July was a positive month overall for investors who ignored the ‘sell in May and go away’ adage and kept their money invested through the summer.

On the economic front, the Federal Reserve raised rates again towards the end of the month, but there were reasons for optimism as inflation has steadily come down in the US as well as in the UK, where rising price growth slowed to 7.9%.

However, the key driver in July was China, where the government provided stimulus aimed at increasing domestic consumption, as well as measures to boost the property sector.

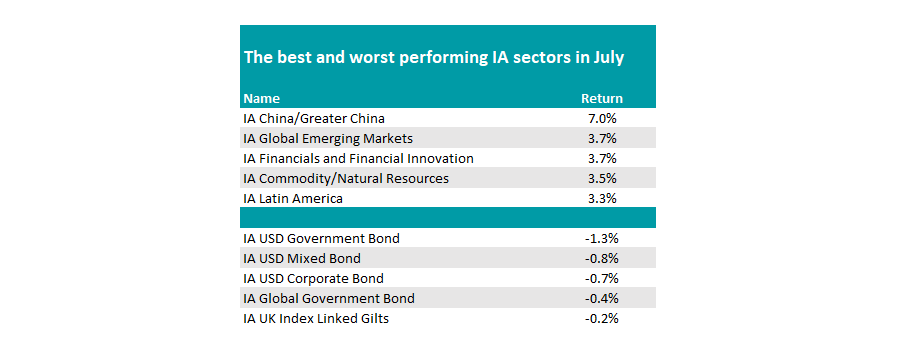

As a result, the IA China/Greater China sector dominated the top of the best returners list, with the sector making an average 7% gain. The news also bolstered the wider IA Global Emerging Markets sector, which was up 3.7%.

Source: FE Analytics

IA Commodity/Natural Resources also was on the rise (up 3.5%), as was the commodity-heavy IA Latin America sector (3.3%) as gold broke through $2,000 per ounce. Over the month the price of an ounce of gold rose $80 to finish at $2,009.

At the foot of the table were fixed income specialists and, in particular, those denominated in dollars. The US currency fell against the euro, yen and pound, although the bottom sectors only made small losses, as the above table shows.

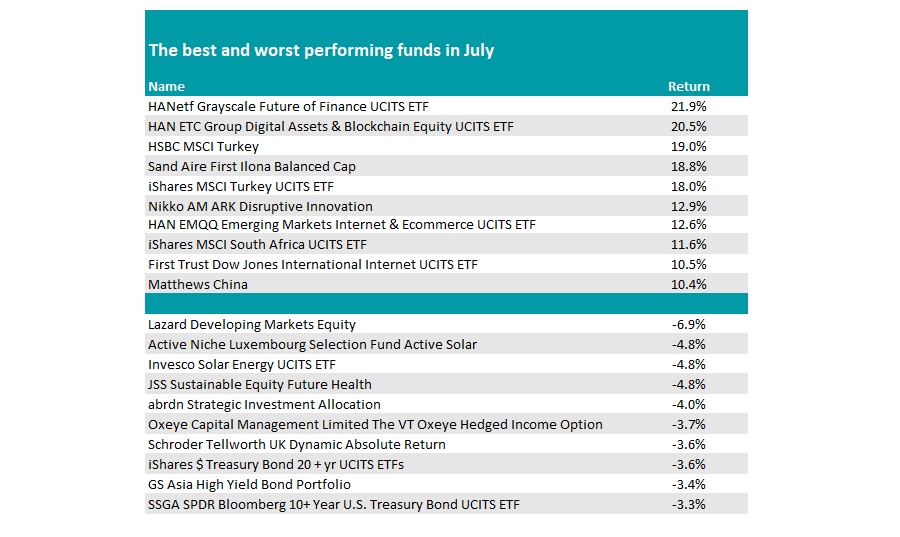

Turning to individual funds, the top of the list is a mixture, with HANetf Grayscale Future of Finance UCITS ETF coming out in the lead with a gain of 21.9%.

It was joined by HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF, which made 20.5%, as anything tech and growth-related continued to perform well.

Indeed, Nikko AM ARK Disruptive Innovation – the portfolio run by high-growth investor Cathie Wood – also made the list, up 12.9%.

Source: FE Analytics

At the bottom end of the top 10 was Matthews China, which spearheaded a number of China funds in the 10-20 range.

Ben Yearsley, director at Fairview Investing, said: “The standout gains were in the Far East in July on the back of stimulus hopes in China. The Hang Seng rose over 7% and MSCI Emerging Markets also rose strongly.

“China dominated July. Asian specialist Matthews took top spot [among the China funds] gaining 10.4%. The dominance continued outside the top 10 with only a few anomalies interspersed with China funds in the top 30 or so best performing funds.”

At the foot of the table, Lazard Developing Markets Equity made the biggest loss of the month, down 6.9%. while there were also losses for solar energy specialists as well as bond portfolios.

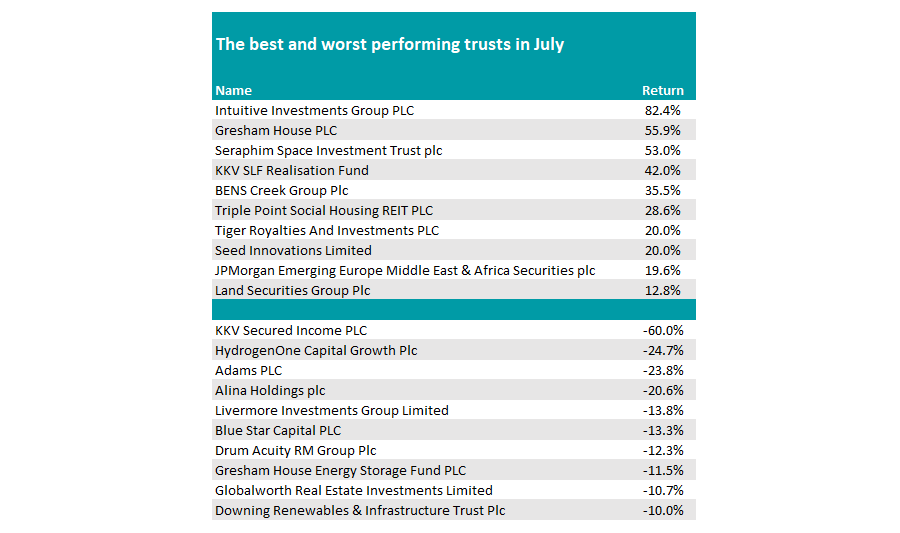

Across to the investment trust space, IT Growth Capital was the best performing sector, up 13.9%, followed by IT China/Greater China, which gained 10.5%.

Conversely, IT Royalties made the biggest loss, down 3.3%, while renewable energy specialist debt sectors also struggled.

For the best and worst individual trusts, “it was the usual esoteric mix at the top of the tables”, said Yearsley. Intuitive Investments Group took top spot, up 82.4% for the month after City veteran Nigel Rudd was announced as chairman.

Source: FE Analytics

Gresham House PLC was next on the list, up 55.9%, while Seraphim Space Investment Trust rose 53%, explaining the top billing for the IT Growth Capital sector. The trust rocketed after it revealed a plan to buy back its shares, as the discount had been as high as 72%.

At the other end of the scale, KKV Secured Income PLC was the worst performer, down 60% over the course of the month, followed by HydrogenOne Capital Growth Plc (24.7%) and Adams PLC (23.