The Vanguard LifeStrategy 100% Equity fund has attracted £976m over the past year, consolidating its widespread popularity. The vehicle is part of Vanguard’s range of multi-asset passive investments and is entirely invested in global equities.

Given its premise, it is usually most appealing to younger investors who can spread the higher risk over a longer term. The fund is offered as a ‘core’ option and covers the breadth of global markets, including the UK, US, Europe, and emerging markets. But investors who are looking for more might be asking themselves – can this horizon be expanded even further?

Below, we ask three expert fund pickers which strategy they would hold alongside Vanguard LifeStrategy 100% Equity.

First up is Peter Sleep, senior portfolio manager at 7IM, who didn’t think there is a “compelling reason” to own another fund alongside it.

“Some investors like to adopt what they call a ‘core and satellite’ approach. This involves holding a fund like LifeStrategy as a core and then buying something a bit more topical or exciting alongside. I would strongly urge investors to resist this approach, as you tend to buy into narrow and expensive areas of the market that professional investors have already fully exploited and where you are quite probably the ‘greater fool’,” he said.

For as much as it “broke his heart” to recommend a competitor, Sleep said that investors would be “far better” to stick with a core fund like LifeStrategy and only buy other funds exceptionally. If you “absolutely have to buy another fund”, he suggested to consider Vanguard Global Small-Cap Index.

“The nature of the Vanguard LifeStrategy funds means that there is a bias to larger companies which tend to grow at a slower rate. You could potentially add some growth with the Vanguard Global Small Cap Index Fund alongside the LifeStrategy fund,” he concluded.

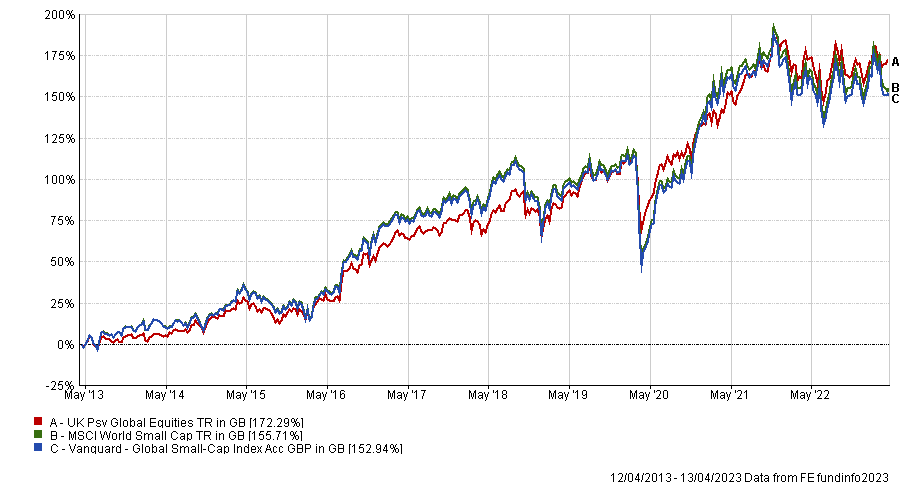

Performance of fund over 10yr against sector and benchmark

Source: FE Analytics

Ben Mackie, portfolio manager at Hawksmoor, opted for private equity, which he said is an “obvious” choice in this case, as investors wouldn’t necessarily be looking for something to diversify risk, but rather for different sources of growth and equity-like returns from something that they can't own in a Vanguard tracker.

The case for private equity is double-sided, according to Mackie. Firstly, with companies staying private for longer, fewer and lower-quality companies going public and a de-equitization trend (private equity firms buying up publicly listed companies), “not a great flow of new ideas are coming into the public market right now”, he said.

The second reason for private equity over public markets is the performance track record. Here, however, people “shouldn't blindly just look at headline performance numbers” but adjust for the leverage that private equity traditionally uses and select managers even more carefully than in public markets.

With these caveats, Mackie’s pick was Oakley Capital, which constitutes “the biggest private equity exposure” in Hawksmoor’s multi-asset funds and “would bring something very different to the sort of exposure investors get with the Vanguard fund”.

Performance of trust over 10yr against sector and benchmark

Source: FE Analytics

“The trust’s underlying portfolio is of very high quality and built up in three core sectors – education, technology, and the consumer. There's a high degree of visibility over them, they are not particularly cyclical and have quite a lot of recurring revenues,” he said.

“The five-year compound growth rate is around 25% and a big factor behind the growth and the net asset value (NAV) [up 24% in 2022] has been the EBITDA [earnings before interest, tax, depreciation and amortisation] growth of the underlying companies, while the valuation of the portfolio remained pretty conservative. The trust typically takes a 100% stake in businesses or a large stake alongside existing management and is very hands-on in driving operational improvement.”

The board is consistent in buying back shares and the trust is currently trading on a 32% discount, but the real attraction, according to Mackie, is the NAV.

Finally, Andrew O'Shea, investment director and head of fund solutions at Pharon Independent Financial Advisers, suggested that the Ninety One Global Environment fund could be a suitable satellite fund to provide enhanced upside potential.

Performance of fund over 10yr against sector and benchmark

Source: FE Analytics

“Whilst the Vanguard fund provides core exposure to global assets, the Ninety One fund invests in companies that positively contribute to environmental change through sustainable decarbonisation by focusing on three main themes – renewable energy, electrification and resource efficiency,” he said.

“The fund managers Deirdre Cooper and Graeme Baker have many years of experience in sustainable investing and they are in turn supported by a team of analysts who have diverse backgrounds and experience which in turn promotes strong debates across the broadest topics.”