Fund managers continue to grow more pessimistic on the outlook for the global economy and are dialling down risk in portfolios, the latest research from Bank of America suggests.

The May edition of the Bank of America Global Fund Manager Survey – which polled asset allocators running a total of $666bn – found that portfolios have been selling out of risky assets such as commodities and adding to cash, bonds and favoured parts of the stock market.

Below are seven charts showing the bearish stance of fund managers across the globe and why they are turning to areas such as tech stocks.

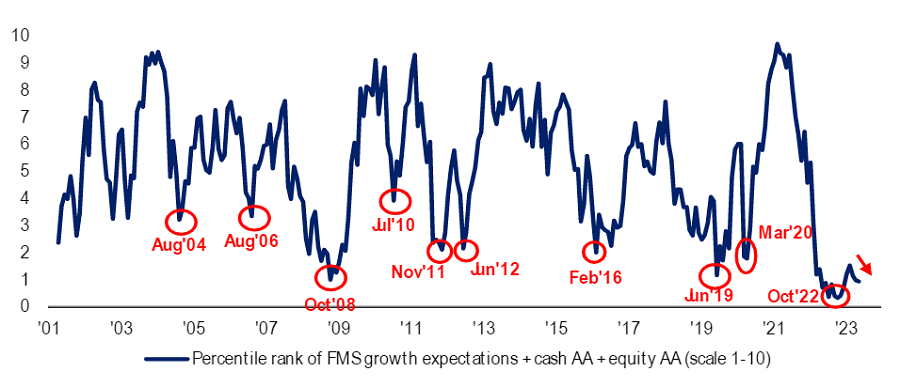

Fund managers turn more pessimistic

Source: BofA Global Fund Manager Survey – May 2023

First up is a look at the general optimism of the fund managers surveyed by Bank of America at the start of the month. It looks at their growth expectations combined with their allocations to equities and cash.

After rising during the opening months of 2023 (albeit while remaining at depressed levels), the latest findings suggest fund managers have become more bearish this month.

“Investor sentiment deteriorated in May to the most bearish of 2023 as investors raised cash balances and turned more pessimistic on growth,” analysts at Bank of America explained.

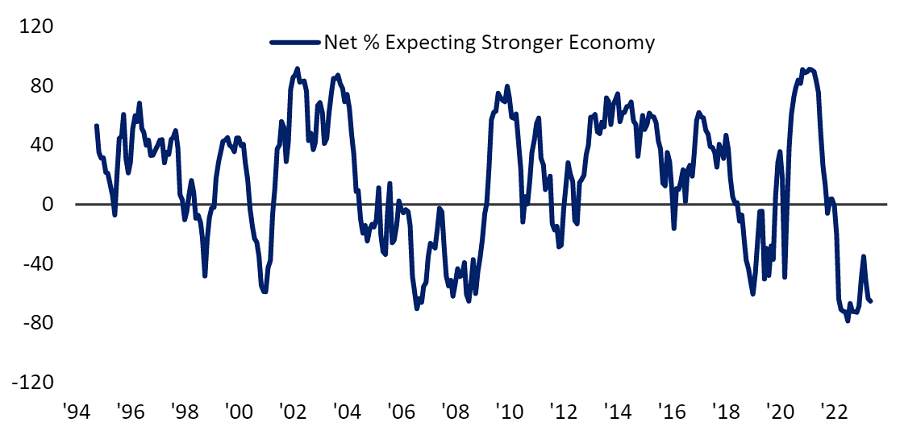

Investors expecting a stronger/weaker economy

Source: BofA Global Fund Manager Survey – May 2023

Indeed, a net 65% of fund managers now think the economy will weaken over the coming 12 months. Although this is only a 2 percentage point decline since last month, this indicator has fallen 30 percentage points since February.

A net 47% also expect a recession in the next 12 months. However, almost two-thirds of fund managers think a ‘soft landing’ is the most likely outcome for the global economy with a quarter expecting a ‘hard landing’; there’s only 4% with the optimism to predict a ‘no landing’ outcome.

