Whether you are an artificial intelligence (AI) enthusiast or believe it is not worth the hype, there is a chance that you might be wrong in both cases.

Investors have been quick to jump on the AI bandwagon this year, with the likes of software developer Nvidia rocketing 217% over the year so far, while technology stocks around the world have risen.

Yet the jury could still be out on whether we will run out of semiconductors or if robot will be managing your finances in a few years’ time. In reality it is often more nuanced than the majority think.

Someone who might have a better understanding of such nuances is Chris Ford, manager of the £742m Sanlam Global Artificial Intelligence fund. From his perspective, there are many misconceptions around AI, as people both over and underestimate its potential.

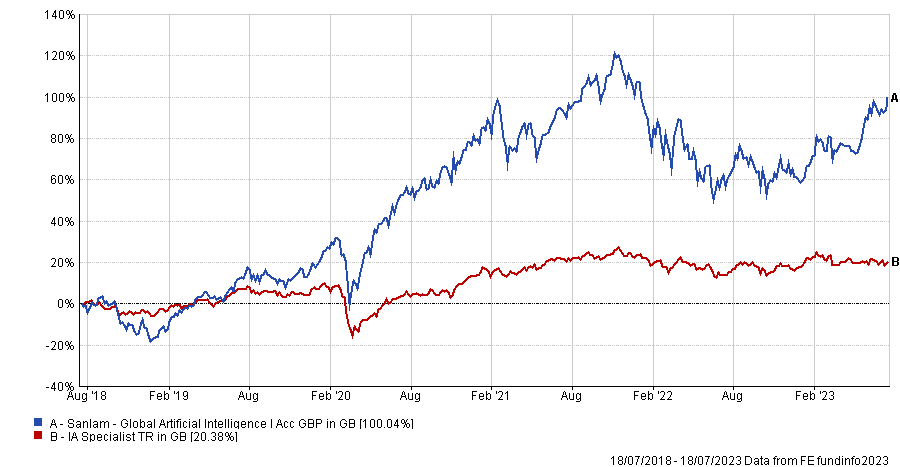

Performance of fund over 5yrs against sector

Source: FE Analytics

“From one side, there is a propensity for people to overestimate the near-term threats that AI pose (not to say that there are none, there are always threats with new technologies). On the other side, they underestimate what AI is capable of delivering, particularly in the fields of healthcare, resource management, transportation and protection of the environment,” he said.

“AI is an amazing tool, but, ultimately, it’s just a tool. Just as you can use a hammer to hit somebody over the head, you can also use it to put a piece of fine art on the gallery wall. What we need is a regulatory framework that enables us to capture all the extraordinary things that AI is already delivering and harvest them and deliver the benefits to society as a whole.”

To exemplify one such use of AI, Ford mentioned its holding in John Deere, which makes up around 3% of the portfolio. From an agricultural machinery manufacturer, the business has pivoted in the direction of data science, beginning with early forays into the world of agronomics about a decade and a half ago and moving to AI in 2019, with the acquisition of Blue River.

Blue River’s technology allowed tractors to remove weeds in a field and at the same time provide just the right amount of fertiliser and irrigation to each individual plants as the machine moves across the field.

“This is a very important consideration today, in a world where water resources are becoming increasingly constrained and fertiliser and weed killer are overused and increasingly regulated. The opportunity to use AI to address these issues was very interesting,” said Ford.

“John Deere had been on my radar for a long period of time, but the point we chose to invest was when it announced that it had launched the world's first fully autonomous tractor.”

While automation might be interesting, it also addresses a pressing business issue in agriculture and elsewhere – the scarcity of human capital. While the discourse often focuses around the jobs that will disappear due to AI, here, Ford turned this argument on its head.

“Are some jobs going to disappear? Yes, absolutely. Some roles are not going to be done by humans anymore. But that of course, has always been the case and every technology evolution has delivered disruption into the human capital markets,” he said.

“But we know that the economy is short of human capital across most of the developed world, particularly so in rural areas where the population continues to urbanise and fewer people want to do manual jobs. With AI, the ability to develop a platform that will allow to offset some of those headwinds is very apparent.”

It's not all just about new machines and driverless tractors, however. Something else was equally crucial to the manager.

“John Deere sells 50% of all agricultural equipment in North America. Their equipment is crawling over half of all the acreage there and collecting data as it goes. John Deere knows more about what farming acreage looks like around the world than anybody else,” he said.

“This information is important for the farmers because it can drive up their yields and profitability, but, crucially for John Deere's business model it means a farmer is far less likely to churn away from John Deere to its competitors, because moving away from its ecosystem would have an immediate detrimental impact on farm economics.”

This, according to Ford, will end with higher margins, more persistent revenues and less churn for the business, driving its stock price higher.

The current AI cycle has brought about a normalisation and broadening of the innovation profile in AI, as well as increased implementation across the board, argued the manager. What is happening at John Deere is being replicated beyond the technology sector in healthcare, financial services, industrials, communication services, consumer discretionary and more.