It was a difficult year for the IA Global sector in 2022, with funds in the group falling 20.7% on average. However, Alliance Trust proved more resilient than its peers, dropping by a shallower 5.8% throughout the course of the year.

The £2.8bn portfolio also outperformed over the long term, climbing 172.5% over the past decade and beating its peers in the IT Global sector by 56.4 percentage points.

It is a popular option for those seeking exposure to global equities, but investors may be wondering what else they can hold alongside it. Here, Trustnet asks fund experts what would complement Alliance Trust.

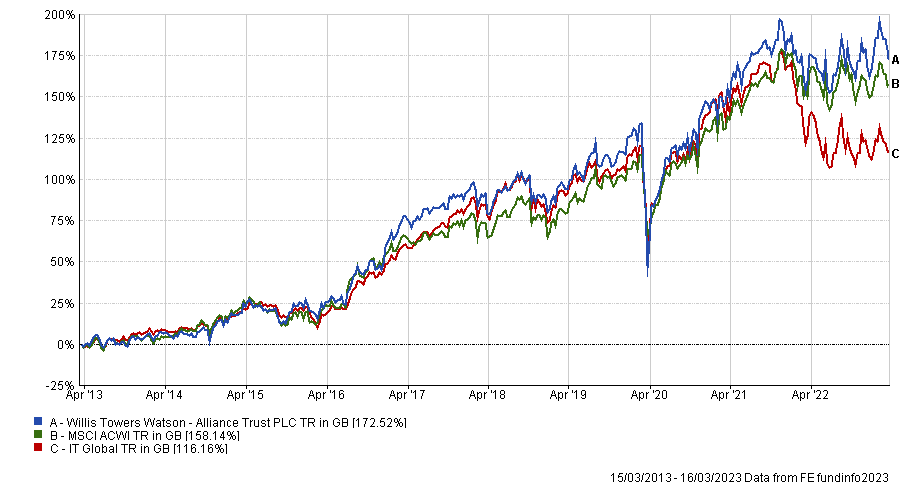

Total return of fund vs benchmark and sector over the past decade

Source: FE Analytics

When blending funds, investors should first consider how any new additions would sit alongside their existing holdings, but Fidelity Global Dividend would make a good pairing in most portfolios, according to Chris Rush, invetsmsent manager at IBOSS.

The £3.4bn fund’s income focus means that its asset exposue differs substantially from that of Alliance Trust, which could add some diversification to investors’ portfolios.

Rush said: “Though it also invests primarily in developed markets, the focus on dividend-paying companies and downside protection means that manager, Dan Roberts, has constructed a portfolio with very different stocks.”

Top holdings include companies such as Unilever, RELX and Deutsche Börse (which account for 12.4% of all assets), and the fund has an overall yield of 2.9%.

Its pursuit of income has also led to a greater allocation to the UK and Europe than Alliance Trust’s US-dominated portfolio.

Fidelity Global Dividend’s 28.7% exposure to the US is significantly below Alliance Trust’s 52% allocation to the region.

Returns were up 156.5% over the past decade, bringing it 46 percentage points ahead of its peers in the IA Global Equity Income sector.

Total return of fund vs sector over the past decade

Source: FE Analytics

It may offer some regional and sectoral diversification, but Fidelity Global Dividend and Alliance Trust mostly provide exposure to developed markets.

Investors who want to mix things up with an allocation to emerging markets and Asia might want to consider the Blackrock Emerging Market fund, according to Rush.

It was up 53.8% over the past decade, beating its peers in IA Global Emerging Markets sector by 17.4 percentage points.

Rush added: “We believe these areas present significant opportunity to investors to boost longer-term returns and diversify their holdings - should they have the risk tolerance for investing.”

Total return of fund vs benchmark and sector over the past decade

.png)

Source: FE Analytics

Alternatively, Gavin Haynes, investment consultant at Fairview Investing, said that the F&C Investment Trust would make a good pairing alongside Alliance Trust.

It is situated in the same sector as Alliance Trust and beat it over the long term, climbing 202.9% over the past decade.

Haynes noted that the trust had gone down the multi-manager route much like Alliance Trust, sharing management between Paul Niven and a set of external managers.

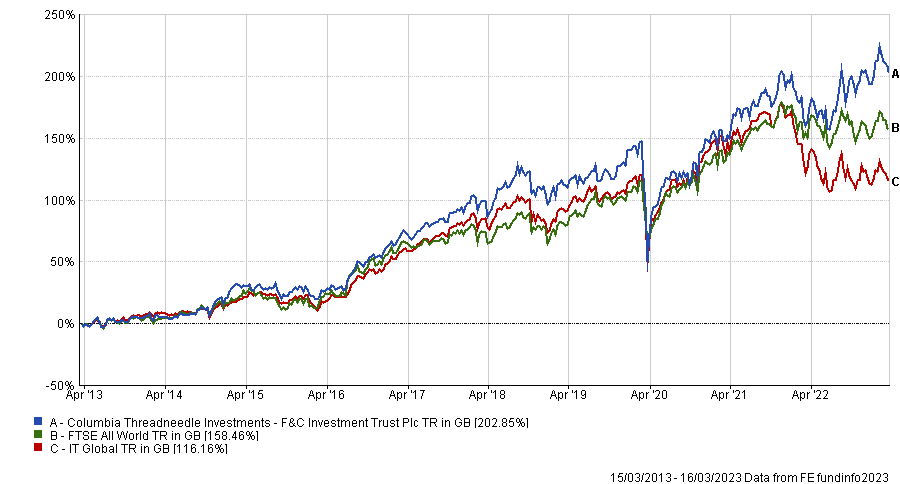

Total return of trust vs benchmark and sector

Source: FE Analytics

He added: “The flexible approach employed by Niven has been demonstrated to good effect over the past year where he has skewed the portfolio towards value and income producing stocks has resulted in strong performance.”

Returns dropped 0.9% in 2022, making it the best performing trust in the sector that year with Alliance Trust coming in second place.

Crucially, the trust’s 12.5% exposure to private equity is the key differentiator between the two, giving F&C an added edge, according to Haynes.

The Royal London Global Equity Select fund would also make a good pairing alongside Alliance Trust, according to Nick Wood, head of fund research at Quilter Cheviot.

He said that Alliance Trust ensures style neutrality by spreading responsibility between nine managers, so anything held alongside it should be a core fund.

“Any fund held alongside the trust should be also be core in nature, unless the investor wants to take an intentional style bet on either higher growth companies or cheaper value investments,” Wood added.

FE fundinfo Alpha manager James Clarke has run the fund since it launched in 2021 alongside Peter Rutter and Will Kenney.

Since then, returns are up 8% while its peers in the IA Global sector have sunk 10.6%, marking it as one of the few funds that has “navigated such different environments successfully”.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics