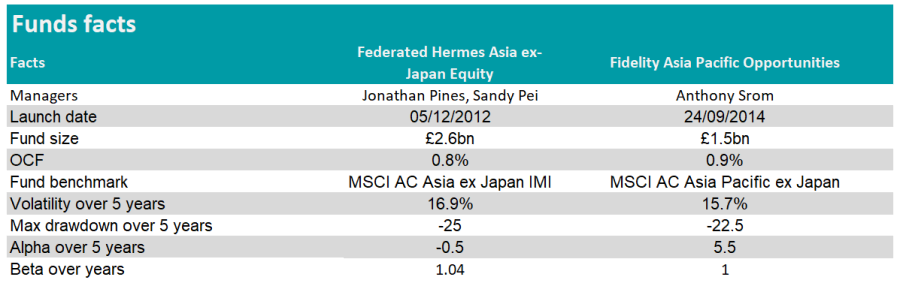

Federated Hermes’ Jonathan Pines recently won the FE fundinfo Alpha Managers Award for the Asia Pacific (ex-Japan) and Global Emerging Markets category, succeeding Fidelity’s Anthony Srom who took home the same prize in 2022.

Both are experienced managers in their field, with Pines having run the Federated Hermes Asia ex-Japan Equity fund since 2012 and Srom managing Fidelity Asia Pacific Opportunities since 2014.

The two funds have done well over the past 10 years as they have outperformed the IA Asia Pacific ex-Japan sector and their respective benchmark, although Fidelity Asia Pacific Opportunities outpaced Federated Hermes Asia ex-Japan Equity.

Performance of funds vs sector and benchmark over 10yrs

Table: FE Analytics

Over five years, the picture is a bit different for the Federated Hermes fund as it has underperformed the sector.

Alena Kosava, head of investment research at AJ Bell, said: “Fidelity managed to deliver higher returns over the last five years, outperforming Hermes and the IA and the index benchmark, albeit with higher volatility.

“Hermes suffered material drawdowns through the Covid pandemic, although drawdowns were more limited in 2022 – being a value strategy it has done relatively well more recently as growth stocks were hit hard through the rate rising cycle in the developed world.”

But everyone knows that past performance is not indicative of future results. With that in mind, Trustnet asked experts which of those two funds would be the best addition to a portfolio.

Source: FE Analytics

Same sector but difference in style

Both funds share a similarity in their contrarian approach to investment.

Gavin Haynes, co-founder of Fairview Investing, said: “The Hermes fund would be deeper value. Jonathan Pines will often be hunting for the most hated stocks in the market, with price being more important than quality.

“The Fidelity fund has a more flexible approach based upon top-down views of the fund manager and where he sees exciting growth opportunities.”

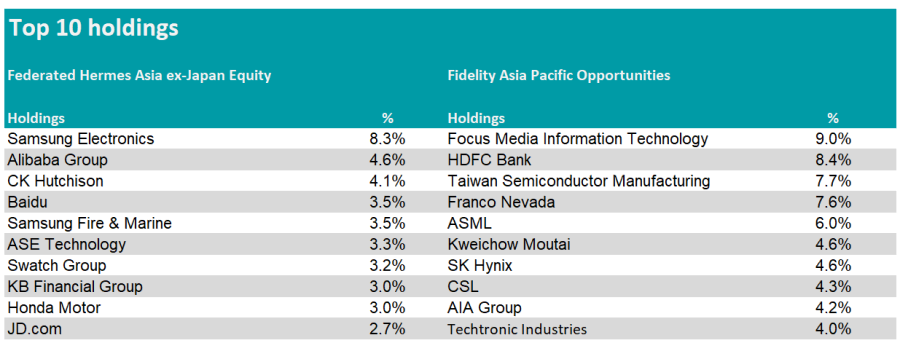

Fidelity Asia Pacific Opportunities is also more concentrated with an upper stock limit of just 35 names and the manager is not afraid to hold positions of 9%+ in his top ideas.

James Yardley, senior research analyst at FundCalibre, warned that it is both a strength and a weakness: “It works great when the manager is right, but you are heavily dependent on him continuing to make the right calls. Any mistakes could result in material underperformance.”

