It is now 10 years since Jen-Hsun Huang claimed that “Moore’s Law is dead” and 36 since Michael Stipe of R.E.M claimed to feel fine when faced with a changing world, however the recent developments in artificial intelligence (AI) have sent tsunami-like shockwaves across the corporate world with almost all companies scrambling to devise an AI strategy.

The advent of AI becoming mainstream has already started to produce winners and losers and has resulted in the mega-tech hyper-scalers returning to their positions as market leaders after a lacklustre (or dismal for many) 2022.

Last month we saw the second quarter report from the golden child of 2023, namely NVIDIA, which sailed over a lofty bar, depicting the opportunity for those companies that are critical enablers of the AI wave.

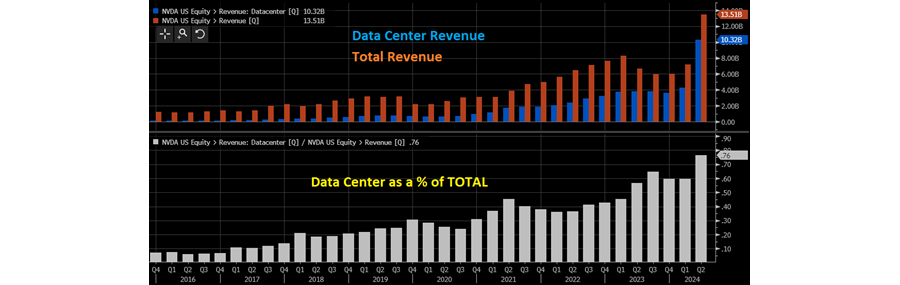

Until the downturn in the sales of gaming graphic processing units (GPUs) last year due to inventory issues, NVIDIA was seen as primarily an enabler of gaming consoles, however, today sales to data centres, providing GPUs to satisfy the demand for accelerated computing and generative AI dwarfs the sales to the other sectors that NVIDIA serves.

Source: Bloomberg

The market was taken by surprise in May when Jen-Hsun Huang, the CEO and founder, announced that the sales in the second quarter might jump to $11bn, primarily from the growth in data centre sales. This was more than 50% ahead of where consensus was sitting. This guidance proved to be rather conservative as the recent results came in 88% ahead of what the analyst community had pencilled in prior to May’s update.

For the coming quarter, the CEO has announced another step-up in guidance to around $16bn, which once again is well ahead of what the market had expected. To top it off, the company also announced a $25bn buyback authorisation to confound those who argue that the valuation multiple is too high and enforce their bullish outlook for the company’s prospects.

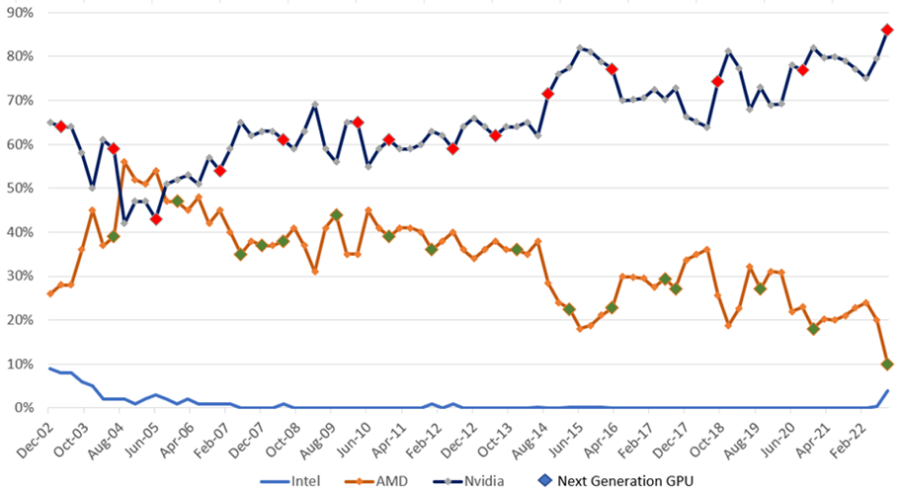

Such stellar growth leads to questions as to whether other companies can profit from this change in the digital world and compete against NVIDIA in the GPU market. Advanced Micro Devices (AMD) traditionally had a strong showing in the market and continues to launch new products, while Intel has finally started to catch up under the leadership of Patrick Gelsinger, after losing its way over the past decade.

However these sales are de minimis when compared to those of NVIDIA which appears to still have the gold standard in products, and has a pipeline of new products that will come out in the coming months.

Source: TIM/Jon Peddie & Mercury Research

A trailing price-to-earnings (P/E) of 110x and a forward P/E of 32x, according to Bloomberg consensus, leads many to shy away from investing in NVIDIA today, especially given that its share price has risen by more than 190% in the past 12 months.

The bulls, however, would point out that the shares where very weak in 2022 and a period of easy comparisons are coming up on the next two quarters. Thus it is only 2024 when investors should be concerned about year-on-year growth rates. As the past two quarters have shown the analyst community has been caught off-guard by the uptake in AIthus, the consensus multiples may prove to be wrong.

NVIDIA’s price occasionally gets ahead of earnings estimates.

Source: Bloomberg

While the GPU manufacturers are experiencing a boom in AI related revenues in the early stages this new cycle, we expect that investors will progressively turn to look for the next layer of beneficiaries, such as those companies who are integral in implementing the AI strategies and infrastructure for the plethora of companies who now claim to have AI at the heart of their future.

Accenture’s research estimates that only 5% to 10% of companies are mature enough in both data and AI to use generative A. at scale and about 50% of companies have not started in their data or AI journey.

So for Accenture and its peers like Capgemini, this is likely to be the start of a multi-year journey.

Richard Scrope is a fund manager at Tyndall Asset Management. The views expressed above should not be taken as investment advice.