Short-dated bonds funds have led the IA Sterling Corporate Bond sector across most risk and return metrics in recent years, Trustnet research shows, as they were less sensitive to rising interest rates.

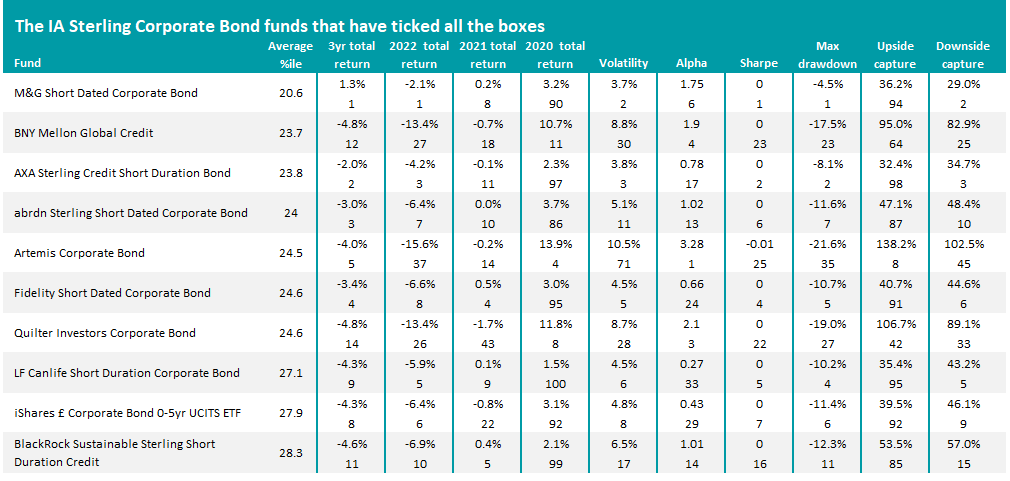

This ongoing series looks for funds that have beaten their peers on all fronts over the past three years, ranking them on 10 different risk and return metrics: cumulative three-year total returns, volatility, alpha, Sharpe ratio, maximum drawdown, upside capture and downside capture over the past three years, as well as returns in each of 2022, 2021 and 2020.

Trustnet works out an average percentile score for each fund across the 10 metrics and the lower the average percentile, the better the fund has performed overall. Given the diverse range of benchmarks used by IA Sterling Corporate Bond funds, we’ve taken the sector average as the benchmark for this research.

Performance of M&G Short Dated Corporate Bond vs sector over 3yrs to the end of 2022

Source: FE Analytics

After running the analysis, the fund that came out on top was M&G Short Dated Corporate Bond, which is managed by Matthew Russell and Ben Lord. It achieved an average percentile score of just 20.6 and its 1.3% total return means it is the only fund in the sector make a positive return over the three years to the end of 2022.

This is largely down to the £271m fund’s 2.1% loss in 2022, which was the best result in the IA Sterling Corporate Bond sector after bonds were hit by rising interest rates and compares very favourably with the 16.1% loss from the average peer.

As can be seen in the chart below, short-dated bond funds came out strongly in this research as they are impacted less by changes in interest rates – which have rocked markets in recent years. Russell and Lord kept the duration of the fund at around 1.5 years for much of 2022, which is relatively low and meant the fund was relatively protected as interest rates were hiked.

High quality corporate bonds have also held up in recent years and M&G Short Dated Corporate Bond has been focused on these assets. It currently has more than half of its portfolio in bonds with a credit rating of AAA, AA or A.

Source: FE Analytics

It’s worth noting that, while short-dated funds tended to make some of the sector’s highest returns when inflation and interest rates were rising in 2021 and 2022, they also were at the bottom of the performance tables in 2020 when central banks cut interest rates in response to the Covid-19 pandemic.

This should indicate to investors that these funds could underperform if central banks start to cut interest rates. Of course, exactly when this will happen is yet to be seen – some analysts think it could start in 2023 in response to recession while others see rates remain high for some time to come.

Not all the funds on the shortlist focus on short-dated bonds, however.

BNY Mellon Global Credit, Artemis Corporate Bond and Quilter Investors Corporate Bond are examples of funds that have been successful in recent years at looking across the entire corporate bond market and other fixed interest assets for opportunities.

As the table above shows, while they might not have been at the very top of the sector during 2022’s interest rate-driven markets, they performed much better than their short-dated peers in 2020.

In a recent note, BNY Mellon Global Credit managers Peter Bentley and Adam Whiteley said: “In our opinion, interest rates will peak in 2023. However, we expect the subsequent reduction in rates will be slower than the market is currently pricing in.

“This is because we believe central banks will be reluctant to repeat the errors made in the 1970s, when interest rates were cut as economies slowed and a sharp rebound in inflation followed.”

Source: FE Analytics

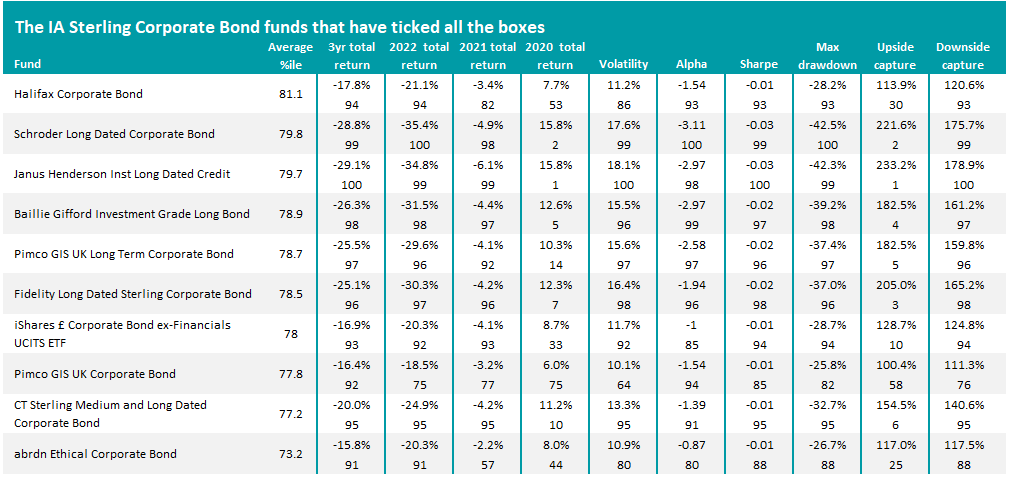

It should come as little surprise that the IA Sterling Corporate Bond funds with the worst average percentile scores are the mirror image of those with the best.

Most of the funds in the list focus on long-dated bonds, making them more sensitive to interest rate movements. This means they outperform when rates as falling (as in 2020) but have been harder hit in more recent years when they have been rising.

Halifax Corporate Bond is the worst fund in this research, as its average percentile for the 10 metrics came in at 81.1.

In contrast to the many of the funds highlighted above, it has a longer duration stance – almost 25% of the portfolio in bonds with a maturity of more than 15 years, with another 10% in those with maturities between 10 and 15 years. Furthermore, it is holding bonds of lower quality with more than half of the portfolio in those with a BBB rating.