UK mid-caps have had a torrid time but there are reasons to be optimistic for the future of the asset class, according to managers of the JP Morgan Mid Cap Trust, which has bucked the trend and made solid returns despite the tough backdrop.

In the 12 months to the end of June 2023, the company made a net asset value (NAV) return of 10.5%, outperforming the FTSE 250 index by 7.5 percentage points. On a total return basis, the trust was up 6.4%, still ahead of the 3% posted by the benchmark.

Managers Georgina Brittain and Katen Patel said there was a lot of juice left in the asset class, which has been hammered by investors in recent years who have turned to the large-cap end of the market for their returns.

Indeed, over the past three years the FTSE 100 has beaten the FTSE 250 by some margin, with the former up 42.3% while the latter has gained just 13.5%.

Performance of indices over 3yrs

Source: FE Analytics

However, there could be good reason to back the out-of-favour asset class. The main one is valuations, with the FTSE 250 index trading on a price-to-earnings (P/E) ratio of just 10.8x forecast earnings for 2024.

The FTSE 100 index of large-cap names trades on an also modest P/E of 10.5x, but there is usually a premium placed on mid-caps as they have more room to grow than their behemoth counterparts.

“The mid-cap index premium has almost completely disappeared; and 10.8x compares to a 20 year P/E average of 13.7x,” the managers wrote in the year-end report.

Indeed, the Bank of America chief investment strategist, Michael Hartnett, has called out UK mid-cap stocks as being at their cheapest versus global stocks since 2003, the report highlighted.

Much of this is down to interest rates, which have shot rapidly higher as has inflation soared post the Covid pandemic. Since then, the UK market has become focused on macroeconomic trends rather than company fundamentals.

“Evidence of this can be seen in the sharp one day upward move of 4% in the FTSE 250 Index when July's inflation figures proved a positive surprise,” the managers wrote in the report.

On this front, although some had expected a recession in the UK, this has not materialise, but growth has remained “pedestrian at best” with future prospects also looking weak.

There is good news, however, as inflation figures have steadily come down, with the managers noting that we are “very close to peak levels” of interest rates.

“Consumer confidence had staged a significant recovery from its abject lows – largely, we believe, due to continuing very low unemployment rates and the wage increases that have been seen this year – although the very recent spike in mortgage rates has caused a setback in what had been an upward trend,” they said.

Within the portfolio, they said there were a number of companies with a dominant market position that had fallen out of favour due to the sector they operate in.

“To give just one example, Jet2, the UK's number one holiday company, is currently being valued by the market at 7x P/E. As we have said before, acquirors of UK businesses are recognising this and M&A is set to continue,” Brittain and Patel wrote.

“The current gearing level of just under 10% in the portfolio reflects our view of the compelling valuations currently available.”

Trust chair John Evans said the trust had performed well in what was a “uniformly negative background” for UK equities, which has particularly hampered the domestic mid-cap names.

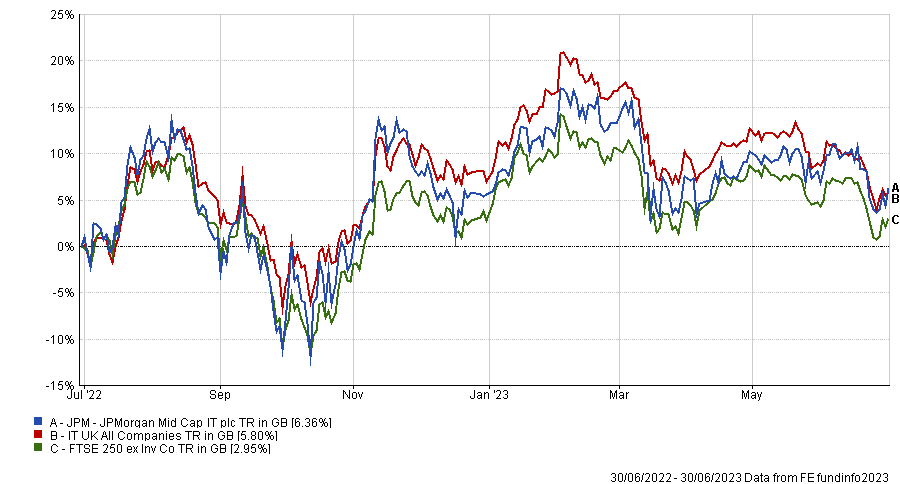

Performance of trust vs sector and index over 12 months to July 2023

Source: FE Analytics

“Having been one of the best performing indices in the world for many years, the FTSE 250 Index has stumbled against such a difficult backdrop and produced poor performance versus both larger UK companies and other markets, particularly the US equity market,” he said.

“Right now the FTSE 250 Index is trading at a valuation level rarely seen in recent years. Logic suggests that buying an out of favour asset at a discounted valuation should be a good starting point for investment returns. This is particularly the case if the earnings progression of the assets is maintained.”