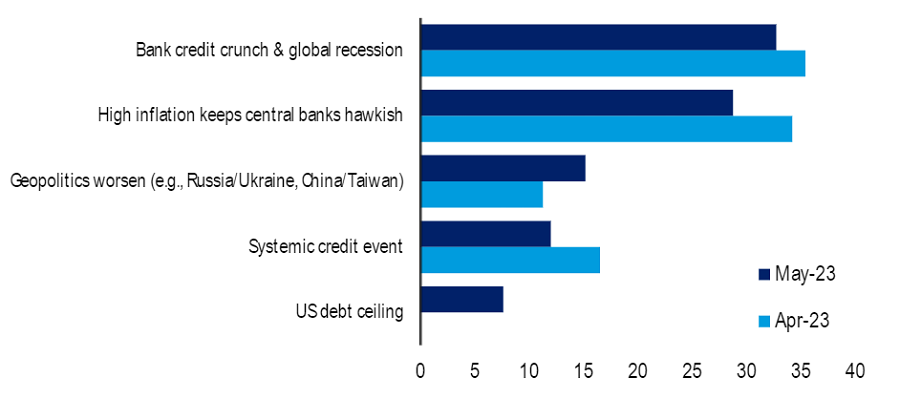

Credit crunch & global recession risks still top of mind

Source: BofA Global Fund Manager Survey – May 2023

The threat of a global recession, combined with a bank credit crunch, remains the biggest ‘tail risk’ cited by respondents to the latest Bank of America Global Fund Manager Survey.

However, this tail risk and those revolving around persistently high inflation and a systemic credit event were cited by fewer managers than in the April edition of the survey.

This month, fund managers were increasingly concerned by the risks of worsening geopolitics and the US hitting its debt ceiling.

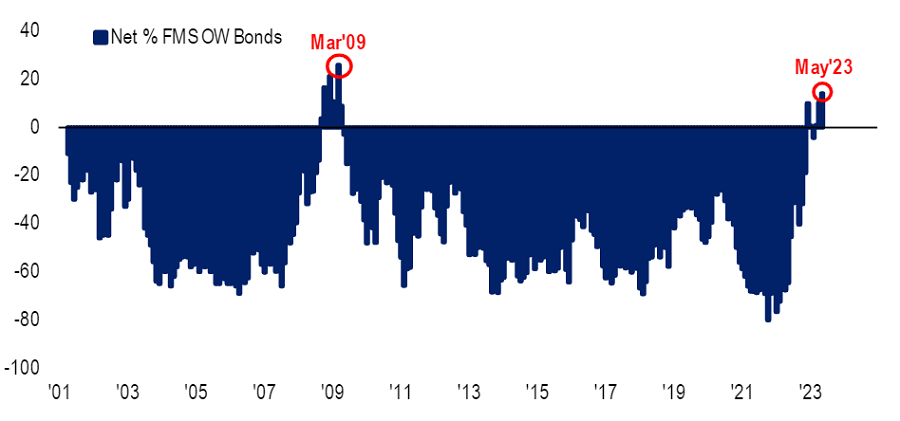

Bond overweight continues to increase toward financial crisis levels

Source: BofA Global Fund Manager Survey – May 2023

Given all this pessimism, fund managers have moved into areas of perceived safety such as bonds and cash.

“Fear of a credit crunch and global recession continues to drive bond allocations up 4 percentage points month-on-month to net 14% overweight, the largest overweight since March 2009,” Bank of America’s analysts said.

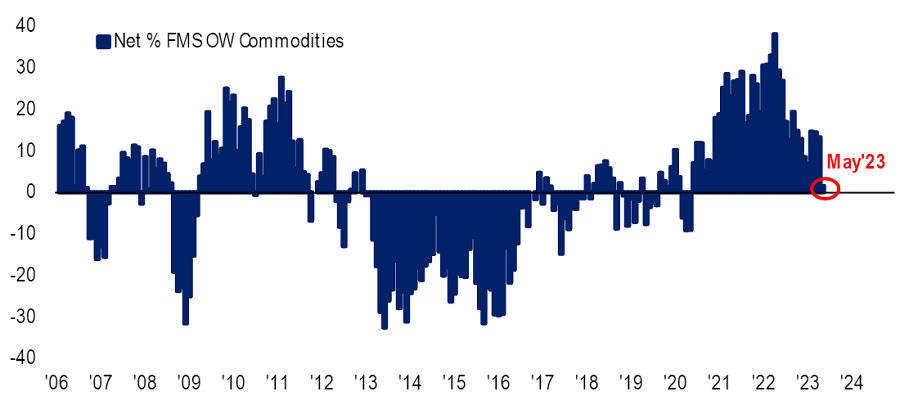

Fading conviction in commodities

Source: BofA Global Fund Manager Survey – May 2023

At the same time, investors have been pulling out of commodities – one of the few areas that made positive returns in 2022, owing to surging inflation.

