Investors can tend to stick with names they know, looking at large-cap companies with recognisable brands. But Daniel Lockyer, senior fund manager at Hawksmoor Fund Managers, has a preference for multi-cap funds, arguing they have a broader investable universe with more opportunities to pick from, which should result in better performance.

He is also a fan of dedicated small-cap strategies, as these stocks are the unheralded names of the future. Indeed, Hawksmoor Investment Management holds several multi-cap and small-cap funds across its different portfolios. This is particularly visible in the top 10 holdings of its MI Hawksmoor Global Opportunities fund, with half having either a multi-cap or a small-cap mandate.

Lockyer said: “We believe there is an opportunity in smaller businesses that have been unintended victims of the huge surge of flows into passive strategies that are forced to own the largest and most liquid assets, and regulatory pressures on active funds to have liquid portfolios.

“That has created very cheaply rated businesses, attracting attention from multi-cap managers and potential M&A targets. This is why our portfolio is biased towards small-caps across multiple regions, not just UK, albeit that is where the bulk of our equity allocation is held.”

Below, Lockyer tells about three multi-cap and small-cap funds investing outside of the UK that Hawksmoor finds particularly interesting.

For the US, he picked VT De Lisle America, which Hawksmoor has owned for a couple of years. The fund distinguishes itself from other US equity funds by its contrarian focus on lowly valued businesses (trading on single digit price-to-earnings (P/E) ratios). Given the dominance of the S&P500 – and in particular tech names – this tends to lead it towards small-caps, which are more oriented toward the domestic economy.

Lockyer said: “The mandate is multi-cap but the opportunity was, and still is, in the smaller companies part of the market.

“The manager, Richard De Lisle has been managing US equity mandates for over 40 years so his opinion on the value on offer within that area of the market should not be ignored.”

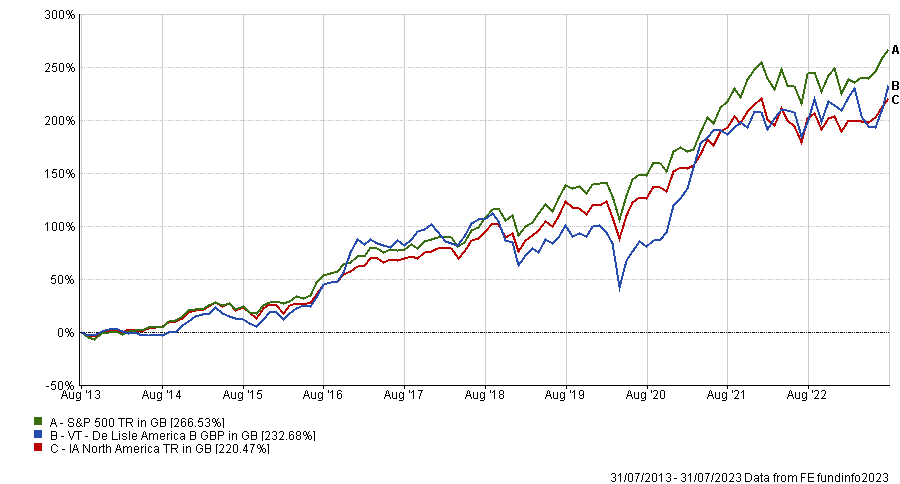

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

In spite of its small-cap bias, the fund uses the S&P 500 as a comparator. It is also part of the IA North America sector, whereas US small-cap funds would typically be constituents of the IA North American Smaller Companies sector.

