Investors should not be so quick to jettison alternatives and jump into bonds now that bond yields have risen as some alternatives still provide attractive income opportunities, according to Mike Bell, global market strategist at JP Morgan Asset Management.

Bonds have become more popular in recent months as fixed income has begun to offer attractively high yield but he argued that alternative assets are still attractive for investors.

Bell started by acknowledging the recent appeal of bonds, stating: “Historically, people have looked to alternatives for income in a world where bond yields have been much lower.

“Today, bonds are back so why would you look at alternatives when you can get nearly a 5% yield on a six-month bond?”

Indeed, Franck Dixmier, global chief investment officer of fixed income at Allianz Global Investors, said that “fixed income is investible again” for the first time in years.

“2022 was one of the worst-ever years for fixed-income returns,” he added. “Yields have since reset, and both upside and downside risks to inflation and growth have become more symmetrical, making bonds a potentially appealing asset class to navigate a volatile environment.”

Above average yields may be attractive amid the current volatility of markets, but alternative assets offer more robust income over the long term, according to Bell.

He said: “I think the high income you’re getting from fixed income at the moment in the short term does pose a bit of competition, but I don’t focus on the short term.

“Bonds are back in fashion, but I think the income available from alternative asset classes is is more like style than fashion in that it’s going to last throughout the economic cycle.”

Investors jumping into bonds now may benefit from short-term tailwinds over the next few months, but those with a longer investment horizon would benefit more from an allocation to alternatives.

Bell added: “If we do end up in a recession then that can lead to cuts in interest rates, and whilst that in the short term would be beneficial for longer duration government bonds, the income available in fixed income would come down.

“Yet the income available in alternative assets classes is likely to remain pretty stable and I think that’s why those assets remain attractive with investors.”

Monetary moves have been front and centre on investors’ minds over the past year and alternative assets offer a greater level of inflation protection that bonds can’t provide.

For example, Bell pointed out that industrial real estate rents in the US were up a sizable 14% in 2022, with returns keeping ahead of inflation rates.

“There aren’t many asset classes that were able to deliver that kind of inflation protection in an environment where we saw a massive pick up in inflation,” he said.

Having exposure to these inflation-linked assets may be advantageous to investors who expect price rises to stay higher than average over the coming years.

Bell’s colleague, global multi-asset strategist Thushka Maharaj, thinks so. She said that inflation is likely to be higher than normal over the next decade, making alternatives a particularly attractive asset class in this new era.

“Within our long-term capital market assumptions, we have increased our volatility expectations for inflation, so essentially inflation uncertainty over the next 10 years will be much higher than we've had in the past 10 years,” she said.

This was echoed by Karen Ward, chief market strategist for EMEA at JP Morgan Asset Management, who said that central banks need to lift their inflation targets by 50% to meet more realistic goals.

Alternative assets may deliver resilience from an income perspective, but they also deliver a better return over bonds, according to Bell.

