The ability to borrow money is one of the weapon in an investment trust’s arsenal. In many cases, it has contributed towards the outperformance of investment trusts relative to their equivalent open-ended versions, as they take out money to invest, making higher returns each year above the interest payments.

For the best part of a decade, low interest rates meant that trusts could borrow extremely cheaply, allowing them to turbocharge returns at a time when the market was broadly rising. However, with interest rates now at their highest since the global financial crisis, it is perhaps worth taking a closer look at how gearing is being employed.

Trusts employ it in different ways. Some have a permanent gearing position (known as a structural position), while others use it more tactically when managers believe there is more value in their respective asset classes.

Anthony Leatham, investment companies research analyst at Peel Hunt, mentioned CC Japan Income & Growth as an example of a good use of structural gearing. The trust, managed by Richard Aston, follows a dividend growth strategy by investing in companies showing the ability and desire to increase payouts for shareholders, taking advantage of the ongoing reforms in Japan.

Performance of funds since launch vs sectors and benchmark

Source: FE Analytics

Leatham said: “CC Japan Income & Growth launched with the intention of operating with 20% gearing. It has helped the strategy to accentuate the returns as well as enhance the income. Since launch in December 2015, CC Japan Income & Growth has delivered a 108% total return versus the open-ended ungeared “sister” fund return of 67% and both offer a yield of .3.1%.

“Whilst not all of this outperformance can be attributable to the gearing alone, it is likely to have been a contributing factor.”

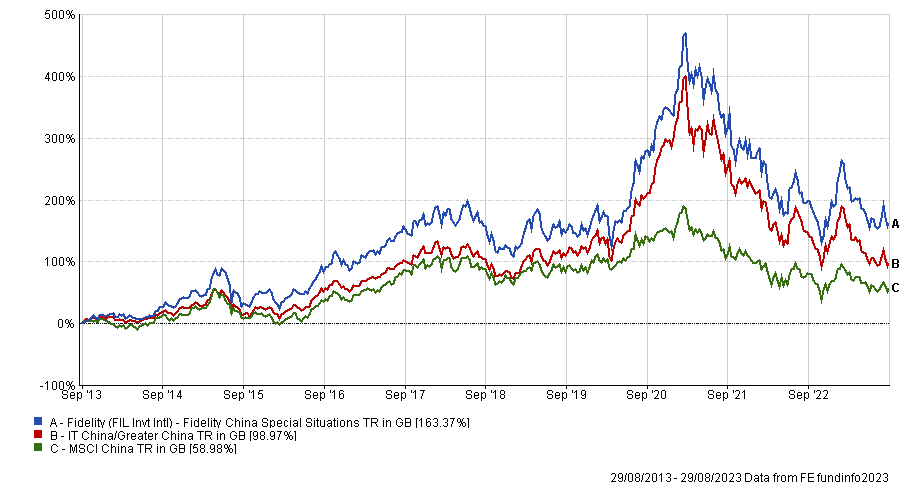

A trust that Leatham considers to make a good use of tactical gearing is Fidelity China Special Situations. The manager, Dale Nicholls, invests in Chinese companies that he deems to be underestimated by the market, with a bias toward mid- and small-caps.

Leatham said: “Fidelity China Special Situations has been active in its use of gearing. In the past 10 years, the total net market exposure has ranged from 110% to 128% and is currently at around 124%.”

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

When using tactical gearing, timing the market can be difficult and is often deemed impossible. Looking at valuations relative to history can be a better metric in that regard.

James Carthew, head of investment company research at QuotedData, said: “Many boards and managers will tell you that attempting to ‘time’ markets by putting on extra gearing close to a market low and taking it off again close to market highs is impossible – and I think that they’re right.

“However, many managers will look at valuations relative to history to determine whether their investments are cheap or expensive and act accordingly – that makes more sense to me.”

An example of a trust using gearing sensibly is Ecofin Global Utilities and Infrastructure, he said. The trust is limited to a maximum gearing of 25%, although the trust was meant at launch to operate with a natural level of gearing of about 15% and a realistic upper limit of 18-20%.

Carthew said: “Its gearing comes via a prime brokerage facility with its custodian (which has sight of its assets and is therefore happy to lend at a relatively low interest rate – about 0.5% over a reference index).

“Nevertheless, the manager is wary of the increasing cost of debt as interest rates rise and the relationship between the cost of gearing and the dividend yield that the trust can earn on the stocks that it buys with this debt. He has been trimming gearing so that it is currently below 10%.”

Performance of trust over 10yrs vs sector

Source: FE Analytics

The cost of gearing can have a material impact on its usage and is becoming a key area of focus in today’s rising rate environment.

Yet, some investment trusts have been able to lock in very low fixed rates ahead of the reversal in interest rates, such as Murray International, F&C, The Bankers, Scottish Mortgage and Mercantile.

Mick Gilligan, head of managed portfolio services and partner at Killik & Co said: “The long-term return from equities is typically 5-10%, whilst long-term investment grade bond yields (to maturity) are currently 6%+. The ability to buy attractive assets with this ‘cheap capital’ is a major advantage.”

Gearing magnifies return when markets go up, but it can also amplify the fall when they fall. Therefore, some investment trusts do not use gearing at all.

In fact, there have been cases where gearing has been detrimental to performance. For instance, Gilligan mentioned Temple Bar as an example of a trust that suffered from too much gearing.

He said: “It ended its multi-decade dividend growth record in the early stages of the pandemic as, due to its extreme value portfolio, the board had to call time out and reduce its high leverage.

“However, the trust has subsequently recovered after this addressing of its balance sheet and the appointment of a new manager.”

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

A more extreme example of a use of gearing that went wrong involves Speymill Deutsche Immobilien, which was delisted from AIM in May 2011, restructured and eventually disbanded. The trust used to buy residential property in Germany.

Carthew said: “We are all relatively comfortable with the idea of using considerable leverage to finance property purchases, but a sudden drop in German property values caused this fund serious problems.

“The properties were held through a number of special purpose vehicles (sub-companies if you like) each of which had its own gearing. One by one, these breached the loan covenants that the lenders had put in place to protect their interests.”