The net 2% overweight to commodities being run at present is the lowest since May 2020 and comes after a 13 percentage point fall in the allocation over the past three months.

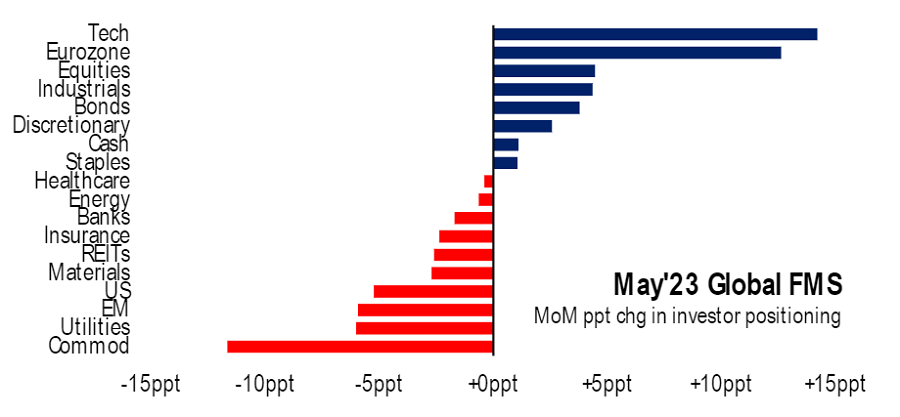

May rotation into tech, EU, stocks; out of commodities, utilities, EM, US

Source: BofA Global Fund Manager Survey – May 2023

Despite a bearish outlook and a move into defensive assets, fund managers have been adding to equities over the past month. The chart above shows month-on-month changes in positioning.

Tech stocks have been the most popular area. At a net 16% overweight, the allocation to tech is at its highest since December 2021. “In a ‘flight to safety’, the allocation to tech has risen by 22 percentage points since March 2023, the highest two-month increase since March 2009,” Bank of America explained.

That said, long big tech is seen by the survey’s participants as being the most crowded trade in the market at the moment, with 30% citing it. Other crowded trades include short US banks (22%), short US dollar (16%) and long European equities (12%).

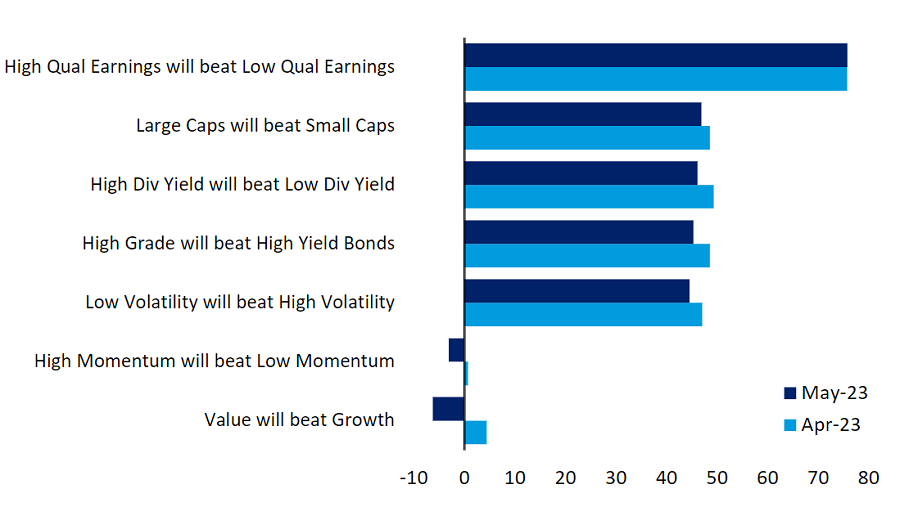

What fund managers think will outperform over the next 12 months

Source: BofA Global Fund Manager Survey – May 2023

When asked for their outlook on different investment factors, a net 6% of managers now expect the growth style will outperform value. This is a turnaround from April’s survey, when a net 4% were in favour of value.

The consensus is that high-quality companies will beat low-quality ones: a net 76% of investors expect this. There’s also confidence in large-caps over small-caps, high dividend yields over low yields and low volatility assets over high volatility.

But a net 3% think low momentum stocks will beat high momentum, another reversal from April when net 1% said high momentum would outperform low momentum.