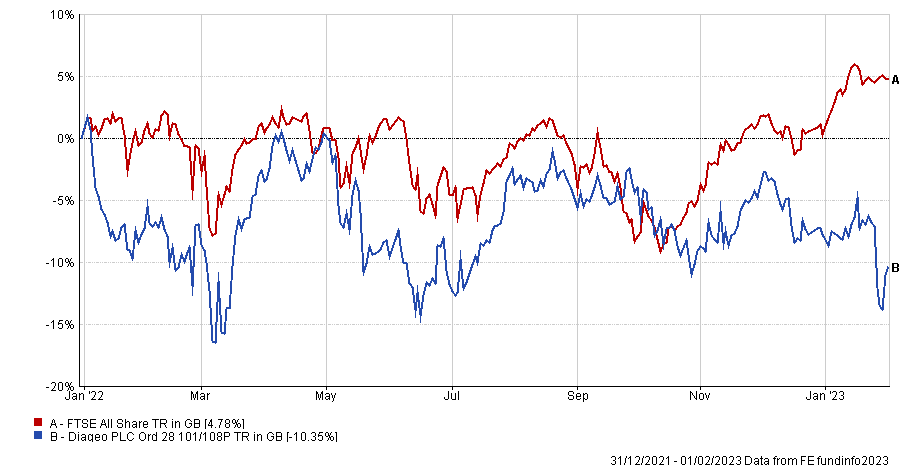

Total return of Diageo vs FTSE All Share since the start of 2022

Source: FE Analytics

“This is annoying for me and all fundholders – given it is one of the biggest positions in your portfolio. It is particularly galling for me because throughout I have been evangelising on Diageo’s behalf to anyone who will listen to me,” said Train.

The fall came as a particular surprise to the LF Lindsell Train UK Equity fund manager, who said interim results at the end of the month showed the firm’s inflation protection and secular growth qualities.

Organic sales were up 9%, while earnings climbed 15% and the dividend was hiked by 5% – the 25th consecutive annual increase. Revenues were 36% higher than in the same period of 2019, pre-Covid.

At the time, analysts were mixed. Mark Crouch, analyst at eToro, said that the results were “robust and reliable”, but Hargreaves Lansdown senior investment and markets analyst Susannah Streeter said they were “glass half-empty results” after the firm announced performance in the US had disappointed.

Train noted this but was unfazed. “Now, it is true that Diageo’s North American sales slowed by more than investors expected, to 3%, and the US is Diageo’s biggest geography (thank goodness). But I don’t see anyone arguing that selling premium spirits brands to the US consumer is not structurally a great category to be in,” he said.

Rather than wavering, the LF Lindsell Train UK Equity fund manager said he has been doubling down, picking up more shares in the stock last month as the price dipped. It is now 9.3% of the overall portfolio, the fifth-largest position in the fund.

“Diageo is an ideal investment to hold in the current economic conditions because it offers a rare and valuable combination of inflation protection and secular growth,” said Train.

“In truth – so you know where I am coming from – I think Diageo is an ideal investment to hold in any economic circumstances and forever. We must buy more Diageo when we can and the price dip did enable us to do so last month.”

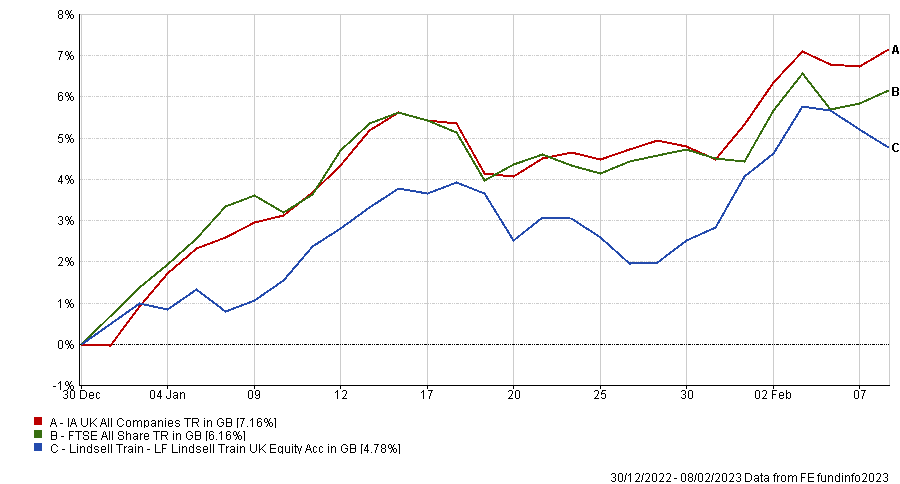

Despite the relative underperformance of Diageo, LF Lindsell Train UK Equity is 4.8% up on the year so far, even though we are only six weeks in.

Total return of fund vs sector and benchmark in 2023

Source: FE Analytics

Some of the fund’s other big positions soared. Schroders was up 10% while Remy Cointreau gained 9%. Fever-Tree, Sage and Experian were each up 6% while RELX and Heineken made 5% jumps.

The big winner for January was Burberry, up 23%, to an all-time high. Since its low in September, shares are up more than 50% and it is now the fund’s largest position at just under 10%.

“A cleverer investor than me might be able to explain to you why Burberry’s stock has enjoyed such a bounce. But beyond acknowledging China is reopening, I don’t see the catalyst – however welcome the gain,” said Train.

“Actually, what I think is this. For a variety of reasons, Burberry’s share price has been out of favour for a long time. Perhaps Burberry had just become too cheap.”

He added that there was the “tantalising proposal” that Burberry will not be the only one to enjoy a reversal in its fortunes and that other companies with dull recent share price returns that sit on undemanding valuations are ready to jump.

“If there are, then Burberry’s 50% share price jump over four months could be a harbinger of better returns from UK equities ahead. We do hope so,” he said.