Income-seeking investors are turning away from dividend paying stocks and towards bonds as fixed income yields rise to attractively high levels, presenting a challenge for equity income fund managers who have not had to compete with bonds for much of the past decade.

Sam Witherow, manager of the JPM Global Equity Income fund, said: “It’s a very painful thing for an equity investor to say but I do agree that bonds are back. If I wasn’t managing this fund, I’d have a higher allocation to bonds today than I would a couple of years ago.”

David Jane, manager of the Premier Miton Multi-Asset Growth & Income, agreed that bonds are looking a lot more attractive now than they have in the past, especially over the short term.

Markets are in a volatile state as high inflation and rising interest rates put investors on edge. With many investors taking a cautious stance, locking in a set income yield now is more attractive than taking a risk with equities.

Jane, who has a 14.1% exposure to bonds, said: “Investors often forgot that bond returns are limited to yield paid at purchase. If held to maturity and the bond doesn’t default, that is the return you will get and no more.”

Although having a guaranteed yield is attractive in the short term, Witherow argued that accepting a set rate now puts investors at a disadvantage because there is no opportunity for growth later on.

He said: “Fixed income is fixed, whereas dividends get paid out of nominal corporate cash flows that grow over time in line or above the level of inflation.”

Indeed, this is especially applicable in today’s high inflationary market where capital is losing its purchasing power at an accelerated rate.

A 4% yield on a government bond, for example, might look less appealing when you take into account that UK inflation rose to 10.4% in February.

Witherow added: “Once you take inflation into account, the real yields on bonds are a lot more modest. From an equity perspective, once you embed that nominal dividend growth, relative returns are much more skewed in favour of equities. If your time horizon is long enough, they’ll certainly do well.”

Though Jane can see the appeal in fixed income as a short-term play, he also agreed that equities are the best option for income over the long term. His allocation to equities is larger than his bonds exposure at 77.2%.

“While volatile, equity dividends are generally more stable than capital values and do not suffer from reinvestment risk,” Jane said.

“As bonds mature, you must reinvest the proceeds at the yields available at the time. So long as your equities continue to pay or grow their dividends, your equity income is relatively secure.”

Likewise, the yields on offer in the fixed income market will not offer the protection investors desire if inflation stays high over the long term, as Jane predicts.

He said: “In this environment, we believe bonds are unlikely to offer attractive real returns over the long term, whereas real assets, such as equities should offer some protection against inflation.”

Karen Ward, chief market strategist for EMEA at JP Morgan Asset Management, also anticipates an era of higher inflation and suggested central banks should lift their inflation targets by 50% earlier this week.

With the appeal of bonds on the rise, Witherow did acknowledge some concerns that income investors might have with dividend-paying equities.

He said that some investors are uneasy that many of the big dividend-paying companies are in cyclical sectors that deliver volatile returns.

“You are pushed into a relatively concentrated universe of sectors that doesn't really represent the growth available in the broader economy,” Witherow said.

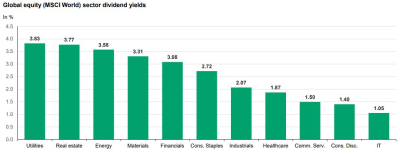

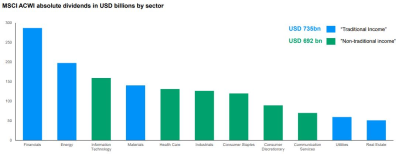

However, he added that those investing globally can get good diversification. While many of the highest dividend yields are concentrated in sectors such as utilities, real estate, energy and materials, that is not the case in terms of net pay outs.

Information technology companies, for example, pay out the third highest amount in dividends to shareholders – more than twice as much paid by utilities and real estate businesses.

Source: J.P. Morgan Asset Management

Sectors such as information technology and healthcare offer lower yields than some of the more traditional equity income areas, but having exposure to them can offer more dividend growth and total returns over time, according to Witherow.

He said: “If you’re prepared to sacrifice a bit of dividend yield you can really open up a much broader universe of dividend-paying companies that, in the long run, are better exposed to those attractive structural growth themes going on in the economy.”

Similarly, fears that companies could slash their dividend pay outs like they did back in 2020 when the Covid downturn put a hold on earnings, are no longer a concern, Witherow added.

Witherow said: “Since then, we’ve had a massive explosion in corporate earnings power and a relatively tepid recovery in dividends, so companies are starting this downturn from a position of strength with regards to pay-outs.

“They are not paying out as much as they would normally do to shareholders – there’s a lot of cushion in their earnings power.”

However, bonds should not be ignored entirely, according to Eugene Philalithis, manager of Fidelity Multi Asset Income & Growth fund. He said that a mixture of both equities and bonds is essential to an income portfolio.

Companies offering “strong cashflow generation and high dividend cover” offer the best income opportunities on the equities side, whilst government and investment grade bonds are the best option in terms of fixed income, he said.

“The higher yields now on offer for high quality bonds reduces the income shortfall and makes portfolios more resilient in case macroeconomic conditions deteriorate quickly,” Philalithis added.