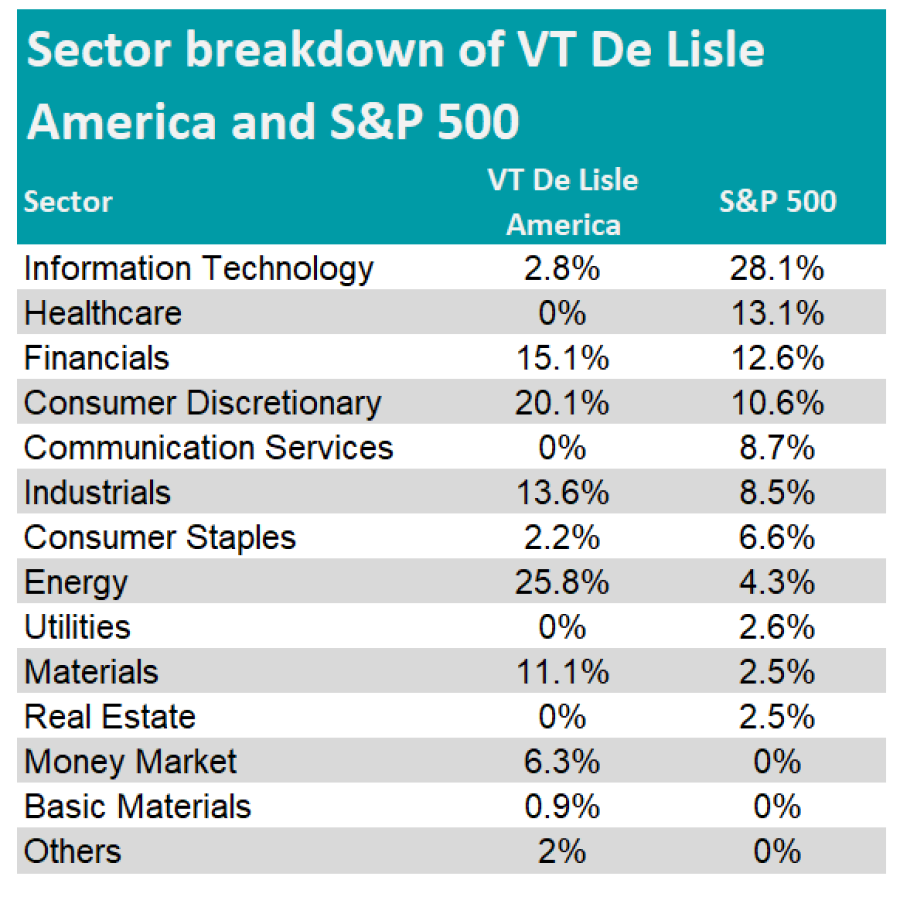

The fund differs greatly from the S&P 500 in terms of sector exposure, with large overweights in energy, consumer discretionary and materials, but a significant underweight in information technology.

Source: FE Analytics, S&P

The fund sits in the third quartile of its sector over 10 years in a period where the US market has been driven by tech stocks. Yet, the fund has achieved top-quartile performance over more recent periods.

In addition to the US, Lockyer finds the prospects of Japan interesting, where the improving corporate governance theme should benefit small-caps.

He said: “This is where balance sheets are least efficient with loads of cash (held for a rainy day) leading to poor returns for shareholders.

“There are plenty of catalysts for value to be realised with listing rules changing to hold businesses to account and improve returns or face shameful expulsion from the index.”

To play this theme, Hawksmoor likes M&G Japan Smaller Companies and Polar Capital Japan Value.

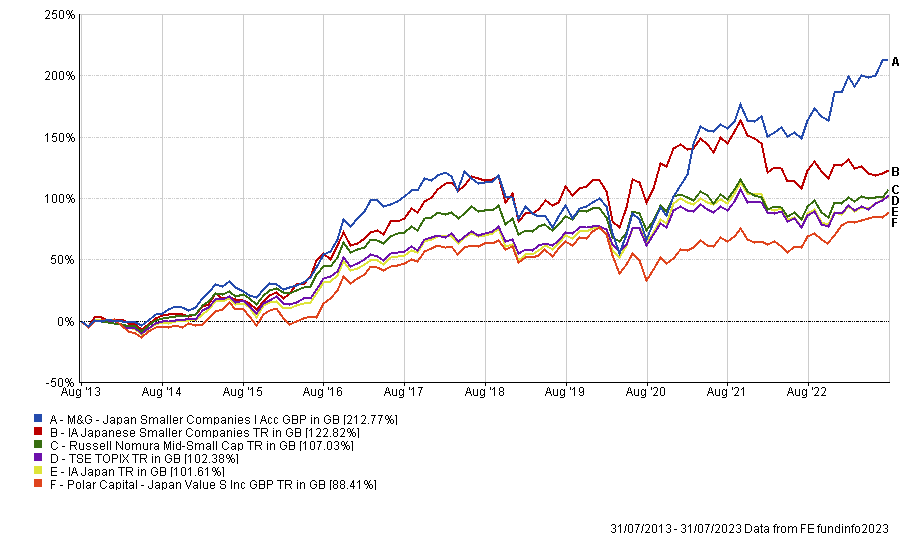

Performance of funds over 10yrs vs sectors and benchmarks

Source: FE Analytics

M&G Japan Smaller Companies is part of the IA Japan Smaller Companies sector. The manager, Carl Vine, is a stock picker seeking undervalued businesses and will usually hold fewer than 50 companies.

While categorised as a small-cap fund, it also holds a few large-cap names such as car manufacturer Honda Motor or tech firm NEC.

The fund has been the best performer among the seven constituents of the IA Japan Smaller Companies sector over different periods.

Unlike the M&G fund, Polar Capital Japan Value is considered a large-cap fund and is as such part of the IA Japan sector. The managers, Gerard Cawley and Chris Smith, apply a multi-cap and value approach to stock picking and will typically hold 45 to 55 stocks.

Over 10 years, the fund sits in the bottom quartile of its sector, but performance has improved in more recent periods, with the fund achieving top-quartile performance over three years and one year.