Investors wanting to make the highest returns from the US over the past decade would have needed exposure to its big tech players, but holding these companies came with a good deal of volatility.

Many of these mega-cap stocks delivered some colossal returns but their large gains came with steep falls, so it was no easy ride for investors.

However, some US managers were able to avoid some of the market’s most volatile stocks while also beating their peers with the highest returns.

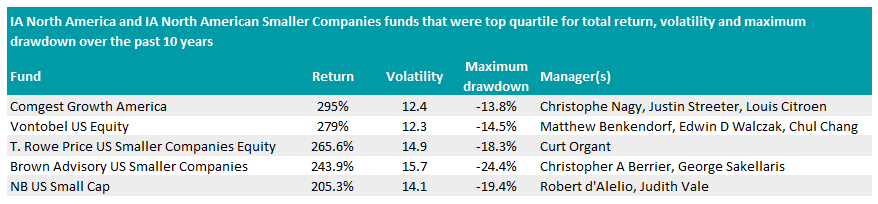

Here, Trustnet found five of the least volatile funds in the IA North America and IA North American Smaller Companies sectors that made top-quartile returns over 10 years.

Source: FE Analytics

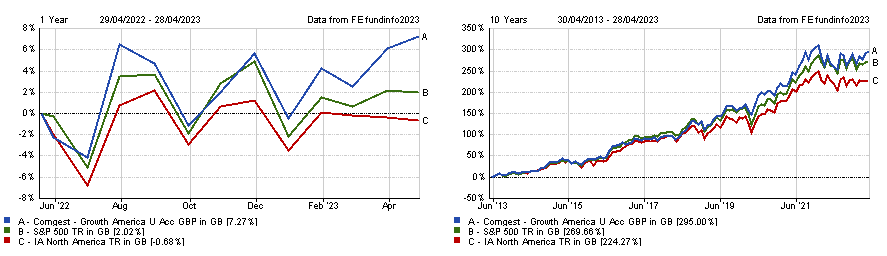

The highest returning fund on the list was Comgest Growth America, which had the ideal blend of making some of the highest returns without taking as much risk as its peers.

It was up 295% over the past decade, beating the IA North America sector by 70.7 percentage points over the period.

Investors holding this $508m (£409m) fund, managed by Christophe Nagy since 2009, did not miss out on technology exposure though – its 37.2% allocation to the sector is 9.4 percentage points higher than the S&P 500 benchmark.

Nagy was able to screen out some of the most volatile names in the technology sector, including its two largest holdings at present – Microsoft and Apple – which account for 17.1% of all assets.

Despite the stormy market conditions of the past year, Comgest Growth America continued to outperform, climbing 7.3% while the sector dropped 0.7%.

Total return of fund vs benchmark and sector over the past year and decade

Source: FE Analytics

Another relatively low-volatility fund that beat the IA North America sector was Vontobel US Equity, which stormed 54.7 percentage points ahead of its peers with a total return of 279% over the past decade.

The $2.2bn portfolio run by FE fundinfo Alpha manager Matthew Benkendorf also maintained its lead over the turbulent past year, rising 3.6% in a sector dominated by losses.

Alongside Comgest Growth America and Vontobel US Equity, there were also five tracker funds that delivered top-quartile returns for the lowest volatility over the past decade.

Each of these passive funds tracked the performance of the S&P 500, which outperformed the average IA North America fund by 45.4 percentage points over the past 10 years.

Having exposure to a broad spread of assets across the index delivered a higher return for less volatility than the average US fund manager who took bets on a smaller number of riskier stocks.

Total return of fund vs benchmark and sector over the past year and decade

Source: FE Analytics

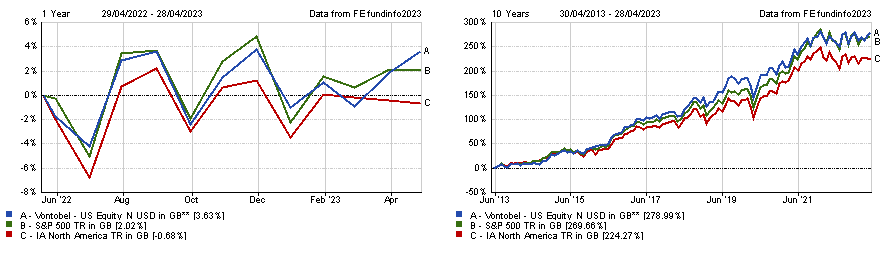

There were also three funds in the IA North America Smaller Companies sector that beat their peers despite taking the least risk.

Of these, the T. Rowe Price US Smaller Companies Equity fund was the best performer, making a total return of 265.6% over the period.

Manager Curt Organt only took over the $2.3bn fund in March 2019, but it has continued to beat the peer group by 16 percentage points since then.

