Many funds cater to investors with specific goals, but some strategies appeal to those of all time horizons.

For example, low-risk trusts typically appeal to older investor nearing retirement, while high-growth portfolios can work better for those with a longer time horizon.

However, some trusts can be a core holding for all investors regardless of their individual needs. Here, Trustnet asked five expert fund pickers for the trusts that investors can buy and hold for a lifetime.

Alliance Trust

Two of the experts Trustnet spoke to said Alliance Trust would make a strong core position in any investor’s portfolio, regardless of their own risk tolerance or time horizon.

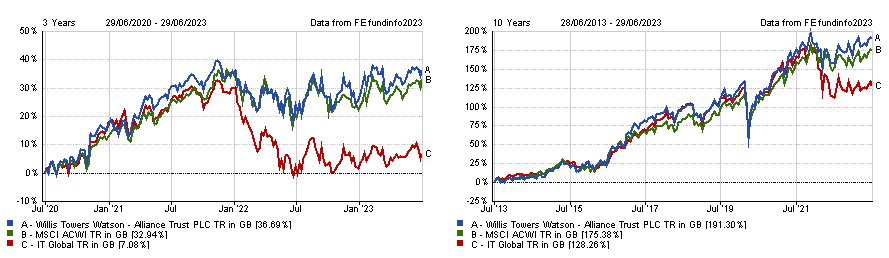

The £2.9bn investment trust has almost tripled investor’s capital over the past decade, with soaring 191.3% and beating its peers in the IT Global sector by 63 percentage points.

Thomas McMahon, investment trust research manager at Kepler, pointed out that its “sophisticated and professional” approach helped it outperform on the short term too, despite volatile market conditions negatively impacting most global equities.

Alliance Trust has returned five times more than other IT Global trusts in the past three years, which were characterised by challenging hurdles such as high inflation and rising interest rates.

Total return of trust vs benchmark and sector over the past three and 10 years

Source: FE Analytics

McMahon said: “The neutral stylistic exposure to global equity markets leaves investors less exposed to the macro factors driving short-term market returns which has proven valuable in a period of heightened volatility.

“We think the persistent volatility across financial markets should continue to create opportunities for the stock-picking expertise of Alliance Trust’s delegate managers to add value, whilst the diversification may provide some downside protection over the longer term.”

The portfolio is divided up between nine different management groups who each have their own investment style, which has led to some truly diversified exposure, according to James Carthew, head of investment company research at QuotedData.

Each manager is given a concentrated allocation of 20 positions that they can fill with their top stocks, with Rajiv Jain, Brian Kersmanc and Sudarshan Murthy of GQG Partners managing the largest portion (20%) of the trust.

Source: Willis Towers Watson

Carthew said: “Alliance Trust has a multi-manager style that gives it exposure to the best ideas of leading global investment managers.

“There is no strong bias to value or growth and therefore it hasn’t been dented by the dramatic swings in sentiment that we have seen in markets over the past few years.”

He also note that its “attractive and growing” dividend – which currently stands at 2.4% – is another of the trust’s main appeals.

Indeed, Alliance Trust has one of the longest track records for dividend growth among the AIC’s dividend heroes, having increased pay-outs for the past 56 consecutive years.

City of London

The City of London Investment Trust is another of the four dividend heroes to have grown its pay-outs for the past 56 years.

However, this £2bn trust has an even higher yield of 5.1%, perhaps due to its focus on high-paying companies in the UK. Top 10 positions include large-cap companies with a hefty yield such as Shell, BP and British American Tobacco.

This high and consistent dividend is one of the reasons why Darius McDermott, managing director of FundCalibre, chose City of London as his trust for all investor’s to hold as a core position.

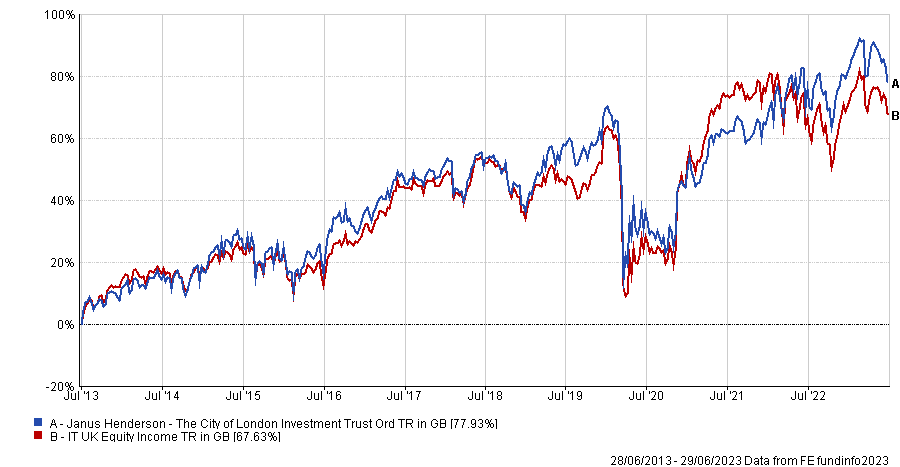

Not only has it delivered strong income growth, but the trust also performed well on capital growth over the long term.

