When times are uncertain, it is important investors put their money on the right horses and invest in businesses that are diversified enough to profit from whichever scenario will result once the insecurities fade.

While central banks have so far been able to lower inflation without crashing the economy, experts don’t seem to think we are out of the woods yet.

Potential sources of turbulence include, for example, inflationary pressure from food and energy prices and a faltering Chinese economy.

Any outcome is far from certain, said Derren Nathan, head of equity research at Hargreaves Lansdown who highlighted companies with a wide enough moat to benefit in most scenarios going forward.

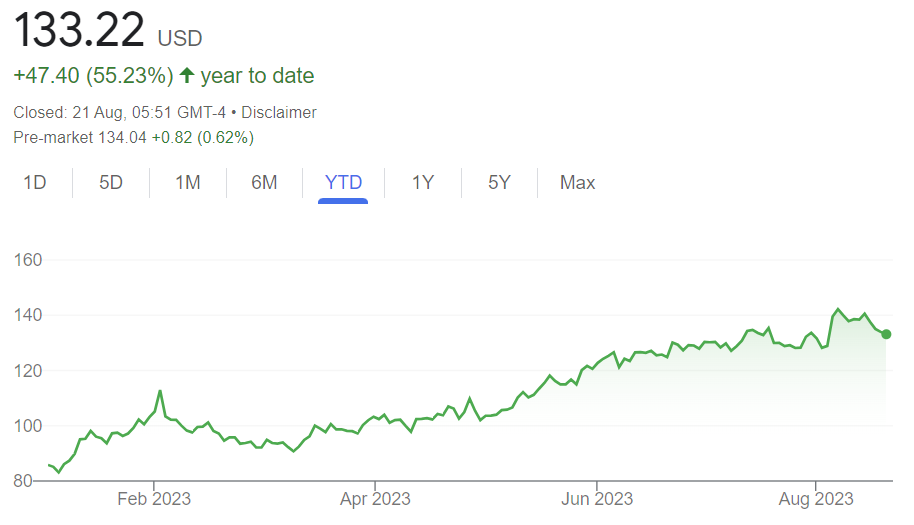

First up is Amazon, which, Nathan noted, isn’t just a box shifter that delivers parcels to our doors. It is mostly appreciated for (and it generates most of its profits from) its cloud business, and has also been carving a market share in the artificial intelligence (AI) space – which is why it has caught investors’ attention this year and should profit from a soft-landing scenario.

Performance of stock over the year to date

Source: Google Finance

“Amazon's riding high on hopes that the huge levels of investment currently being ploughed into AI, will remain a longer-term megatrend. The surge in AI interest is an exciting opportunity for the world's biggest cloud platform, and management is pushing hard for the company to expand its offering in the space,” ” said Nathan.

“We think this division is a prime candidate to benefit if the US economy manages to avoid a recession. With a price to earnings multiple of 50x, however, it faces extra pressure to deliver growth.”

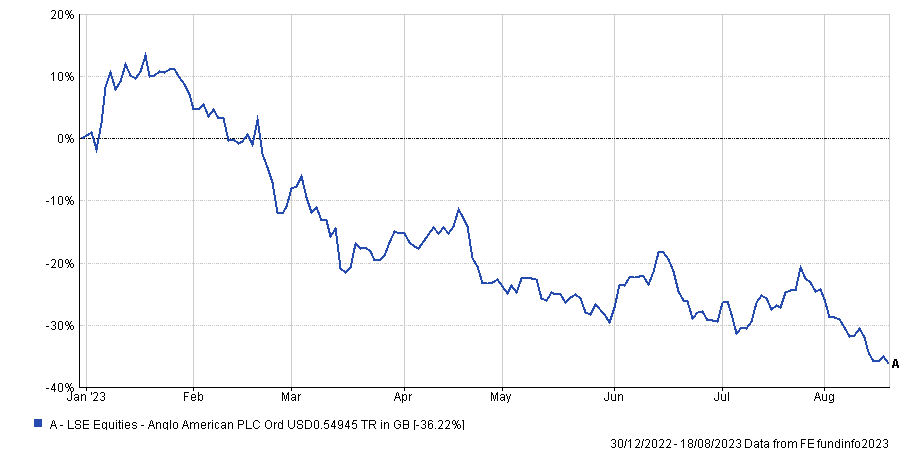

The second pick is UK miner Anglo American, which is seen in a pessimistic light by investors for different reasons, the latest being a weak Chinese economy, which could create further headwinds for industrial commodities like iron ore and coal.

However, it should still deliver results, according to Nathan, who praised its diversification.

Performance of stock over the year to date

Source: FE Analytics

“Anglo has plenty of other strings to its bow. Its Quellaveco copper mine is starting to deliver and we're supportive of growing the profile in metals that support the energy transition such as copper,” he said.

“We're also excited about the potential for the Woodsmith project [a new polyhalite fertiliser mine being developed in the North East of England], which could give a fresh avenue into crop nutrients, an area that could be a driver towards strong long-term growth.”

The stock hasn't escaped the recent sell-off in the sector after the profits of 2021, when commodity prices rocketed, which has prompted it to announce a significant step up in production over the second half of this year.

“That offers opportunity, but also the potential for uncertainty and volatility if increased output doesn't materialise.”

Finally, US oil field services company Baker Hughes has an ace up its sleeve should it need to mitigate possible dips in oil prices.

Performance of stock over the year to date

Source: Google Finance

“The oil field service side of the business generated 20% revenue growth in the second quarter of the year, driven by a strong uptick in offshore activity by oil and gas companies,” noted Nathan.

“If oil prices continue to strengthen, this trend could accelerate. However, it did note some headwinds in North America and we are mindful the ongoing slowdown in activity in areas such as Texas and the Permian basin is a risk.”

For this reason, it is key that the company diversifies with its industrial & energy technology division – a “growth opportunity” which enjoyed even faster growth, benefiting from “strong momentum” in new energy technologies such as hydrogen and blue ammonia.

“Baker Hughes has been growing earnings faster than its similar-sized competitors and would appear well placed to continue this trend. That's attracted a valuation towards the top of the pack, so there's little room for disappointment,” concluded Nathan.