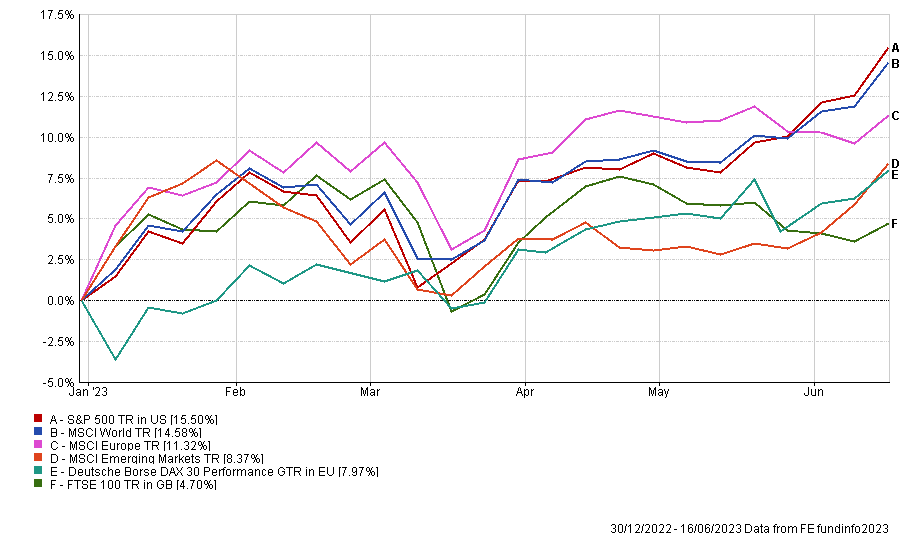

Few investors were expecting Europe to perform at the beginning of the year, as the continent was a risk of an energy crisis. Yet, the winter was relatively mild and as energy price came down European stocks have done well.

For instance, the MSCI Europe index outperformed global and US indices until mid-May when they claimed back their rank, boosted by the AI rally.

While not as transcendent as the MSCI Europe, the German index also had a good start this year, even beating the S&P 500 in March.

Performance of indices YTD

Source: FE Analytics

Having a specific allocation in Germany is not very common and there are very few active funds dedicated to the German market in the Investment Association (IA) universe.

Barings German Growth Trust, in the IA Specialist sector, is one of those few funds offering investors a specific exposure to the largest economy in Europe. Over 10 years, it has done better than its benchmark, the HDAX, which includes the 110 largest German equities. However, it has also outperformed the MSCI Europe over the same period.

Below, manager Robert Smith explains why European and German indices have been doing well this year and warns that the energy crisis in Europe is not over.

Performance of fund vs benchmark and MSCI Europe over 10yrs

Source: FE Analytics

Could you explain your investment process?

The German market is dominated by a handful of massive businesses. So the way to generate alpha is to have a concentration on mid- and small-caps and you want global franchises in niche markets. The fund is still going to be predominantly large-cap because so much of the benchmark index is made up of these handful of mega-cap stocks and you need them for liquidity, but you generate your alpha from owning the mid- and small-caps.

We monitor all the firms’ announcements on a daily basis. One of the key things you want to look at, which is often triggered by those announcements, is positive earnings-per-share revisions, because it's a factor that works more often than not in the German market.

Get those things correct and over a medium to longer term period you should have outperformance.

Why should investors have a specific allocation to Germany in their portfolio?

The investment argument is that Germany is at the heart of Europe. My suggestion is to have an investment exposure to the heart of Europe and then to allocate to a wider European fund.

You can either have the German holding as a satellite holding to your wider European exposure or alternatively the other way around.

I would say the reason to have the German fund as core and the wider European exposure as satellite is because there are so many world class leading businesses coming out of Germany.

What are the characteristics of the German market?

It is dominated by a handful of mega-cap stocks but there's a long tail of mid- and small-caps. Often, they're still global franchises and they will concentrate in niche areas of the market where there's less competition and may become sort of global specialists.

The other characteristic is that German firms usually have strong balance sheets. There's a lot less of leveraging up and willingness to do acquisitions with cash resulting in massively leveraged balance sheets. They don't like doing that in Germany, that's not in their psyche. It is much more about organic growth or if there is an acquisition, they will often use equities as a currency.

How different is it from the UK market?

There's no oil & gas businesses in Germany, while you’ve got BP and Shell in the UK. There's no mining firms either, while in the UK you’ve got Anglo American, Glencore or Rio Tinto.

The other way around, Germans have car manufacturers. In the UK, the only one that’s quoted is Aston Martin, which is a bit of a special situation, high-end manufacturer. There's none of the mass market automotive businesses, whereas in Germany you've got Mercedes, Volkswagen and BMW.

The DAX index has been performing well since the beginning of the year. How do you explain it?

I think that is a case of over-bearishness at the start of the year. Then all the way up to the beginning of June, you've seen the gas price comes down and people have been extrapolating that the crisis is over, that inflation, company and energy costs will be coming down. Therefore, outlooks got to be better than expected and money's been going into equities in Europe as a result.

In Germany, it’s been driven by those big mega-cap businesses. In actual fact, small- and mid-caps have been underperforming this year.

What macroeconomic factors worries you the most at the moment?

It's whether the next winter is going to be a particularly harsh winter or not. The only reason Europe managed to get through the last winter was because it was particularly mild. Gas storage capacity is still nowhere near what it needs to be to cover a particularly harsh winter.

The problem with that is that it is impossible to predict at the moment. If the winter is particularly harsh, the gas price will go through the roof again. Inflation will be checked up again, unless it's all thrown back on the taxpayers by the government subsidising everyone with their utility bills. Either way, it is not going to be very palatable.

There's another element as well. Coming into this year, most corporates still have got bulging order books. But by the same token, you're coming into quite a dramatic slowdown because of the high interest rates. So the question is, will the order books run out before the interest rates start to turn down and demand picks up again?

It is very difficult to come out with an accurate outlook for the next 12 months when there are two big uncertainties.

How difficult is it to apply environmental, social and governance (ESG) criteria in the German market?

It's fairly easy to implement. A lot of the German businesses have been at the forefront of recycling, cutting emissions and doing more with less long before ESG became fashionable. It is largely because doing more with less is the best way to cut costs. They've been doing that for years. It's obviously become more formalised and everyone has to produce reports about it, but again, these guys have been very much on the front foot in that respect.

Where Germany is partially backward, it is probably on the governance side, especially in the small-cap end of the market. There's still large family stakes in those firms and that tends to mean that there's a lot less independence on the boards.

How did you get into German equities?

I was originally an equity analyst with a particular focus on autos and industrial firms at Barings. That included all the big chemical as well as the machinery businesses, such as Siemens and things like that. So, I actually knew a fair chunk of the German market as an analyst.

At the time my predecessor resigned, I was running the UK mid-cap fund at Barings. I was sort of an obvious replacement for him and I had proven I could run a fund. I already got all this pre-existing knowledge of the German market. That's how it came about.

What do you do outside of fund management?

I'm still bringing up two kids, so I don't know much time for anything else.

I play table tennis. That's my top side-line.

If you want to relate that to something else, Warren Buffett is actually into table tennis.