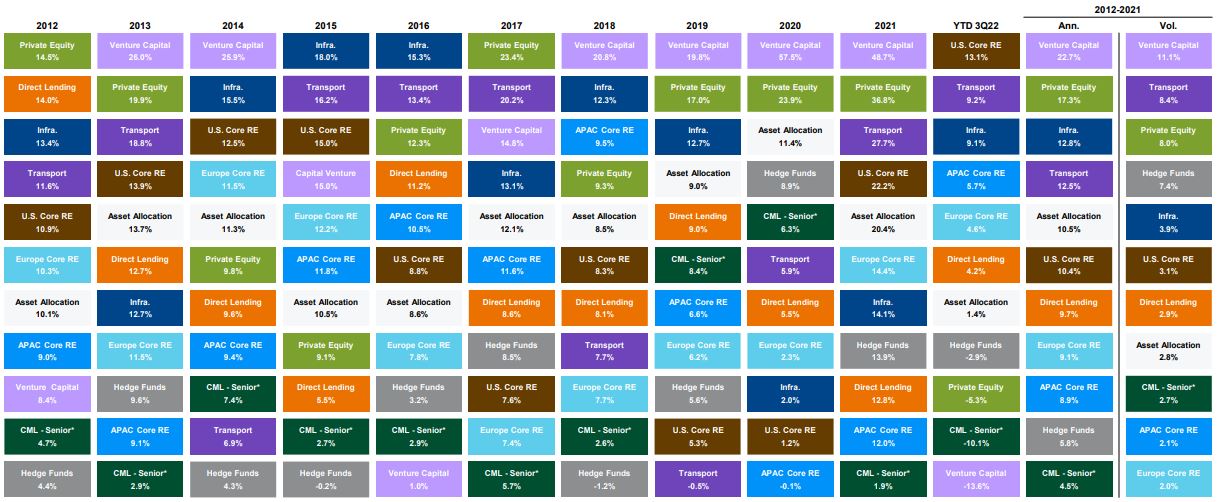

Venture capital, for example, was the best performing alternative asset class between 2012 to 2021, delivering an annualised return of 22.7% over the period.

Bell said: “For the type of investor looking for very strong and high returns, some of those private asset classes have historically been able to deliver.

“In the first three quarters of last year the S&P 500 went down and global bond markets were hit very hard, yet many alternative asset classes were doing a lot better than bonds or stocks.”

Returns for venture capital assets dropped 13.6% in the first three quarters of 2022, but other alternatives such as US core real estate soared 13.1%.

Alternative asset class returns since 2012

Source: J.P. Morgan Asset Management

This highlights the need for diversification, according to Phil Waller, alternatives portfolio manager at JP Morgan Asset Management, who said that alternative asset classes behave very differently from one another.

He added: “The important thing about this for all investors, is that the alternative market is not a homogenous space – all of the asset classes within alternatives offer different qualities to investors’ portfolios.

“What private equity brings to a portfolio is very different to what they'll get from real estate, so this gives us a greater set of options to work with, whether clients are looking for inflation protection, diversification, or a way to meet their sustainability goals.”

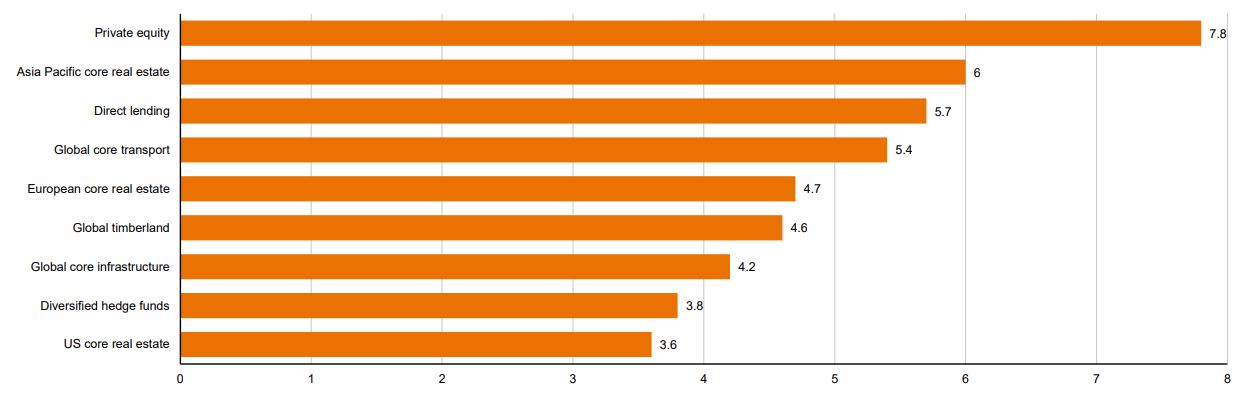

Looking forward, analysts at the firm forecast the highest growth from private equity assets, predicting an annualised return of 7.8% over the next 10 to 15 years.

Annualised returns expectations over the next 10-15 years

Source: J.P. Morgan Asset Management

J.P. Morgan currently has $216bn in alternative assets, but only 13.4% of that is in private equity assets.

The majority (27.3%) is held in real estate, but this is because it was the only alternative asset class the firm invested in for a long time, according to Waller.

It began moving into other areas of the alternative market once analysts realised the income opportunities available there were greater than they could find elsewhere, such as fixed income.

Ultimately, Bell said that exposure to a broad spread of alternative assets can provide better income, inflation protection and total return over the long term than an allocation to bonds.

He said: “The diversification that you get from alternatives as well as the higher return and inflation protection are some of the key reasons why investors are looking to alternatives and why I think they’re going to continue to in future.”