Funds with an environmental, social and governance (ESG) investment approach lagged their conventional peers in 2025 although some managed to generate decent returns, FE fundinfo data shows.

Having previously been one of the hottest areas of the investment industry, ESG funds have fallen out of favour in recent years as higher interest rates and political headwinds hampered returns and put off investors.

This continued in 2025, with figures from global funds network Calastone showing ESG funds benefited from a small net inflow in 2025’s opening quarter but were hit with redemptions over the rest of the year.

After taking in £31m in the first quarter, these strategies shed a £755m in the second quarter, another £1.7bn in the third quarter and £1.4bn in October and November. December’s flow figures are yet to be published.

FinXL shows there are 1,120 funds in the Investment Association that describe their investment focus as ‘ethical/sustainable’, which is 20.4% of the 5,483 funds in the whole IA universe.

The average return in 2025 among these ethical/sustainable strategies was 10.3%, compared with 12.2% from their average conventional peer – an underperformance of 1.9 percentage points.

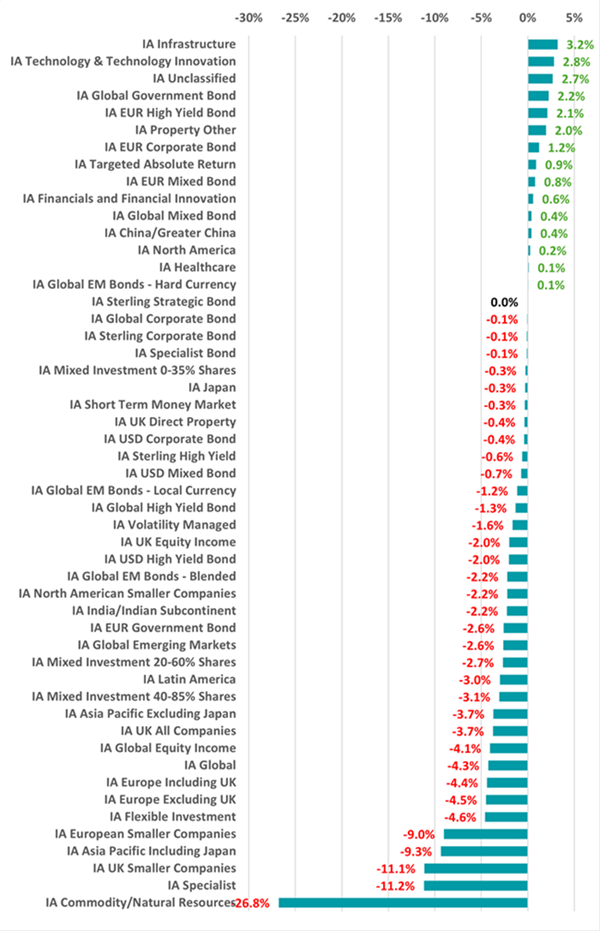

Indeed, the average ethical/sustainable fund outperformed the conventional strategy in just 16 peer groups. As can be seen below, these sectors included IA Infrastructure, IA Technology & Technology Innovation, IA North America and IA Healthcare.

Relative performance of ethical/sustainable funds vs conventional funds in 2025

Source: FinXL. Difference between 2025 total return, in sterling, of average ethical/sustainable and conventional funds between 1 Jan and 31 Dec 2025.

There are several reasons behind this. ESG funds typically overweight technology, healthcare and consumer-facing growth companies while underweighting or excluding traditional energy, defence, materials and commodities sectors.

While this helped ethical/sustainable strategies to outperform in areas such as the tech and healthcare sectors, it acted as a headwind in broader categories when industries such as defence and commodities made some of the year’s highest returns as these funds were unable to take exposure to them.

There were also some political headwinds for ESG investing, largely due to Donald Trump returning to the White House at the start of the year. The Trump administration withdrew the US from the Paris Agreement for the second time, eliminated diversity, equity and inclusion (DEI) programmes through executive order and created new legal risks for asset managers promoting ESG credentials, all of which caused some companies to retreat from previously stated ESG commitments.

Ida Kassa Johannesen, head of commercial ESG and education at Saxo Bank, said at the time: “Policies that undermine ESG principles can affect investor confidence in companies that prioritise sustainability. These companies might find themselves at a competitive disadvantage compared to those benefiting from deregulation and lower compliance costs.

