The elevated volatility in markets since the start of the year has created both risks and opportunities for investors, according to analysts at Vanguard.

While the banking stress, further rate hikes and tighter credit conditions might be reasons for concern, the probability of a recession has been moved further back into the future, according to the portfolio solutions team, as core aspects of the economy (including consumption and the labour market) continue to appear healthy.

Below, Edward Saracino, Bill Puggini and Rob Dziuba look into how investors can tweak their portfolios to capture the most upside going forward.

The first area to consider is investment-grade credit, as rising yields have propped up return expectations for the asset class.

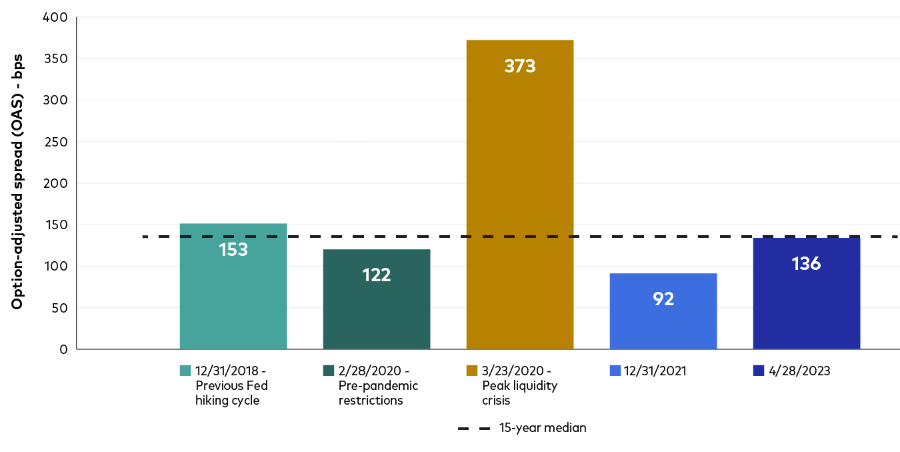

“While corporate investment-grade credit spreads are higher than at the end of 2021, before Federal Reserve rate hikes, they are still near their 15-year medians. As of now, current pricing does not necessarily reflect a recession,” said the team.

“While unique crises drove the two most recent recessions and don’t match what we anticipate going forward, the past four recessions suggest that spreads either widen or stay even relative to the 12 months before a recession begins. This could happen again in the future, but not meaningfully, perhaps 50 basis points higher.”

US investment-grade spreads over time Source Vanguard, Bloomberg

Source Vanguard, Bloomberg

In this scenario, portfolios should find value in maintaining a diversified credit exposure, according to the expert allocators.

It’s possible that investment-grade corporate bonds could underperform US Treasuries in the short-term, should the economy enter a downturn toward the end of 2023 into 2024, but over intermediate and longer periods of time, it’s “reasonable to conclude” that investment-grade credit’s higher yields can produce higher absolute returns, they said.

“The future is hard to predict, but one thing we do know — diversification works. Having a balance of both government and credit in your investment-grade portfolio is our preferred approach,” the team concluded.

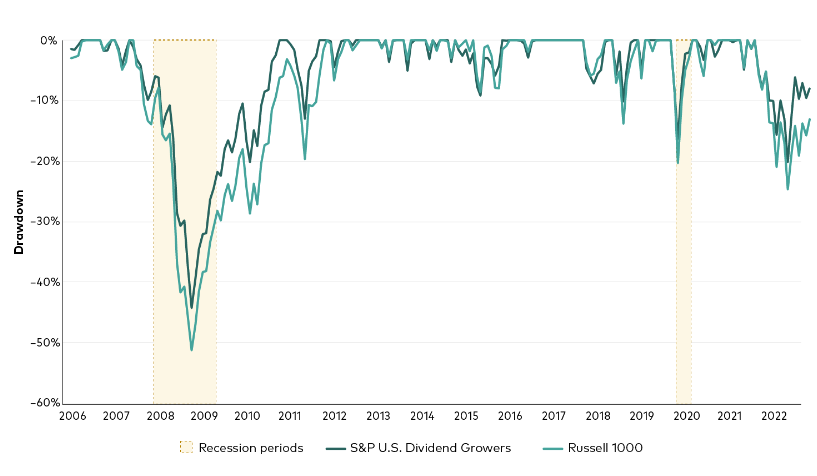

Moving over to equities, the Vanguard team suggested looking at dividend growers, which have been shown to do well in times of equity stress.

Max drawdowns for dividend growers from 2006 to 2022

Source: Vanguard, FactSet

“Dividend growth is a proxy for quality: companies must have sustainable earnings/growth, healthy cash flows/balance sheets, and strong capital management, so it’s not surprising that they have historically outperformed the broad market and done so with lower volatility, typically outperforming on the downside,” the portfolio solutions team said.

“The more you drawdown, the more disproportionate appreciation you need to recover. Down 50%, you have to go up 100% to recover. Down 40%, you only need to go up 66% to recover.”

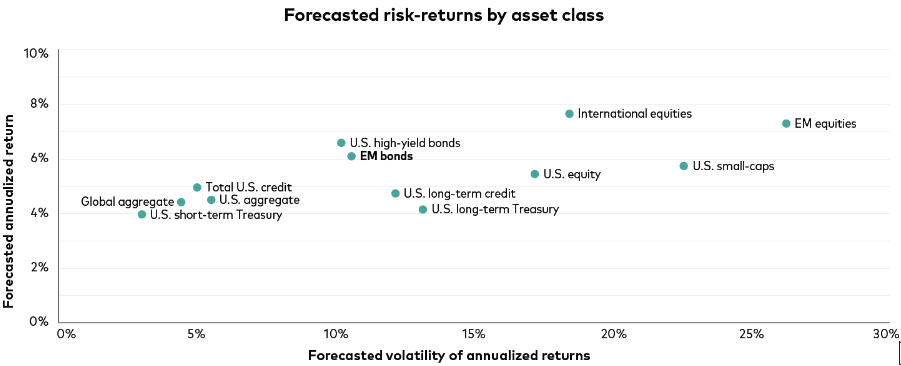

Finally, emerging-market (EM) bonds have an “alluring” potential to diversify a portfolio and boost yields.

“If you’re interested in looking past this cycle of high short-term rates and seek to position bond portfolios for the next couple of years, which could see eventual rate cuts both in the US and abroad, EM debt may offer an intriguing risk-return profile,” the team said.

“One of the key aspects of EM bonds is that the drivers of risk and return are so different from US corporate bonds, because EM bonds are largely government-issued. If sized and risk-managed correctly, they offer strong risk-adjusted returns, especially in relation to US corporate bonds.”

10-year annualised nominal return forecasts by asset class

Source: Vanguard

Investors however should be careful not to outsize their allocation to this asset class, as it can add “significant volatility” to a portfolio.

As of now, the EM debt market has “a significantly larger proportion of more creditworthy countries” than it did years ago, but if still feeling uneasy, investors can consider funding their EM bond allocation from equities rather than fixed income.

Vanguard research found that investors achieved higher Sharpe ratios over time by funding a risky asset like EM bonds from the riskier side of their portfolio.