Total return of fund vs sector and benchmark since manager took over and over the past decade

Source: FE Analytics

Trailing behind was the Brown Advisory US Smaller Companies and NB US Small Cap funds, with each climbing 243.9% and 205.3% respectively over the past decade compared to the sector’s 186.7% average.

Overall, lower volatility US funds made higher returns, but it was close. Taking the least volatile 25% of funds and most volatile 25% from a combination of both the IA North America and IA North American Smaller Companies sectors, the former beat the latter, although it was by a meagre 0.9 percentage points.

However, it was more boom or bust among those with the highest risk. While some funds made much more than their lower-risk rivals, others failed to match them.

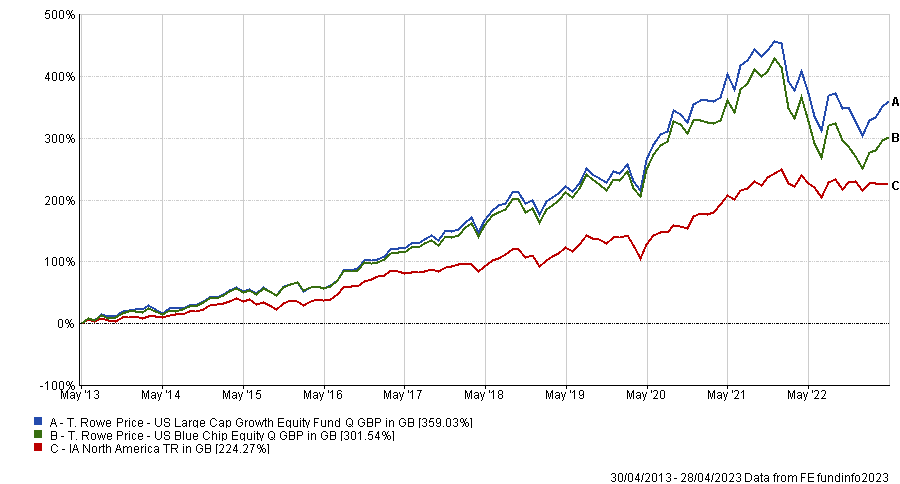

Two IA North America funds run by T. Rowe Price – US Large Cap Growth Equity and US Blue Chip Equity – beat the sector while also having some of the highest volatility and maximum drawdowns.

They climbed 359% and 301.5% respectively over the past decade, beating the best performing low-risk fund (Comgest Growth America).

The overall return was higher, but those holding these funds would have had a more stressful time watching their investment take some steep drops. The T. Rowe Price US Blue Chip Equity fund, for example, had the biggest maximum drawdown on the list, falling 33.7% at its worst point.

Total return of funds vs sector over the past decade

Source: FE Analytics

Other top-returning, high-risk funds included New Capital US Growth and UBS US Growth, which soared 325.5% and 311.5% over the past decade, but the highest outperformance came from trackers.

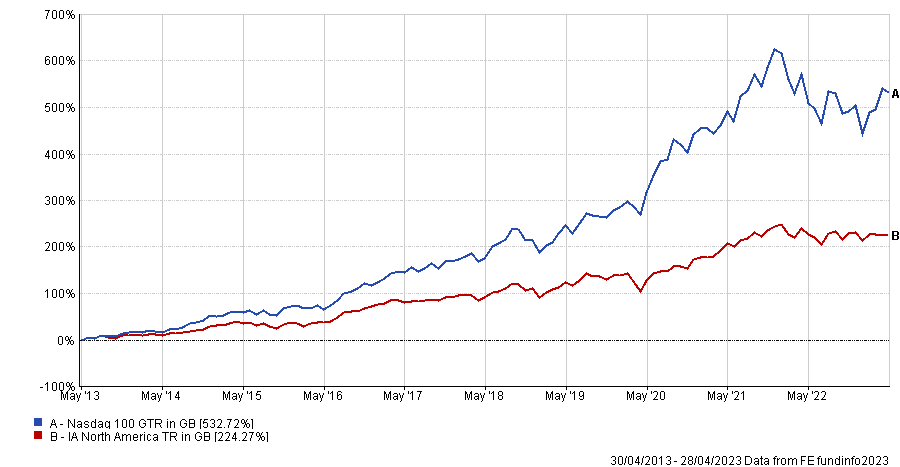

The Invesco EQQQ Nasdaq 100 UCITS ETF and iShares NASDAQ 100 UCITS ETF were two of the most volatile funds in the IA North America sector over the past decade, but each gained a sizable lead on their peers with total returns of 505.5% and 502.4%.

Total return of the Nasdaq 100 vs sector over the past decade

Source: FE Analytics

More than half of the index (55.2%) is dominated by technology companies and, while this did make it a volatile holding over the past decade, investors with a higher risk appetite were ultimately rewarded with above average returns.