“Consequently, they might experience poor performances, which could in turn reduce the performance of ESG-focused funds and decrease the demand for these funds and the companies they invest in, ultimately slowing the growth of ESG investments.”

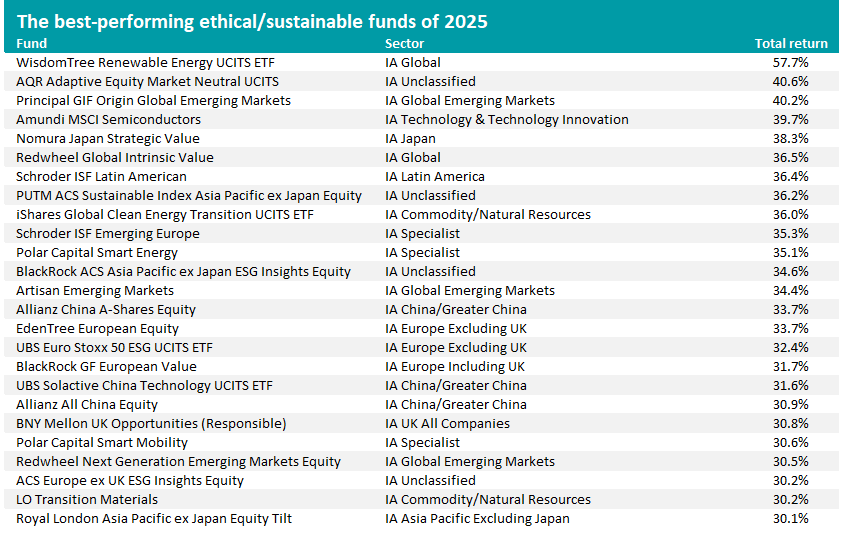

When it comes to the performance of individual ethical/sustainable funds, the best performance of 2025 came from WisdomTree Renewable Energy UCITS ETF with a total return of 57.7%. This made it the 32nd best performer in the whole Investment Association universe.

As its name suggests, the fund invests in companies in the renewable energy value chain, including wind, solar and hydrogen. The rise of artificial intelligence (AI) has increased energy demand, boosting investor sentiment on the sector in general, while industrial hydrogen applications have started to mature after years of hype, benefiting that specific area.

Source: FinXL. Total return in sterling between 1 Jan and 31 Dec 2025.

The table above shows the top 25 funds that are flagged as having an ethical/sustainable investment focus. Only a handful – such as WisdomTree Renewable Energy UCITS ETF, PUTM ACS Sustainable Index Asia Pacific ex Japan Equity, iShares Global Clean Energy Transition UCITS ETF, BNY Mellon UK Opportunities (Responsible) or BlackRock's ACS Europe ex UK ESG Insights Equity fund – have names that make clear that ESG is part of their approach.

But most of the funds on the list have a non-ethical/sustainable focus – such as emerging markets, semiconductors or value investing – then include ESG principles as a part of their process.

That means it is fairly mixed bag of funds on the table, although a few trends can be seen.

We’ve mentioned energy already. Joining from WisdomTree Renewable Energy UCITS ETF in this theme are the likes of iShares Global Clean Energy Transition UCITS ETF (up 36%) and Polar Capital Smart Energy (35.1%). LO Transition Materials also has some exposure to this theme.

Several funds focus on Europe (EdenTree European Equity, UBS Euro Stoxx 50 ESG UCITS ETF, BlackRock GF European Value). Unlike the US, Europe has remained committed to ESG through regulatory frameworks like the Corporate Sustainability Reporting Directive and the EU Circular Economy Action Plan, which continued to drive capital toward green infrastructure and circular economy innovations.

Emerging markets are another common theme, either through a global emerging market approach (Principal GIF Origin Global Emerging Markets, Artisan Emerging Markets, Redwheel Next Generation Emerging Markets Equity) or more focused portfolio (Schroder ISF Latin American, Allianz China A-Shares Equity, Royal London Asia Pacific ex Japan Equity Tilt).

A number of factors contributed to this, including the general outperformance of emerging markets over developed markets in 2025, the US’ aggressive tariff policies (up to 3,500% on some solar imports) forcing a supply chain shift towards China, India, Vietnam, and Mexico, and China continuing to pursue its decarbonisation goals.