The departure of Liontrust Sustainable Future Corporate Bond’s most senior manager later this year led is not enough to take it off Hargreaves Lansdown’s Wealth List of recommended funds, but has raised some questions going forward, according to Hal Cook , senior investment analyst at Hargreaves Lansdown.

It joined the list March last year and will undergo changes to the management structure as a result of the veteran fund manager’s departure.

At present, Stuart Steven is head of fixed income for sustainability at the firm, so he alone has the deciding vote on any decision making, but any management decisions in future will be a team effort.

When Steven retires in September, the hierarchal structure will be ditched and the remaining managers – Kenny Watson, Aitken Ross and Jack Willis – will make decisions jointly.

Investors might feel sceptical about the fund once Steven leaves and the management structure changes, but there are reasons to be hopeful, according to Cook. “The remaining managers are experienced investors in their own right, particularly Watson.”

Watson is the most senior manager on the fund behind Steven, having joined the fund in October 2013. He is followed by Ross, who has been a co-manager for eight years, and Willis, who has been running the fund for two.

However, the analyst admitted that the “loss of an experienced investor and team leader in Steven does reduce our conviction in the fund”.

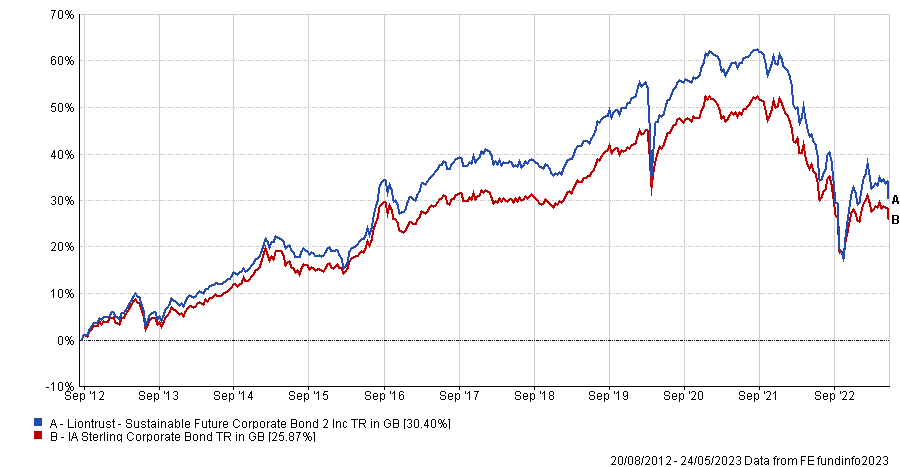

Steven has run the fund since 2012, during which time it has been a top-quartile performer returning 30.4% and beating its peers in the IA Sterling Corporate Bond sector by 4.5 percentage points.

Total return of fund vs sector under Steven’s management

Source: FE Analytics

Analyst at Square Mile Research also recognised risks around Steven’s departure, but said the remaining managers – who have shared industry experience of more than 50 years – are a safe pair of hands.

“We decided to retain the fund's rating as our conviction on the fund is based on the strong resources, longestablished investment process and highly collegiate teambased management approach,” they said.

“The team has been managing funds in this way for many years now and investors can rest assured that this fund does far more than bolt on ESG considerations.”

The same sentiment was echoed by Stevens when he announced his retirement in March, who said his departure won’t impact the running of the fund.

“It is a good time for me to retire given the development and expansion of the fixed income team over the past few years,” he said.

“There is extensive knowledge and experience on the team. For investors, there is continuation in both the same managers being responsible for the funds and using the same investment process.”

Cook added that Steven’s successors should uphold the strategy, especially given that Ross and Willis have spent their entire professional careers at the firm.

“They came through the graduate program, so as investors, are very aligned with the strategy and the sustainable mandate it adheres to,” he said.