City of London made a total return of 77.9% over the past decade, beating the IT UK Equity Income sector by 10.3 percentage points.

Total return of trust vs sector over the past 10 years

Source: FE Analytics

Manager Job Curtis has been running the fund for over 30 years now (during which time the fund is up 616.9%) and his expertise in the field is one of the main appeals for McDermott.

“His thorough research process and conservative approach to stock selection have generated steady returns over a long time, and maintaining dividend income is of the utmost importance to the board,” he said.

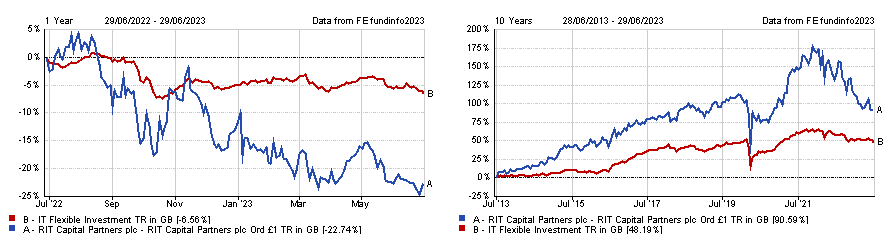

RIT Capital Partners

Alternatively, Numis director Ewan Lovett-Turner said that investors might want to consider RIT Capital Partners as a trust they can hold on to for good.

The £2.8bn portfolio made a 90.6% return over the past decade by investing a mixture of private and public assets. Most allocations are skewered towards the former, with 40% of the portfolio invested in private equity funds and assets versus 35% in listed ones.

Recent underperformance (it was down 22.7% over the past year) and fears over private equity holdings have dragged the discount down to 21.4%, but Lovett-Turner said these concerns have been overdone.

Total return of trust vs sector over the past year and 10 years

Source: FE Analytics

“Ultimately, we believe the portfolio will be more resilient than some commentators are expecting,” he explained. “This view is supported by several transactions in the first quarter which have validated valuations of the large private assets.”

Some investors fear the illiquid nature of private equity, but Lovett-Turner said he can see these concerns receding, meaning the current discount could be as an attractive entry point as new buyers will get.

“This discount is an excellent buying opportunity to access a team with a strong track record of delivering a defensive return profile from a differentiated portfolio of hard to access assets,” he said.

“We also see scope for the discount to narrow, from near record wide levels, with the support of buybacks and improved communication from the company. RIT Capital remains a core buy.”

Personal Assets Trust

Shavar Halberstadt, equity research analyst at Winterflood, described Personal Assets Trust as an “an all-weather fund that could be a core holding in many portfolios”.

He said this £1.8bn trust may be a good option for more cautious investors given FE fundinfo Alpha Manager Sebastian Lyon’s recent move away from riskier assets.

Lyon repostioned the portfolio to have a higher weighting towards ‘safe haven’ assets such as gilts (14% of all assets), US treasuries (11%) and gold (11%). He also dropped his exposure to 22% – the lowest it has been since Lyon took over as manager in 2009.

Although short-term performance took a hit from high rates and inflation, the trust delivered a 169.6% return since Lyon’s appointment.

Total return of trust vs benchmark an sector under Lyron’s management

Source: FE Analytics

Despite taking equity exposure down, Halberstadt said the positions he maintained have high growth potential. He said names such as Microsoft, Alphabet and Diageo may appeal to investors who want growth as well as mitigated volatility.

“While Personal Assets Trust is expected to lag in bull markets, it is designed to preserve capital and exhibit significantly lower volatility than either its peers or the index,” Halberstadt added.

“Its zero discount policy substantially eliminates de-rating risk. Therefore, the fund may present a suitable option for a wide range of investors in volatile times.”

| Trust | OCF | Yield |

| Alliance Trust | 0.6% | 2.4% |

| City of London Investment Trust | 0.5% | 5.1% |

| RIT Capital Partners | 2.1% | 2% |

| Personal Assets Trust | 0.7% | 1.2% |

Source: FE Analytics