Identifying companies that can thrive in different market conditions is key to future-proof your investments, but this doesn’t mean that more vulnerable companies have no room in a portfolio, said Kirsty Gibson, co-manager of the Baillie Gifford American fund.

In fact, it’s a matter of being aware of which businesses will not survive in different situations and deciding how much to invest in them.

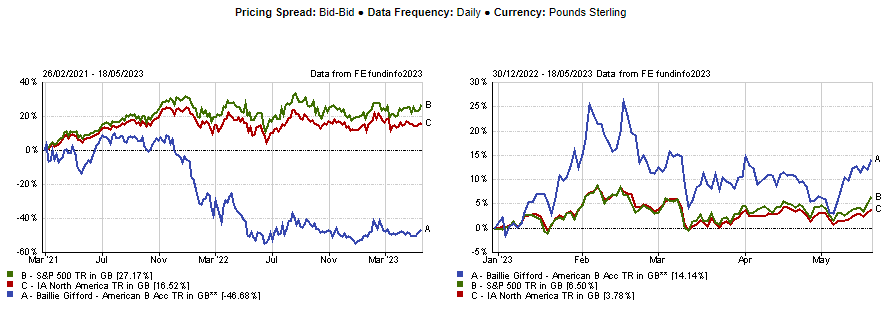

Gibson has been a decision maker on the fund since 2016 and the management team includes FE fundinfo Alpha Manager Tom Slater, Gary Robinson and Dave Bujnowski. Since March 2021, the growth-focused investment style pursued by Baillie Gifford has fallen out of favour with investors because of the adverse monetary environment, which had a profound impact on performance, but the strategy made a comeback over the year to date, as illustrated in the graph below.

Performance of fund since March 2021 and over the year to date against sector and index

Source: FE Analytics

The fund is benchmark-agnostic and will exhibit above-average volatility due to its focus on high conviction positions, said FE Investments researchers, who nevertheless praised the strategy for its “clear focus on bottom-up stock selection” and “clear ability to leverage expertise in growth investing”.

After the past three years, which the manager acknowledged have been “very tough” for investors in the fund and “even tougher” for the underlying businesses, the future ahead isn’t the more certain, with risks including a debt-ceiling crisis, persistently high interest rates and a recession looming in the US as well as other developed markets.

But, when comparing the situation to the great financial crisis of 2008, Gibson sees more differences than similarities.

“We've done a lot of work in the past couple of years on the resilience of our portfolio, identifying those companies that have a greater need to raise capital (which in an environment where capital is scarce is a difficult situation to be in) and those companies which are resilient,” she said.

“More than 75% of companies that we hold are generating free cash flow, which is one of the main focuses for companies right now. Many of them raised a lot of money during the pandemic, so they’ll also have very large balance sheets.”

One area she avoids is companies that are particularly indebted, but noted that no matter how strong some businesses appear, there are challenging situations in which they'll struggle.

“Some businesses will not survive in different situations, and what we need to decide is how much of our portfolio is invested in those type of businesses and how much is not,” said Gibson.

“We hold some early-stage biotechnology businesses which still require capital and are not profitable and some of them aren’t generating a lot of revenue. But we know that they are there and we also know that they are a small percentage of the portfolio. Does that mean that a big stock market crash will be easy for them? No. But does it mean that they have greater chances of surviving than they would have done? Yes.”

The team’s investment philosophy is to look among the technology disruptors for businesses with “long-term structural tailwinds” that will continue independently of the macro environment, which can slow their progress but won’t stop it.

“We're looking for businesses that we believe can withstand the macro environment and the changes that are happening around them. They may need to slightly alter their course and take a different path in adverse times, but they'll still be able to achieve their normal ambitions because those structural changes are inevitable at some point,” said Gibson.

And these companies are those that combine “atomic” elements (meaning that they compete in the physical world), and “byte-based” elements (compete online).

This model, which encompasses companies such as e-commerce giant Amazon, pharmaceutical giant Moderna and biotech firm Ginkgo Bioworks as well as online retailer Shopify, communications expert Twilio and food delivery company Doordash, “look poised to disrupt a whole new set of industries”.

“Their capital intensity combined with the fact that they have free cash flow generation could meet the current environment and exceptional opportunity for them to shore up their competitive position, but also emerge from this environment stronger than when we went in,” said Gibson.

“All bytes-and-atoms business models are united by the fact that it takes time for the potential that business models to be appreciated, or even acknowledged in some instances. And that makes these businesses the perfect candidates for long-term, patient shareholders looking to invest in innovation and change. Opportunities abound, but only if you're opting to look for them,” she concluded.