There was a fall in UK dividends over the second quarter of 2023, a closely watched report reveals, although analysts see some short-term reasons to be positive.

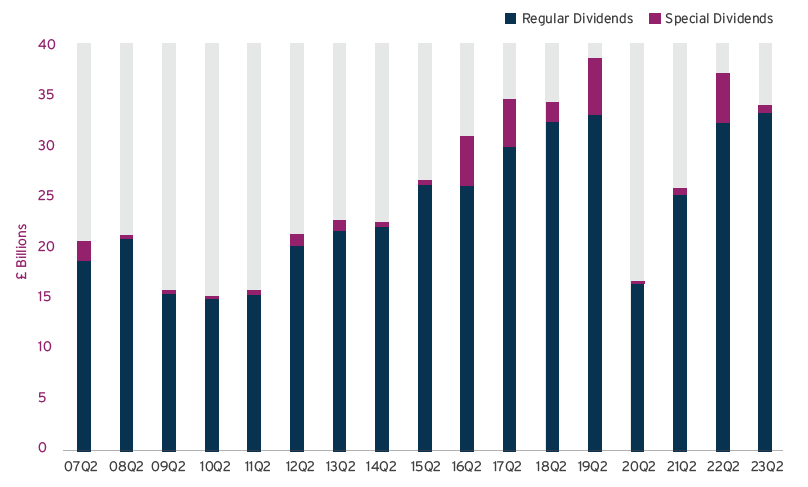

The latest quarterly Dividend Monitor, published by global financial services company Computershare, shows UK dividends fell 9% to £32.8bn on a headline basis in the past three months. This was attributed to lower one-off special dividends, which were down 86% year-on-year.

However, the report added that underlying growth in regular dividends was “encouraging” at 3.5%, amounting to a higher-than-forecast £32.2bn.

UK Q2 dividends

Source: Computershare Dividend Monitor

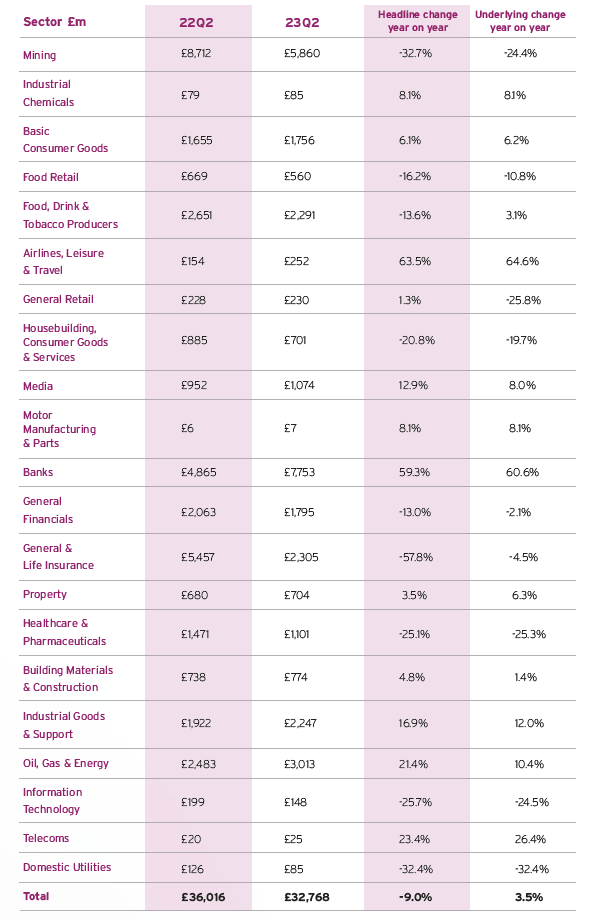

Banks were the biggest contributor to the total, paying out £7.8bn during the quarter on the back of very strong profits. Their dividends were up 61% on an underlying basis.

“HSBC, the largest of them, tripled its profit in the first quarter year-on-year, easily beating analyst expectations. It recently told shareholders that it has substantial capacity for further dividends and share buybacks. HSBC duly paid its first quarterly dividend since before the pandemic in the second quarter and at a much higher rate (10c per share) than had seemed possible even a few months ago,” the Dividend Monitor said.

“Along with the strong performance of the other banks, the sector is therefore comfortably the biggest engine of UK dividend growth in 2023, on track to raise headline payouts by more than £3bn this year.”

The industrials sector also posted encouraging dividend growth during the second quarter, with payouts rising 12% on a headline basis. Companies such as pest and hygiene group Rentokil, packaging producer Smurfit Kappa and car dealership Inchcape were highlighted for their strong growth.

Payouts from the oil sector rose 10% year-on-year on an underlying basis, although this is not as strong as the dividend growth from the sector last year. This is a reflection of the fact that oil prices have moderated more recently.

Dividends from the airlines, leisure & travel sector have been the slowest to make a comeback, owing to the hit the industry took during the Covid lockdowns of 2020 and 2021. The sector’s payouts jumped by two-thirds in the second quarter but this was from a “very low base” and it remains some way off pre-pandemic levels.

The worst performing sector was mining, as miners’ profits have been falling in line with commodity prices. Headline dividends (which are a better marker for cyclical sectors like this one) dropped by one-third, although Computershare pointed out that the sector is still likely to deliver more in dividends this year than any year before 2020.

Q2 dividends by sector (£m)

Source: Computershare Dividend Monitor

Computershare’s Mark Cleland said: “UK companies collectively made record profits last year and have so far proved resilient in the face of interest rates, similar to their international peers, which has provided significant support for dividends and share buybacks.”

The UK's economic outlook has worsened over the past quarter due to persistent inflation that has outpaced market predictions. UK policymakers are willing to risk a potential recession if it leads to inflation coming under control, although this would negatively impact corporate profits, the report added.

Against this backdrop, Computershare expects headline payouts to fall in 2023, down 1.7% to £92.4bn thanks to lower one-off special dividends and negative exchange-rate effects. That said, this is £1bn more than forecast just three months ago, while regular payouts that exclude specials are now on track to reach £88.9bn – equivalent to an underlying increase of 6.1% for the year.

“The dividend outlook has brightened in the short term. Banking profits are soaring as they benefit from higher interest rates, and dividends are following suit,” Cleland finished.

“Outside the banking sector, companies with pricing power are building margins, contributing to inflation but in turn boosting their dividend fire power, and there are still small pockets where dividends are still catching up after cuts made during the pandemic, which is boosting the total paid.”