“Europe” and “growth” are not synonymous with one another, as the old continent is more often associated with banks, defence stocks and industrials that typically fall under ‘value’ investing.

Janus Henderson’s Marc Schartz brings the two apparently contrasting concepts together in his European Growth fund, with strong results. He uses a contrarian approach, buying companies that are unjustifiably out of favour with the wider market.

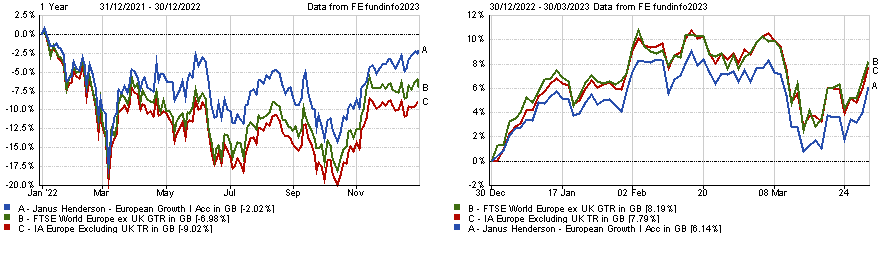

Performance of fund against index and sector in 2022 and over the year to date

Source: FE Analytics

While he looks for things that are unloved, Europe itself has experienced somewhat of a come-back in 2023, as the energy crisis wasn’t as harsh as people were expecting. But the war in Ukraine still rages and the banking scare has further stirred the pot, impacting valuations.

Below, Marc Schartz discusses why the European economy outlines his definition of ‘contrarian growth’ and explains why he won’t have a 0% allocation to banks anytime soon.

Performance of top IA sectors over the year to date

_MA000023.png)

Source: FinXL

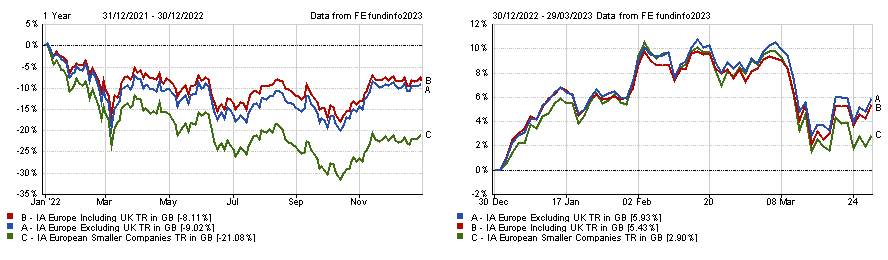

Performance of IA European sectors in 2022 and over the year to date

Source: FE Analytics

Can you describe your investment strategy?

We are a pure bottom-up fund that aims to provide alpha by having differentiated views on company specifics, rather than making macro, factor or sector calls.

In our stock-picking, we look for ‘contrarian quality’, by which we mean companies in unusual places that have an ability to derive a high return on their capital.

We have a mid-cap bias, as we invest 40% to 50% of our assets in companies that have a market capitalisation below €20bn, which is where we find the most attractive ideas.

Can you elaborate on ‘contrarian quality’ and where you find it?

We find contrarian quality in places where we have a different view than the market on the fundamental outlook of a company.

We try to identify quality where others see persistent under-delivery, for example companies that have a good product or a good service, but that have not delivered in financial terms for years, or sometimes decades. Identifying these early on can be very powerful.

Secondly, we like areas which the market considers to be on boring trajectories and are overlooked despite a strong underlying growth trend. And finally, we buy companies that the market might be shying away from because they’re encountering cyclical headwinds. This allows us to have a very balanced portfolio in terms of sector and industry exposures.

Where are you allocating to at the moment?

Industrials is a home turf for us. In Europe, you have a lot of companies with global leadership positioning in niches like equipment for semiconductors or mining. These are very good businesses, which sometimes remain under the radar and can be cyclical and can sell off quite dramatically, which happened last year. And that's exactly when we pick them up.

Are you reconsidering your exposure to banks after the Credit Suisse saga?

At 7.5%, banks are an underweight for us compared to the benchmark. The banks we have are often different, for example we own Nordea and Fineco, with the latter hardly being a bank, but rather more an Italian investment platform. These institutions are perfectly fine.

Overall in Europe, I struggle to see one bank collapsing after the other, because they are strongly capitalised. But one has to be very honest and if confidence does go out of that sector, that can be scary. I cannot sit here and say nothing can happen, but we will not go to 0% in banks, that’s not my call.

One thing that did make me re-think my allocation to banks is the situation with Credit Suisse’s AT1 bonds. Banks over time will have to replace their AT1s junior bonds, which will struggle from now on as an asset class, with other forms of capital. Ultimately the cost of funding has changed, and that has a reflection on the share prices.

What were the best and worst calls of the past year?

The star performer of our portfolio was Rheinmetall, a German defence company that is up 200% over the past 15 months.

Performance of stock over 1 year

Source: Google Finance

It’s one stock where I can say it was a top contrarian holding for a long time, as defence had become something of a dirty name in the investment world and was almost deemed uninvestable by many. This company traded at ludicrously low valuations despite delivering solid financial results and now with the war in Ukraine there’s greater awareness of the need for this type of players.

On the flip side, the biggest detractor was Kion, another German stock which cost us 140 basis points in performance.

Performance of stock over 1 year

Source: Google Finance

It focuses on two lines of business, forklift trucks and warehouse automation. Both are exposed to decent structural trends but from an operational point of view, this company was much less well-managed than we thought and couldn’t recoup costs when interest rates rose. We adjusted our position but have confidence in the new management to turn the situation around.

What do you do outside of fund management?

As a true Luxembourgian I just enjoy my cycling so I go up and down the Kentish hills on Saturday mornings. And for the rest, it's spending quality time with my wife and two children.