Source: FE Analytics

In terms of regional exposure, Federated Hermes Asia ex-Japan Equity carries significant over- and underweights. For instance, it has a strong tilt toward China and South Korea but no exposure to Australia compared to the broader market.

Kosava said: “Federated Hermes has a bias towards China with c.36% of the fund allocated here – this is c.7% ahead of the index and some 15% higher exposure relative to Fidelity, which carries an 8% underweight relative to the broader market.”

In comparison, the Fidelity fund is more neutral in terms of geographies but takes off-benchmark positions such as Canada and the Netherlands.

Haynes also pointed at both funds’ underweight to India, although Fidelity Asia Pacific Opportunities has an 8% allocation to the country.

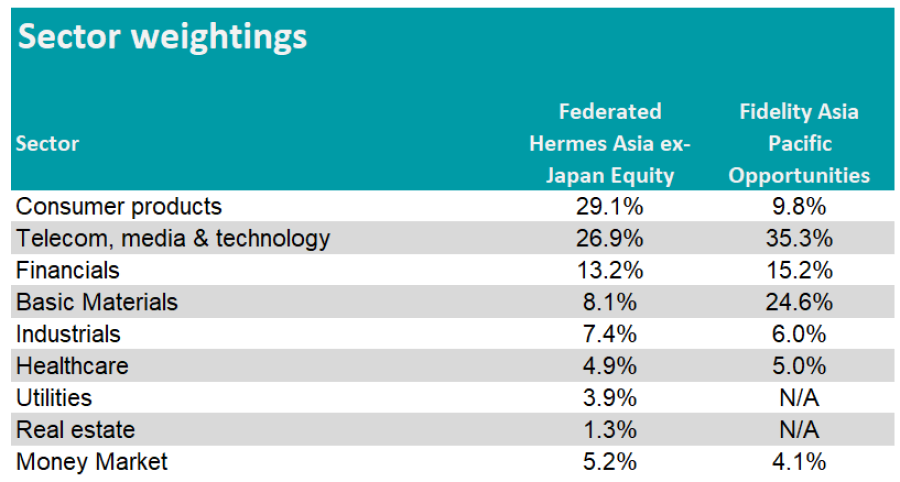

He said: “I believe that India has exciting long-term growth prospects. However, it is structurally a more expensive market and due to the deeper value approach of Hermes, there is little India exposure.

“Although underweight, the Fidelity fund has a material weighting, with Srom prepared to pay up for exciting growth. I think is important to have some India in a broad Asia fund, so this makes me believe that the Fidelity fund has an edge going forward.”

Sector weightings

Source: FE Analytics

Verdict

When asked to choose between one of the two funds, experts showed a slight preference for Fidelity Asia Pacific Opportunities.

Rob Morgan, chief analyst at Charles Stanley, said: “Although it is a close call, I prefer the higher active share and conviction of the Fidelity fund in terms of being able to add value for investors.

“The manager has shown a high level of stock picking skill across different regions over the longer term and Fidelity has a very strong analyst resource in the region.”

Fundcalibre’s Yardley also leaned toward the Fidelity’s fund, despite finding both funds “excellent”.

He said: “The Fidelity fund has been more consistent and we think it adapts better to different markets.

“The Federated Hermes fund has an outstanding long-term track record, but alpha generation has been a bit weaker in recent years – although I should add the fund has recovered well recently, aided by a style tailwind. We still think it's an excellent fund, we just slightly prefer the Fidelity one at the moment.”

Haynes did not have any preference and said it would depend on the top-down outlook for Asia which is uncertain at the moment. However, he added that the Federated Hermes fund would be better positioned if the post-Covid recovery in China can be sustained, as the Fidelity fund has a slightly less conviction in the China story.

Kosava added that both funds would be a good pairing.

She said: “Perhaps allocating this alongside a more core and/or growth option could work well – having both funds would work well as the overlap is relatively low and so is the correlation (0.8 is relatively low considering it’s the same asset class) between the two funds over time. “