Baillie Gifford has responded to criticism of Scottish Mortgage’s investments in unquoted companies, with James Budden, the group’s director of marketing and distribution, claiming that often the only difference between its public and private holdings is a stock market listing.

Scottish Mortgage recently hit the news after non-executive director Amar Bhidé was asked to resign after he questioned the composition of the trust’s board and the extent of its investments in private companies, which last year accounted for more than 30% of the portfolio, breaching a self-imposed limit.

“In my opinion they do not have the capabilities and governance clout to be able to monitor the illiquid investments on which there is little audited information in the public sphere,” Bhidé told The Financial Times.

“The fact that you’ve pulled it off for the last 10 years has been due to an utterly aberrant period in financial history. Don’t delude yourself that you can keep playing this game.”

While Budden didn’t respond specifically to Bhidé’s claims, he said the managers of Scottish Mortgage are often questioned about its private holdings by investors and analysts, who mistakenly compare its approach with the one taken by venture capital or private equity firms.

He said these tend to be the major investors in small, early-stage companies, where they install their own board members to help the founders build up the business, before selling out at the IPO.

“That’s not what we do,” said Budden.

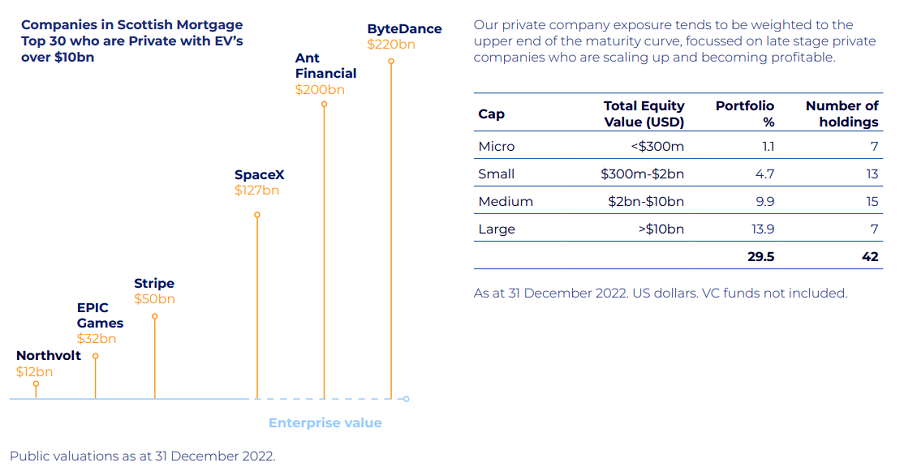

Instead, most of Scottish Mortgage’s private holdings tend to be more than £2bn in size, while some of its largest unlisted positions – such as SpaceX and Stripe – have market capitalisations that would put them in the FTSE 100’s top-20.

“It's a very different approach,” Budden continued. “The unlisted companies we invest in have got boards of directors, thousands of employees – essentially, they have much bigger structures than the majority of public companies. You don't need a person on the board to tell them what to do.”

Scottish Mortgage began investing in unlisted companies about 10 years ago upon the realisation that many businesses were “scaling up without the need to tap markets for money”.

Budden said this became uncomfortable for the trust as it meant it was missing out on the best years of returns in many high-growth businesses.

He said the manager at the time, James Anderson, began to ask questions about how to get involved in companies before they listed, when an opportunity arose to buy a part of Alibaba owned by Yahoo.

“That was the most fantastic investment,” said Budden. “Scottish Mortgage kept it after IPO and the managers only recently sold it when they reduced their exposure to China.

“We hold private and public in the same way – it's about long-term prospects. They just happen to be different structurally.”

One of the worries over private businesses is that their strong performance in the decade or so to the end of 2021 was driven by ultra-loose monetary policy – what Bhidé called “an utterly aberrant period in financial history”. When inflation and interest rate expectations began to rise about 18 months ago, these began to suffer enormous write-downs.

Budden claimed that the maturity of Scottish Mortgage’s private holdings sets them apart from the rest of the unlisted space, which is dominated by early-stage companies. For example, he pointed out that the 28% fall in the private component of the trust’s portfolio last year meant it did better than the public one, which was down 35%.

This is unlikely to placate the critics who cite a lack of visibility in the trust’s private holdings, as such performance figures are based on valuations that are largely determined by an internal team.

Again though, Budden said Scottish Mortgage approaches this issue in a different way to venture capital and private equity companies, which only value their holdings when they have interim results or a funding round approaching.

“Scottish Mortgage carried out 585 valuations on a private portfolio of 52 stocks last year,” he said.

“The committee looks at valuations quarterly on a rolling basis. Then there are a lot of trigger events such as a change in company fundamentals or an announcement about an IPO. It also looks at what's happening to similar companies in the public space and will adjust the valuations accordingly.”

He added: “Baillie Gifford would refute the claim that we can't do this. We think we are very good at it. It's just we do it in a different way to private equity and venture capital.”