The City of London and JPM Global Growth and Income trusts are popular options for investor seeking an extra source of revenue via dividends.

They both invest in dividend-paying companies with the objective of growing their payments to the trust’s shareholders, but each trust offers a different route to the same end goal.

Here, Trustnet asks expert fund pickers whether they favour the high yield of the UK trust, or the strong returns of its global counterpart.

Yield

The City of London trust invests primarily in UK stocks, which are renowned as being among the highest dividend payers in the world: the FTSE All Share has a yield of 3.5% at present.

However, this trust has a penchant for companies that pay above the market average and currently yields 4.7%, some 1.2 percentage points above the index. It also makes it one of the biggest among its peers in the IT UK Equity Income sector.

JPM Global Growth and Income, run by FE fundinfo Alpha Manager, Helge Skibeli, along with Timothy Woodhouse and Rajesh Tannaon, the other hand, has a global reach. Global dividends are much lower on average, with the FTSE All World yielding just 2.3%.

At 3.6%, the trust it is one of the better payers in the IT Global Equity Income sector and is 1.3 percentage points ahead of the index (even paying out more than the UK market). However, it is 1.1 percentage points lower than City of London.

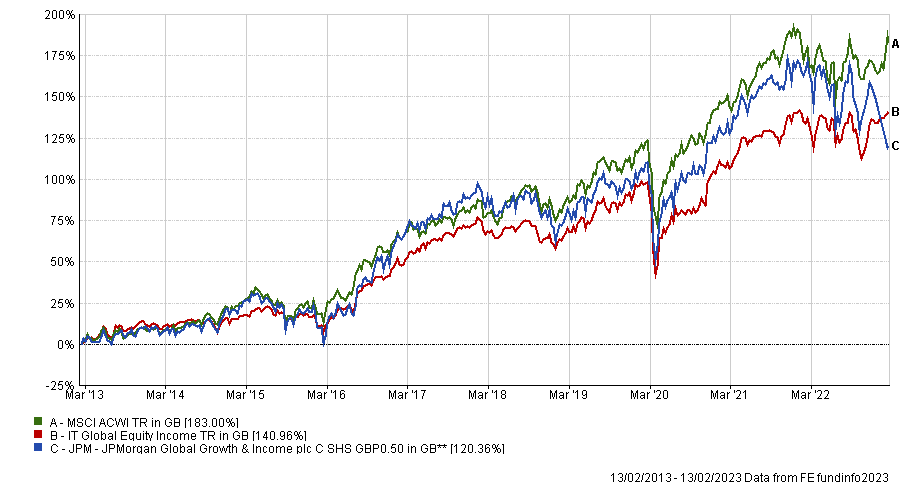

Total returns

While the UK trust pays more in dividends now, investors who held the global trust over the past decade have made a better overall return. JPM Global Growth and Income was up 120.4% over 10 years, while the City of London trust climbed 99.2%, as the below chart shows.

Total return of trust vs benchmark and sector over the past decade

Source: FE Analytics

Some of JP Morgan trust’s performance can be attributed to the rise of US tech giants. It has a 64.2% weighting towards American companies, giving it an added boost from high-growth names such as Microsoft and Amazon, which are the two biggest holdings in the fund.

Dividend yields on these companies tend to be a lot lower – or in Amazon’s case, non-existent – but their share prices have swelled considerably over the past decade.

Expert opinion

Salih said that investors could benefit from holding JPM Global Growth and Income and City of London alongside each other – the high returns and growing yields of global companies could make a good pairing with the UK’s established dividend payers.

However, if pushed to own one, Salih said he prefers the UK trust. “Right now, I would lean towards the City of London trust purely because the old-style UK equity income stocks – and the value tilt of the UK index – look extremely attractive, with UK plc still significantly undervalued versus its global peers.”

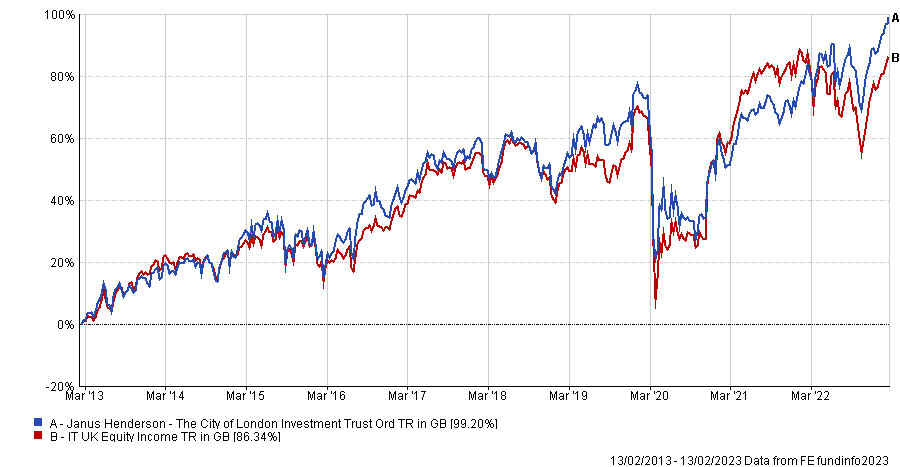

Total return of trust vs sector over the past decade

Source: FE Analytics

He pointed out that both trusts are often trading on a premium, which is a positive sign, but the higher yields and track record for growing dividends makes City of London a more appealing option in the present environment.

Salih added: “The City of London trust is more of a core offering, with manager Job Curtis typically having a bias towards international earners in the FTSE 100.

“The conservative approach – coupled with the ability to consistently increase dividend payments for well over 50 years – makes it a clear eye-catcher for those searching for a reliable income.”

Gavin Haynes, investment consultant at Fairview Investing, also preferred City of London. He pointed out that although its assets are domiciled in the UK, their reach is global.

Investors concerned about backing themselves into a single region therefore shouldn’t be too concerned, as they’ll still be supported by revenues from around the globe.

Haynes said: “The 85-stock portfolio is focused on multinational mega-caps with the global earnings focus reducing reliance on the domestic economy. A favour for energy, tobacco and financials has proved beneficial recently.”

The ongoing charges figure (OCF) of 0.45% also makes it somewhat cheaper than its peers, which could provide a low-cost route for actively managed UK equity income, according to Haynes.

These two trusts could indeed make a reasonable pairing, according to Andy Merricks, fund manager at 8AM global, but if made to choose he would side with the global strategy.

While the long-track record of the trust and its manager, Job Curtis, who has been running the £2bn fund since 1991, are certainly appealing, he said the forward-looking nature of JPM Global Growth and Income was “very much synonymous with modern living”.

Merricks said: “City of London is very much a strategy that has stood the test of time. The portfolio doesn’t look particularly modern though.

“My personal preference is to overweight the future and underweight the past and as such would be drawn to the JP Morgan trust as my preferred choice as I see more potential in realising a better overall return by investing overseas rather than being restricted to stocks listed primarily on the UK market.”